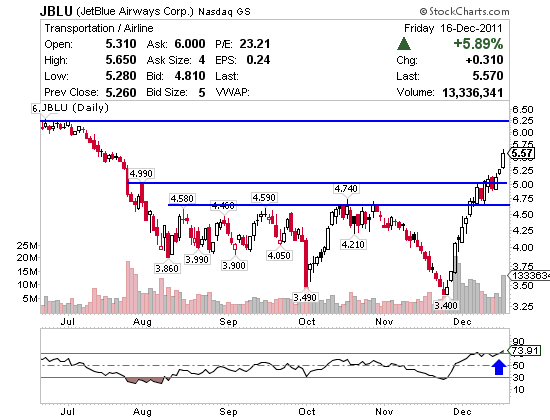

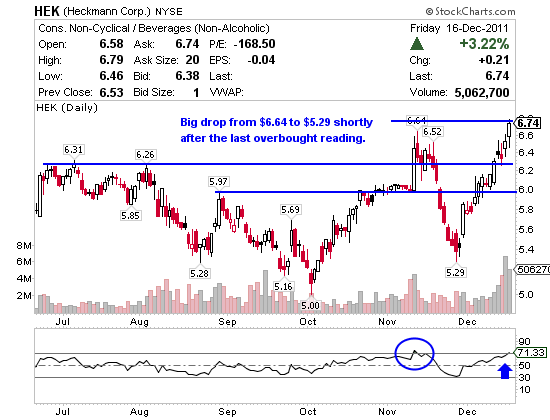

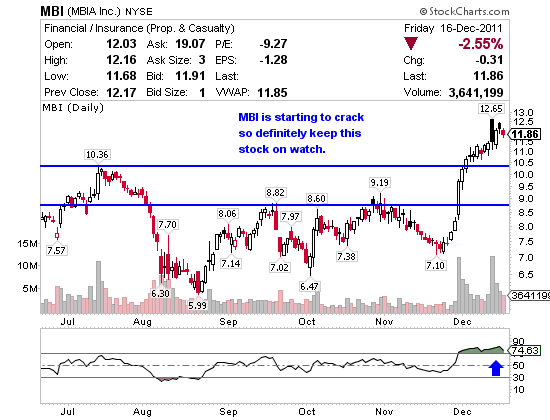

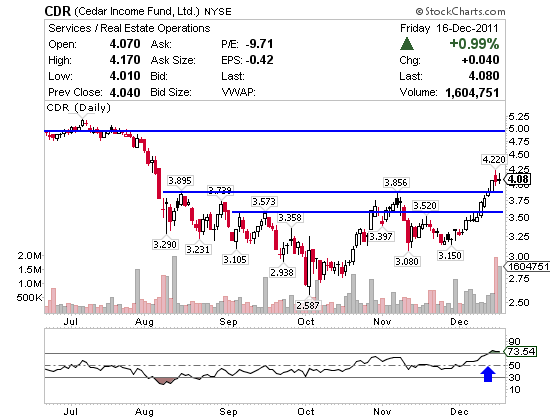

The following stocks JBLU, HEK, MBI, CDR and SWHC are technically overbought above with a 14-day Relative Strength reading of 70 or higher. Many of these charts could continue to climb steadily but when they crack it’s a given that profit taking will ensue. Trade your hand right and this can be a very favorable chart patterns going long followed by short. If you are new to shorting, this FREE 45-minute video I did will get you started.

JetBlue Airways Corp. (NASDAQ:JBLU) provides passenger air transportation services in the United States. JBLU has a market cap of $1.66 billion and a reported short interest of 4.7 days to cover. As of Friday 12/16/11 the 14-day Relative Strength of JBLU was 73.91 and heading up. Resistance is at $6.28 – $6.45 before shares can push the 52-week high of $6.79. Support is at the MA(200) of $5.06.

Heckmann Corp. (NYSE:HEK) is a holding company, acquires or makes investments in various businesses. HEK has a market cap of $786.74 million with a reported short interest of 12.3 days to cover. As of Friday 12/16/11 the 14-day Relative Strength of HEK was 71.33 and accelerating up making a new 52-week high at $6.79. There should be light support at $6.70 followed by $6.50 – $6.30 before all three major Moving Averages 20, 50 and 200 around $6.

MBIA Inc. (NYSE:MBI) provides financial guarantee insurance and related reinsurance, advisory, and portfolio services for the public and structured finance markets; and asset management advisory services in the United States and internationally. MBI has a market cap of $2.29 billion and a reported short interest of 12.1 days to cover. As of Friday 12/16/11 the 14-day Relative Strength of MBI was 74.63 and weakening. Resistance is at $12.65 with support at $11.00, $10.63 and $10.30 before the 20 Moving Average. The 52-week high is $14.96 from last January.

Cedar Shopping Centers Inc. (NYSE:CDR) is a real estate investment trust, engaging in the ownership, operation, development and redevelopment of supermarket-anchored community shopping centers and drug store-anchored convenience centers in the United States. CDR has a market cap of $272.07 million and a reported short interest of 6.6 days to cover. As of Friday 12/16/11 the 14-day Relative Strength of CDR was 73.54 and slightly heading up after a crack Thursday. Resistance is at $4.22 and $4.33 with support at $3.85 followed by $3.50. The 52-week high is $6.59.

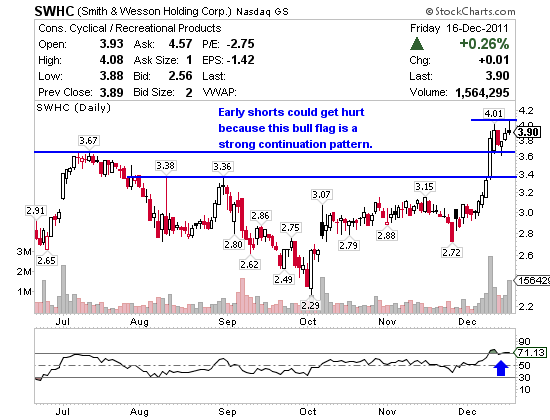

Smith & Wesson Holding Corp. (NASDAQ:SWHC) provides products and services for safety, security, protection, and sports in the United States and internationally. SWHC has a market cap of $253 million and a reported short interest of 8.7 days to cover. As of Friday 12/16/11 the 14-day Relative Strength was 71.13 and slightly strengthening after an overbought reading and a price pullback from $4.01 – $3.62. There is resistance at the 52-week high of $4.08 with support at $3.60.

0 Comments