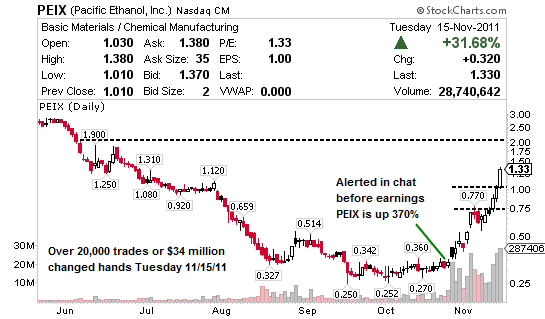

Don’t think penny stocks are one of the best markets to be in? Heard bad stories about penny stocks? What if I told you that from October 26th, 2011 to Wednesday November 11th, 2011 two sleeping NASDAQ stocks would wake up and run 340% on massive volume?!!! Then would you consider thinking outside the box and playing something other than blue chips? I bet you’d be even more shocked when you find out our chat room alerted PEIX before their earnings and several traders in this same room loaded the boat before this massive move. You have to be in it to win it, let’s take a closer look.

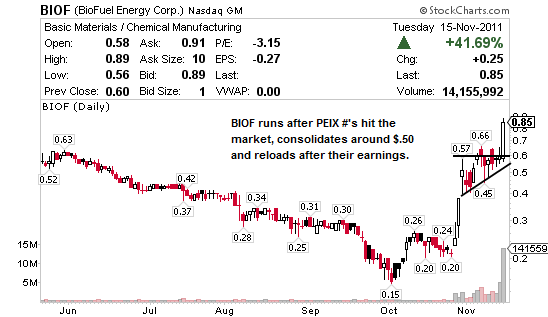

BioFuel Energy, Corp. (NASDAQ:BIOF) and Pacific Ethanol, Inc. (NASDAQ:PEIX) are at the center of the penny stock universe. Of the two, BioFuel Energy appears to be the ‘sympathy stock’ following in the footsteps once extremely popular Pacific Ethanol similar to when lithium stocks ran back in May and when coffee stocks in July. An example of a ‘sympathy stock’ in that coffee run up we saw back in May would be Javalution Coffee, Co. (OTCBB:JCOF) which for no reason other than following stocks like Coffee Holding Company, Inc. (NASDAQ:JVA) ran from $.30 to $2.08 before fully retracing back to where it started just a few months later. Sympathy aside, both BIOF and PEIX are hot right now and can be cash cows to swing traders like myself who repeatedly dip in and play the momentum – welcome to the wild ride that is penny stocks. At this point I’m looking at both stocks as good short opportunities.

Pacific Ethanol, Inc. (NASDAQ:PEIX) produces and markets low carbon renewable fuels in the western United States and was first to move back on October 26, 2011 after reporting booming Q3 results. How booming? Try record net sales of $271.6 million compared to $46 million in the same period in 2010 selling 122.6 million gallons of renewable fuel or a 22% increase over Q2. This helped PEIX log $4 million in net income compared to a loss of $12.9 million in they year-over period. PEIX was alerted in my chat room just before earnings at $.30 cents and swing traders have made boatloads off this 370% move. So what’s the chart look like moving forward you’re wondering, let’s take a closer look. One quick look at the chart clearly shows you that PEIX is overbought. Stocks that are overbought can remain that way but become more volatile as the days go on and eventually the boat tips and people take profits. Tuesday PEIX etched almost 21,000 trades or just under $35 million in dollar volume. Support on any pullback is light at $1.31 and stronger at $1.12. Resistance moving forward is at $1.40, $1.90 and $2.12 or the 200 Moving Average.

BioFuel Energy, Corp. (NASDAQ:BIOF) engages in the manufacture and sale of ethanol and its co-products in the United States. BIOF started its run up right around when PEIX made it’s move and consolidated near $.50 before it’s November 9th earnings report in which they reported $2.5 million in net income on revenues of $162.5 million. The increase in net income was $4.3 million compared to the prior year period and helped shares build a bull pennant formation on the chart before breaking out again Tuesday to the high $.80’s. Like PIEX, BIOF is clearly overbought and can remain that way so long as volume continues to support these higher levels. Tuesday BIOF etched over 17,000 trades on almost $10.5 million in dollar volume. Support on any pullback is at $.66 with resistance ahead at $1.00. While riding these trains can be fun while they’re hot, lithium plays last May and coffee stocks over the summer should remind traders that pigs get slaughtered i.e. taking profits along the way is never a bad strategy.

Jason, I appreciate the service you offer as well as your insight into BIOF and PEIX.

im curious as to what your thoughts are on both stocks for the coming week…?

I’m in BIOF at .81 and curious if I should just take the loss now. But, I’m certain that Q4 for both companies are going to outperform just like Q3 did.

Morning Ben! I like PEIX to climb from here and think $1.60 – $2.00 is in sight. If BIOF follows like it did last time then we’d likely see $.80 to $1.00 this week. As you know those are only my opinions… but I did go long PEIX Friday supporting my stance there.