In the beginning of May I added a strategy to BondSwingTrades called account builders (Read more). The focus here is to teach customers how to use video lesson 1 and video lesson 2 to identify the same chart patterns I tackle in BondSwingTrades but apply them to lower priced stocks.

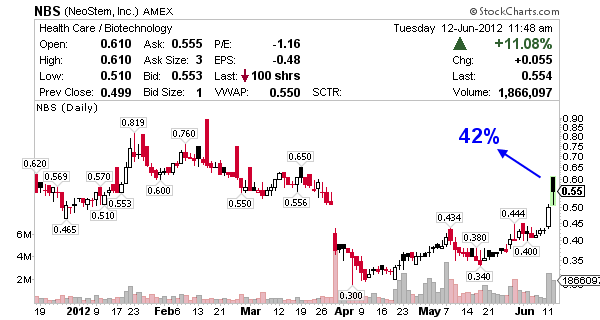

Today I’m highlighting how simple continuation patterns from video lesson number 2 turned into 42% and 58% winners just this week alone. While account builders will never go out to the entire swing trade list as an alert because they’re not liquid enough… my point should be loud and clear that my system works great on anything $.25 – $10, you just need to apply it to the price range that fits your portfolio best.

Heck, I even teach people how to find these huge winners for themselves in video lesson 4 which pulls it all together. My team and I have created a family atmosphere with well over 300 traders in my two premium chats daily.

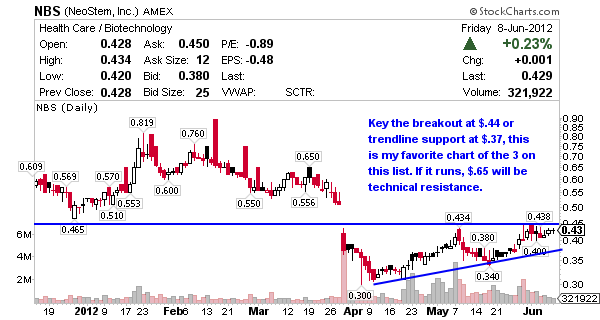

NBS published on June 11, 2012

Before

Neostem (AMEX:NBS) is a biopharmaceutical company, engages in the development and manufacture of cellular therapies for oncology, immunology, and regenerative medicines in the United States and China. Definitely my favorite chart of the group and plenty of volume for account builders. Key $.44 because if that goes it’s into the gap and off and running for $.65. Technically it’s nearing overbought so if it runs it will be heavy up top so don’t overstay the welcome. A trendline pull to $.37 might work too. (Proof)

After

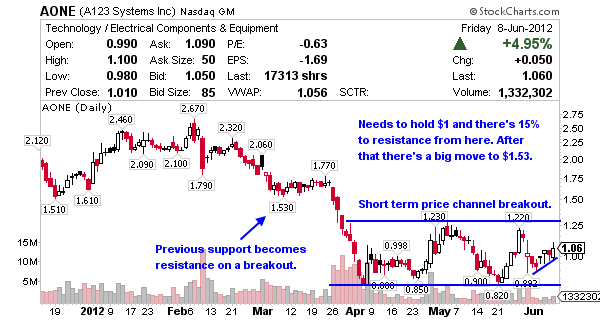

AONE published on June 10, 2012

Before

A123 Systems (NASDAQ:AONE) designs, develops, manufactures, and sells rechargeable lithium-ion batteries and energy storage systems worldwide. AONE’s market cap is $156 million and the short interest is 13 days to cover with 25% of the 106 million float short. They have $113 million in cash and $163 million in debt. (Proof)

After

I was testing out your service with the free updates and in one day you made me 25% on AONE. I bought at 1.28, and sold at 1.50. I don’t know how you do it man, but anyone who doesn’t listen to you must not like making money! ~Kyle

Jason,

Got into AONE on Friday and out this morning (+$217). I watched your 1st and 2nd videos and have been watching & learning in the chat room since last Monday. I tried one trade and took a $50 loss. I got into AONE and hit an 11% winner! Yeah, I could have made a LOT more, but it was an extremely disciplined sell. Another trade like this pays for the cost of membership but well worth it! Just want to say thanks and I look forward to more of your account builder alerts. It’s fun watching and learning and learning to fish!

Thanks Jason!

That’s awesome Michael – 11% wins are huge on real stocks like AONE.

JASON, YOU KICK ASS !!!! I just looked up AONE before I jumped over to your site and OMG !!!! 58% UP !!!! Good pick buddy !!!! Have a great night !!!!

I just wanted to say I’ve learned a lot just from the information you offer for free. Your try-before-you-buy results are money-makers in their own right. Pulled 28% out of AONE after the gap up.

Hey Jason,I been watching some of these amazing picks,and I had a question about opening an account with a small amount of capital.Is there any brokers you recommend who allow shorting small cap stocks?

Interactive Brokers is good.

Signed up for your swing trade service 3 days ago. Have yet to make a trade, as I’m freeing up cash right now. Will start with 3 grand, should I do one trade for 3 grand or 2 for 1500, just to get started?

Okay, so… you basically tell us a stock that you think is going to go up within the next day or 2. We buy low, then once it hits it’s 10% jump, sell? I bought SVNT at $.75. It hit $.88 but your chart said it could go to $1.20 so I was gonna wait one more day and see what happened. It’s gone back down to $.79 since. Should I sell now and break even or hold on for another jump?

I alert 3-5 swing trades per week by chat, text and email. We always target 5-10% and pay ourselves in the process. I’m not sure on SVNT sorry… chart is looking weak of late but it certainly could squeeze if it holds above $.70.