I’m constantly on the hunt for solid swing trades like LOCM, MITL, AEN, AMWI, UPI, TAT and JOEZ. Normally I try to position before the move like I did with HDY recently at $3.06 before it ran about 30% the following day, however, sometimes swimming with the current is an easy way to grab quick profits too. Swing trading, for those of you who are unaware, is a speculative activity where stocks are repeatedly bought or sold at or near the end of up or down price swings caused by price volatility. A swing trading position is typically held longer than a day, but shorter than trend following trades or buy and hold investment strategies that can be held for months or years. My filter for the stocks on this list is between $.25 and $5 with 300 trades or more the day before. The following stocks could deliver some decent profits moving forward if they continue so here’s what I’ll be watching for.

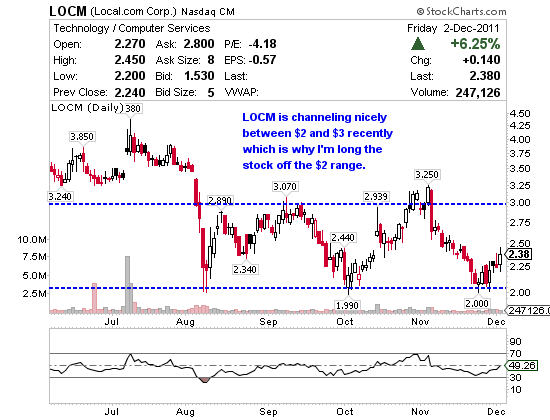

Local.com Corp. (NASDAQ:LOCM) operates as an Internet search advertising company that enables businesses and consumers to find each other and connect locally. I believe Local.com is a prime buyout candidate by either Groupon, Google or Living Social due to their huge traffic and extremely large footprint in the daily deals space. Groupon (NASDAQ:GRPN) has a huge market cap comparatively ($12.09 billion) so it would be very easy for them to buy LOCM ($52.55 million). A quick search of Local.com on Alexa, Compete or Quantcast illustrates the massive traffic I’m referring to, which is exactly what companies like Groupon want and need to be successful in this competitive niche. LOCM has $10.12 million in cash, $8 million in debt, 22.08 million shares outstanding and a book value of $2.38. The reported short interest on LOCM is very high at 10.75 days to cover which is why I have bought and like the stock above $2. I never base trades on buyout speculation but instead try to position technically and fundamentally for solid swings… if I get lucky then so be it. Since starting this service about a year ago I’ve only been able to time one buyout perfectly which was TomoTherapy and wow was that a wonderful morning back on March 7, 2011. Additionally, LOCM is trading well under a big placement from earlier this year meaning big money was willing to support this LOCM at much higher levels. Technically I think LOCM is on its way to $2.70 – $3 or better in the short term after having held support at the $2 range once again. I’ve made some big bucks swing trading LOCM in the past trying to time a buyout, watch this video for proof of how I did it. Redchip recently covered the stock (paid for by LOCM) and I think they did a nice job detailing why I think LOCM will eventually be bought out. I love the Beta on LOCM at 2.27 which is why I come back to this swing trade so often.

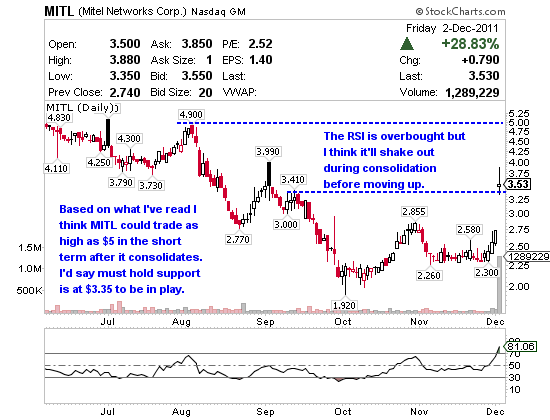

Mitel Networks Corp. (NASDAQ:MITL) provides integrated communications solutions to the small-to-medium sized enterprise market in the United States, Europe, the Middle East, Africa, Canada, Caribbean, Latin America, and the Asia Pacific. Shares jumped big and I mean big Friday after Q2 results showed revenue growth and positive signs of restructuring. MITL has $71.30 million in cash, $310.40 million in debt, 53.60 million shares outstanding and a book value of $.82 per share. Their market cap is $189.21 million. The reported short interest on MITL is high at 9.47 days to cover and no doubt part of the reason the stock gaped up so high Friday morning. This is the same type of action I’m looking for on Local.com and a few of my other swing trades that have high short interest. All you need is good news out of the company and short cover drives up the price very quickly when it’s that high around 10 days to cover. I used this same technique on Hyperdynamics (NYSE:HDY) last week buying at $3.06 before it ran about 30% the following day. Technically I’d look for MITL to hold $3.30, not rocket science, and shake out profit takers while consolidating with new buyers like myself. Once it reloads it appears the high $4’s are a good swing trade target.

Adeona Pharmaceuticals, Inc (AMEX:AEN) operates as a pharmaceutical company that develops medicines for central nervous systems. AEN has $7.47 million in cash, no debt, 28.13 shares outstanding and a book value of $.30 per share. The reported short interest on AEN is also high at 7.49 days to cover as of the last settlement date on 11/15/2011. Wednesday AEN reported top-line results from its pilot Phase I/II open label, three month safety study of oral high dose zinc therapy in ALS, also known as Lou Gehrig ‘s disease. This chart is clearly in breakout mode and news like this can stick and keep it in play for quite some time. Right now I like it above $1.10 and think it’ll trade just below $2.25 in the short term or the 52-week high. The Relative Strength is a bit toppy here off this move so I’ll look to accumulate a position on the dips. My only concern here is the market cap is outside my $100 million to $300 million range but again, the chart is hard for me to ignore so I’ll definitely make an exception as I do from time to time. Like LOCM, the Beta of 2.27 makes this trade more attractive to me than others.

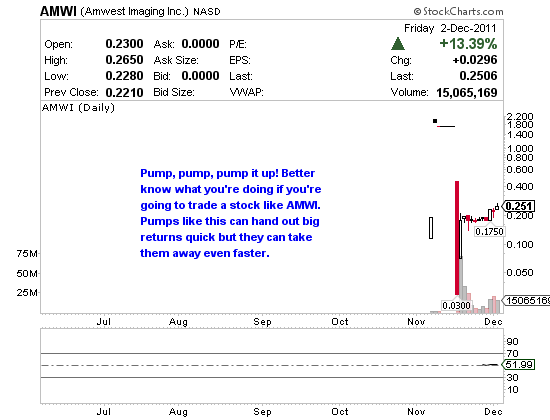

Amwest Imaging Inc. (OTCBB:AMWI) is a pump and dump and not deserving of a company description. I’m almost embarrassed to include it amongst some of these quality small caps but honestly, I’m just a swing trader and if I can game a pump and dump for profits you better believe I’ll do it. Profits are profits, doesn’t matter what stock it comes from after the trade clears your account. So anyway, they claim to be a development stage company, focusing on helping companies become efficient through digital conversion and indexing of documentation blah, blah, blah. AMWI’s market cap, for now, is $124.39 million but don’t expect that to hold up forever. Bottom line is their the focus of a pump and dump right now so I have nothing else to add on this company other than if you’re going to trade the momentum you better know what you’re doing. Trades like this are not for beginners because the price action can get very ugly very quickly without warning when pumps dump. If you don’t believe me then read my blog post here on another recent pump and dump Raystream (RAYS). Anyway, it made the filter but I’m not sure I’ll trade it given all the other options on this list.

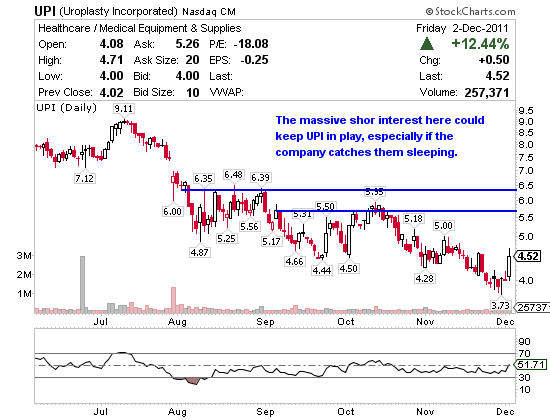

Uroplasty Inc. (NASDAQ:UPI) is a medical device company, engaging in the development, manufacture, and marketing of products for the treatment of voiding dysfunctions. I really like the chart on this one so if the Relative Strength can hold the centerline this time I’ll look to swing it because I think it could pop in the short term. UPI has $14.16 million in cash, no debt, 20.81 million shares outstanding and a book value of $.98 per share. The last reported short interest on 11/15/11 was 23.75 days to cover which is massive and no doubt part of the reason shares bounce from time to time. While I don’t know or care to know a ton about the company, the short interest alone could make for a profitable swing if the company sneaks those shorts like MITL did last week. I’d say a reasonable swing trade range would be between $4.30 and $6 in the short term if and when it can break through the $5 range which will offer up some sellers. UPI’s Beta is 1.43 and the market cap is $94.04 million.

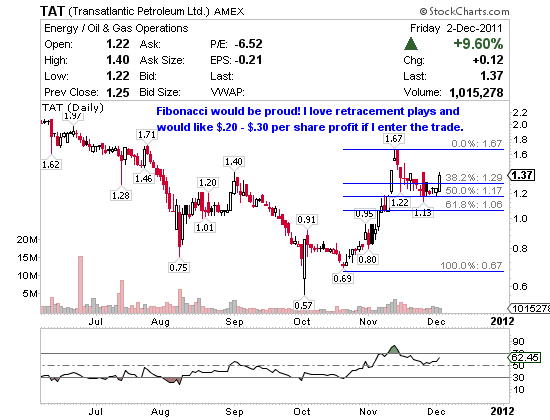

Transatlantic Petroleum Ltd. (AMEX:TAT) is an integrated international oil and gas company, engaging in the acquisition, exploration, development, and production of oil and natural gas. The market cap on TAT is a little big for me at $501.05 million but I really like the bull flag on the chart so it’s in play. CEO N. Malone Mitchell III bought 110,000 shares, increasing his purchase just in November to 610,093 shares, so that he ended the week with 1.9 million shares. That type of size is what I look for when there is insider buying taking place. A few thousand shares I’d consider fluff but over 600,000 in November is not fluff out of a company this size. Technically this is a clear cut retracement play so I’ll look to position of the 20 Moving Average or even the $1.10 range should it pull back. If it advances from here, which i think it might then $1.70 to $1.80 is my short term swing target. TAT has $22.13 million in cash, $159.13 million in debt, 365.73 million shares outstanding and a book value of $.68 per share. The reported short interest on the stock is relatively small at 1.7 days to cover so don’t expect a short squeeze to assist a swing trade move. The Beta is 1.48, I like them above 2.

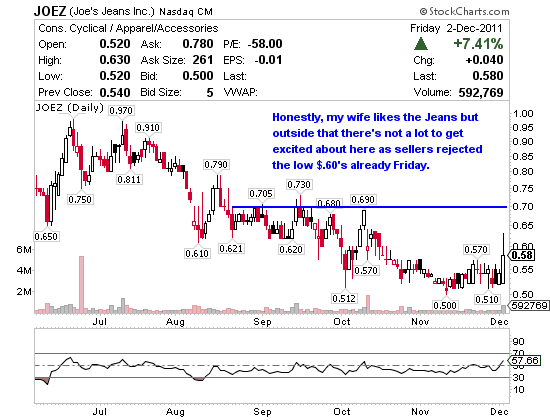

Joe’s Jeans Inc. (NASDAQ:JOEZ) engages in the design, development, and marketing of apparel products worldwide. JOEZ has a market cap of $37.25 million, total cash of $11.64 million, debt of $4.56 million, 64.22 million shares outstanding and a book value of $1.01 per share. The reported short interest on JOEZ is 1 day to cover so they’ll be no help from shorts should it continue up from here. The Beta on JOEZ isn’t desirable either at 1.34 meaning it’s not going to give me the returns I look for as quickly as stocks above 2 like AEN and LOCM. Technically JOEZ looks attractive if it can hold this recent move above $.55 then there’s really no resistance until the $.70 which could mean an easy $.10 per share profit. Other than AMWI, this is my least desirable trade but it did hit my filter and I’ve traded it before so I felt obligated to report on the 7% move Friday. The Relative Strength has not broke the 70 line all year so it’ll be interesting to see if this move sticks, then I might try a swing with a 10-20% goal across several days.

I am long LOCM

Luv your commentary; your journal. Luv it, luv luv luv it…..!!! Now that that’s out of the way, I want to say that I would love it even more; would be sold completely if you would give alerts on sub-penny stocks.

Thank You

Timothy Davidson

Hi Timothy! Thanks for the feedback, I really appreciate it. I don’t alert or trade thin stocks and have very precise guidelines for this service. Please read the quick start guide to better understand why I think it’s imperative to be trading liquid stocks. My range is $.25 – $5 and generally an alert will have 300 trade or more in a day or roughly $1 million in dollar volume. Here’s the guide http://www.jasonbondpicks.com/quick-start-guide. It’s probably also important to note that while trading stocks under $5 for about a decade, I don’t know one real trader making a living trying to game thin subbers which is another good reason to focus on liquid small caps. Let me know if I can be of any other help and again, thanks for writing.