NOTE: This is a guest post from my good friend Ben Sturgill of DailyProfitMachine.com

—————————————-

When traders ask me what I look at – I tell them one thing..

I Follow The Money Flow

You see, nothing is more important than what the money is doing in the markets

It doesn’t matter what technicals say, if there are no buyers, the stock will never go higher in price.

It’s simply supply and demand.

And I’ve developed a proprietary scanner, where I can track these orders right when they hit the markets

In times of higher volatility, many traders struggle to find a strategy that works, but I found my edge in the dark pools…

Recently, I’ve pulled down some of the my career record percentage gains*

Just check out some of these recent trades:

- NIO – 500% gains in two weeks!

- SPWR – 150% gains in two days!

- MARA – 300% gains in four days!

- MSFT – 125% gains in one week!

- UPWK – 100% gains in two days!

- DKNG – 200% gains in one week!

You see, this back and forth of the markets creates trading opportunities

And I’ve been finding that traders are flocking to specific sectors in anticipation of a new president

Now, I don’t want to speculate on what could happen… I want to follow what these funds predict the markets will do next

And that’s why I’ve focused on hunting momentum in the dark pools and have been landing lunker-size profits trade after trade.

Dark Pools

New traders struggle with information overload when it comes to learning how to trade.

From position sizing, risk management, to finding stocks to trade, there is never a shortage of material to read

And many people learn the same basics about moving averages, candlesticks, and broad fundamentals… But never what supply and demand really means.

You see, this is a hidden edge, kept far away from the public.

This is because the big institutions are afraid they will lose money

So, How do I find these trades?

I started with these 4 questions that I had to answer first:

- Have I seen this stock trade in the Dark Pools lately?

- Is the dark pool volume larger than its average?

- Are there any large single dark pool trades?

- Are there any Intermarket Sweep Orders?

Now for me, I found that the more boxes that are checked off the list, the better signal there is for the dark pool scanner.

Check this out to see how I found a 500% winner in NIO just by scanning the Dark Pools

Hidden Momentum In The Dark Pools

When it comes to the basics of trading, supply and demand gives me the edge I need

And this is the strategy that I want you to be a part of

A strategy that you shows you how the ‘smart money’ flows around the markets

This strategy is jam-packed with daily research of stocks and monitoring the trading activity on every stock..

My goal is to get into trades following the dark pool traders and exit with a 100%- 200% profit in just a few days!*

Now, I know you are wondering… Does this even work?

Well, I think it does!

Just check out some of these huge wins I’ve had recently

Still don’t believe me?

Read it and weep…

*Mic Drop*

You see, these trades simply come to you

Once you learn how to read the dark pools you will never go back to reading technicals

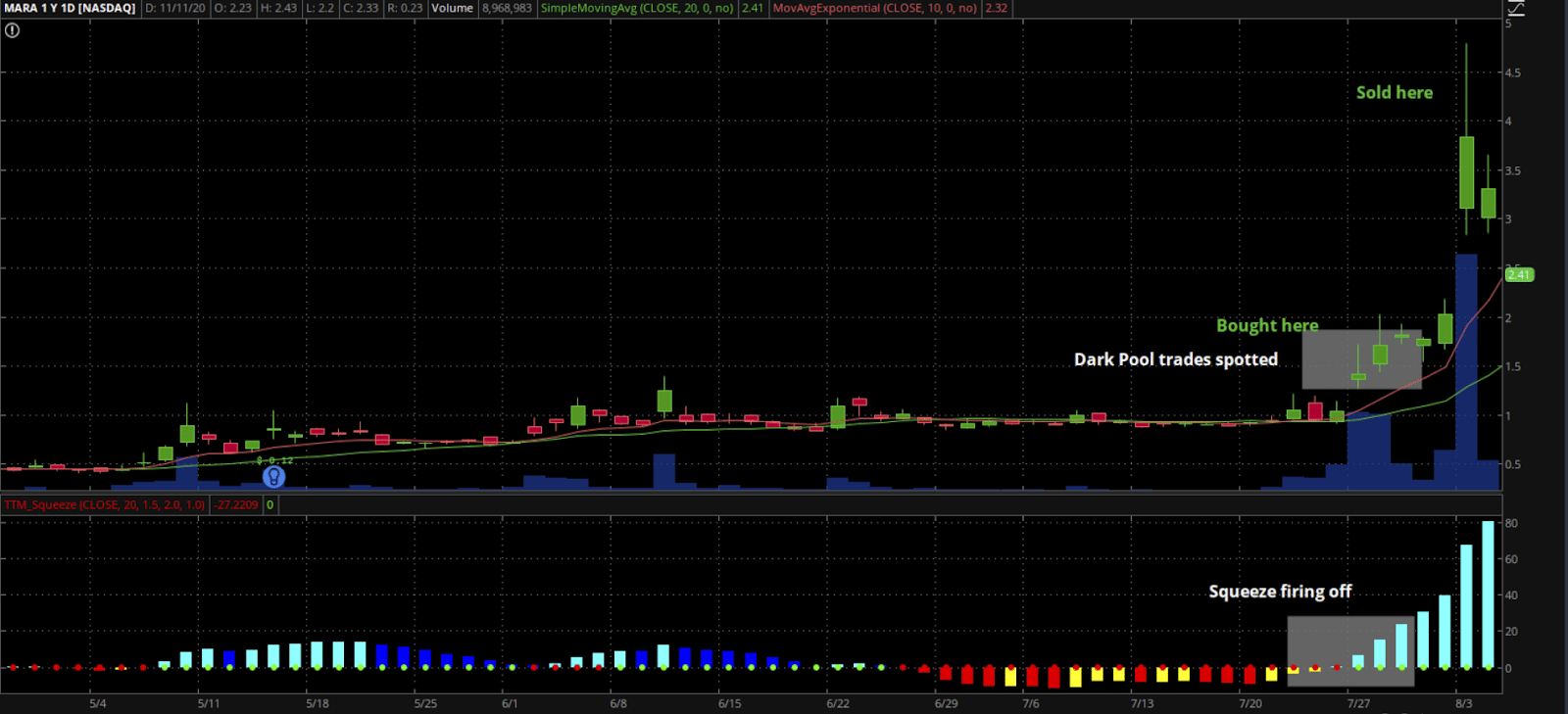

How Did I Trade MARA?

Hint: It Involves Money Flow and reading the dark pools.

You see, the dark pools may have given away the direction of one of my largest trades WEEKS BEFORE it actually hit

From the scanner, I noticed a few things that were happening that were out of the ordinary for this stock

Then I broke down and analyzed this trade using my 4 step process

- MARA hit the dark pools repetitively and caused a tremendous amount of momentum on this stock.

- On Friday, I saw 10 million shares hit the dark pools

- Increasing volume and sideways trading into momentum moving averages signals a break out as buyers pile back into this trade

- Large trade blocks start to come in, growing in size each time

- Intermarket sweep orders, or the “I want it now” order type that traders use to fill their shares started to come in and move the stock around

But Wait… There’s More!

I believe that if you don’t keep growing, you will fall behind

And this is applied to life and my trading

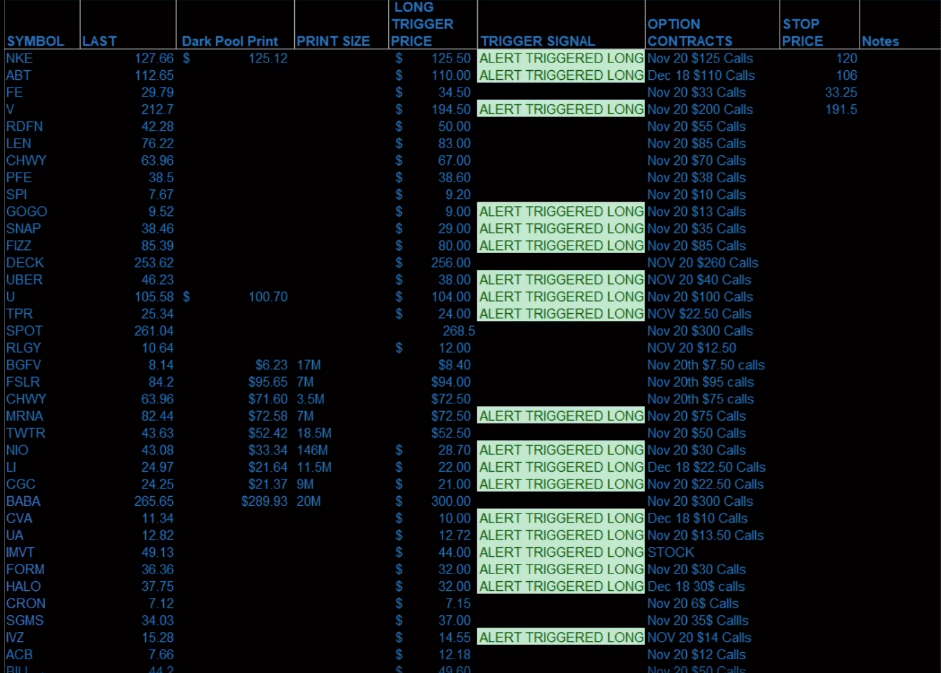

Recently, I’ve expanded my offering to give traders a first hand look at the stocks I’m watching at any point

This means Dark Pool Profits subscribers also get access to my LIVE WATCHLIST.

This is a brand new feature, a dynamic watchlist based on dark pool activity, in real-time.

Why do I feel this is valuable?

First, it’s valuable because it helps you focus on stocks that I’m focused on

Second, I take trades off of my watchlist, so you will have access to look at the same stocks that I do every day.

And this means that at any point… you could be looking at the next stock price explosion on your screen right now

[Want to see what stocks I am currently trading? Click here to learn more]

I continue to monitor the Dark Pools for more and more of this trading activity every single day

So if you don’t want to miss the next trade like this that could land you a 500% profit …

0 Comments