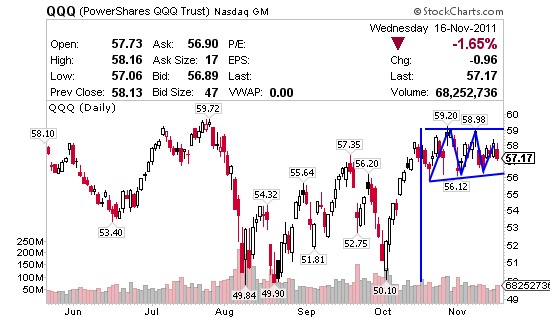

Futures are down to start today’s session, things could get bearish but I think they’ll turn up tomorrow or early next week. Since that’s my belief I’ll attempt to hold my swings despite being down on most positions. My reasoning is fairly simple and revolves around the major indices. If you look at some popular ETF’s like the SPY, QQQ and DIA we can clearly see a new channel has developed or what I would call a bull flag off the last big urn in October. Right now we’re at the bottom of that bull channel so if my theory is correct buyers will come in soon and the market will find a reason to turn. If we break the bottom of that channel on the SPY and QQQ then I’ll be inclined to log these losses and start over.

Let’s take a look at today’s economic calendar from MarketWatch. Investors are awaiting U.S. data on weekly jobless claims and October housing starts that are due at 8:30 a.m. Eastern time. The Philadelphia Fed Business Outlook Survey for November is due at 10 a.m. Eastern.

Regarding our positions here are my thoughts.

RENN broke support yesterday at $4.50, plain and simple. It went down when the market was crashing hard into the close and despite jumping back above $4.50 quickly that support area is now weaker. If the market recovers I think I’ll still win on RENN but if it does not, then I’ll be taking a loss here because I can’t risk this thing dropping below $4. I’ll keep you posted if I make any moves but my immediate goal is to make it to Monday.

COOL has been a terrible trade by me breaking all of my rules. I was up over $2,000 which was over 10% and I went for the big score. Now I pay the price with giving it all back and that should be a lesson for all of us to take our stinking 10% when we have it. This stock was alerted at $3.18 and ran to $3.63 just days later. I rode it back down, locked in $1,300 and then bought right back. Now I’m down $1,000 this morning meaning my total profit so far is only $300 when it should have been $2,500 a week ago. It’s good to revisit lessons from time to time. My play on COOL is solid above $3, stop out below there.

QPSA has been a wild ride. After making 60% recently I bet an option and was up 50% on that. Failure to follow my rules and go for big scores once again watched $2,000 in profit walk away from me and now I’m down $1,600. Seems I need someone to kick me in the ass and get me to follow my own bloody rules I teach. This is not like me and between COOL and QPSA I’ve now given up about $5,000 in profits for $2,500 in losses and anyone who can do simple math knows that’s a $7,500 swing. We need to follow these rules cause they work… I NEED TO FOLLOW THE RULES is what I meant to say. ARGH!!!

Late in the day yesterday I told you I was planning to buy EK and LOCM which I ended up doing. The alert only made it out by Skype and text message because it was right before the close. Here is what I bought and what I’m looking for.

EK is a crazy stock that I’ve played a number of times. The recent increase in price action makes it worth my starter position of 10k shares at $1.25. Goal is simply 10% short term and I’ll add another 10k shares if it pulls back $.10 to $1.15. The bet is on potential of hype surrounding the sale of their coveted patents. However keep in mind this stock could drop to $.50 very easily on bankruptcy news so be careful.

LOCM seems to have support at $2.40 which is why I like it here. I bought 5k shares at $2.43 and I plan to add 5k shares today so long as it doesn’t look like the market is going to meltdown. Catalyst here is potential for big news and or a short squeeze off decent support. If it heads down I’ll get out and buy back around $2.25.

0 Comments