When building watch lists, it’s good to have a basket of stocks in each sector so when the market heats up, you can act quickly and with conviction. Last week my subscribers and I made good money on a few technology / gaming stocks I know well to include GLUU, COOL and THQI and this week I think there will be opportunities there again. Below you’ll find details about the stocks, a little history on last week’s swing trades as well as how I’ll look to play them this week.

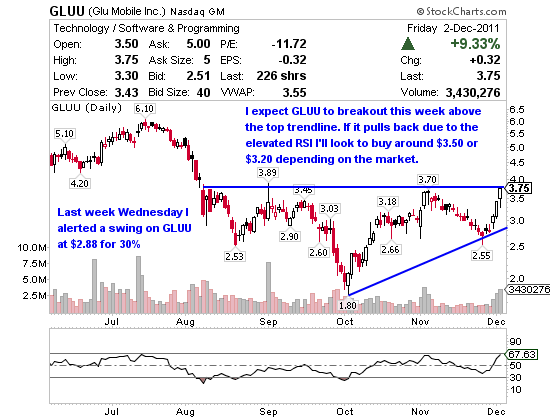

Glu Mobile Inc. (NASDAQ:GLUU) engages in the design, marketing, and sale of casual and traditional mobile games worldwide. The market cap on GLUU is $238.87 million with a Beta of 2.41 and a relatively small short interest of 4.93 days to cover per the last settlement date on 11/15/11. GLUU has $37.05 million in cash, no debt, 63.70 million shares outstanding and a book value of $.91 per share. Last Friday the leader in social gaming expanded their portfolio on Google+ adding Bug Village. Other popular titles by the company include Contract Killer Zombies and Gun Bros. This is one of my favorite stocks to swing trade and I really like the company. Last week Wednesday I figured GLUU would turn back up so I alerted it at $2.88 for a 30% gain so far or roughly $1 per share owned. My reasoning to alert the turn was simple, I knew GLUU was only down because the market was down and the Zynga road show this week would put GLUU in the spotlight again. Now I’m looking for GLUU to breakout into the $4 range in the short term. Should the market dip this week GLUU needs to hold $3.50 to $3.15 support on pullbacks. It’s important to note the Relative Strength is quickly approaching the 70 line with a current reading of 67.63. The last time GLUU was able to hold near the 70 line for a decent amount of time was back around February when the stock ran from $1.98 to $5.08 before retracing to $3. The only other time this year we say GLUU hold a high Relative Strength was in late May for about a week.

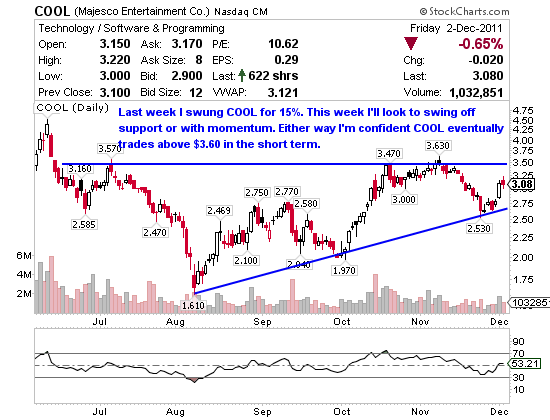

Majesco Entertainment (NASDAQ:COOL) develops and markets video game products primarily for family oriented mass-market consumers. The market cap on COOL is $119.67 million with a Beta of 1.81 and a very small short interest of 1.58 days to cover per the last settlement day on 11/15/11. COOL has $19.67 million in cash, no debt, 38.86 million shares outstanding and a book value of $.69 per share. Last Thursday the innovative provider of video games announced the release of JAWS: Ultimate Predator for Nintendo 3DS and Wii system. Their most popular title is Zumba Fitness which sold over 4 million copies and they just recently released Zumba Fitness 2. This is also one of my favorite stocks to swing trade and I really like the company. The Beta of 1.81 makes it a little less volatile than GLUU but I find I’m able to swing both with a high degree of accuracy. Last week I bought and alerted COOL at $2.74 after GLUU started to run for a solid 2-day swing out at $3.14 on Friday for 15% profit. This week I’ll look swing COOL again if it can hold near the 20 Moving Average of $3.07, otherwise I expect support at $2.90. Resistance on COOL is at $3.30 followed by $3.60 before it can break into a new trading range. I firmly believe we’ll see COOL trading between $3.60 and $4.50 in the short term and possible higher than that. Timing is everything with swing trading, so despite my bullish sentiment on the stock you must be sure to weigh the direct and indirect variables before making your moves, something I teach subscribers about every Tuesday and Thursday night at 9:00 p.m. EST in chat.

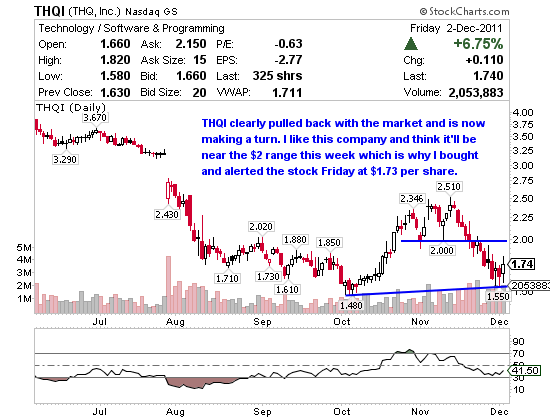

THQ, Inc. (NASDAQ:THQI) develops, publishes, and distributes interactive entertainment software for various game systems, personal computers, wireless devices, and the Internet. The market cap on THQI is $118.98 million with a Beta of 2.27 and a large short interest of 9.4 days to cover per the last settlement date on 11/15/11. THQI has $51.06 million in cash, $100 million in debt, 68.38 million shares outstanding and a book value of $1.07 per share. This company is less popular amongst swing traders when compared to GLUU and COOL but it does get solid liquidity and the market cap is right in my wheelhouse between $100 million and $300 million. Like GLUU the Beta on THQI is over 2 which means it’s a volatile stock, more volatile than COOL which is exactly what I look for when swing trading. Last Thursday THQI said they joined forces with South Park Digital Studios on “South Park: The Game” to develop the next chapter in South Park entertainment. Like my alert on GLUU at $2.88 and COOL at $2.74 Wednesday… I think THQI is the next to turn and run, especially considering the large short interest which no doubt has grown considerably since the last settlement date on 11/15/11. For this reason I bought and alerted THQI at $1.73 on Friday and believe the stock will trade above $2 this week. Technically THQI has support at $1.55 which is where I’ll continue to scale into this trade should it pull back. The 50 Moving Average is at $1.91 with the 20 Moving Average at $2.03 so I expect this move to slow down in that range before I’ll assess the stock again. The Relative Strength is bouncing off oversold levels which is exactly what I look for when swing trading.

I am long THQI

0 Comments