Stocks have been all over the place this week and it goes to show you…

In this market environment, it’s important to remain nimble…

And look for different ways to take advantage of the wild activity, especially in tech stocks.

For me personally, I’m focused on waiting for sharp pullbacks to utilize bull put spreads or strong breakouts to utilize bear call spreads.

I know what you’re thinking, “Jason, why don’t you just use puts or calls outright?”

Well, given the way tech stocks have been, I don’t think it’s wise for me to purchase calls or puts because the very next day the premium can get sucked out if the underlying stock moves against me.

Not only that, I’ll be susceptible to drops in implied volatility and time will be working against me.

That said, let me show you how I actually used an options spread strategy to my advantage this week.

How I Trade Tech Stocks More Efficiently

Listen, we all know tech stocks can offer explosive returns, but to be honest with you…

Trading the stocks outright is a little too risky and eats up way too much buying power, but there are times when I see one of my favorite setups and know I need to pounce. For example, on Tuesday, I actually loved Zoom Communications (ZM) as a long.

However, a $350+ price tag per share was way too expensive.

Before I get into the strategy I used, let me show you my thought process.

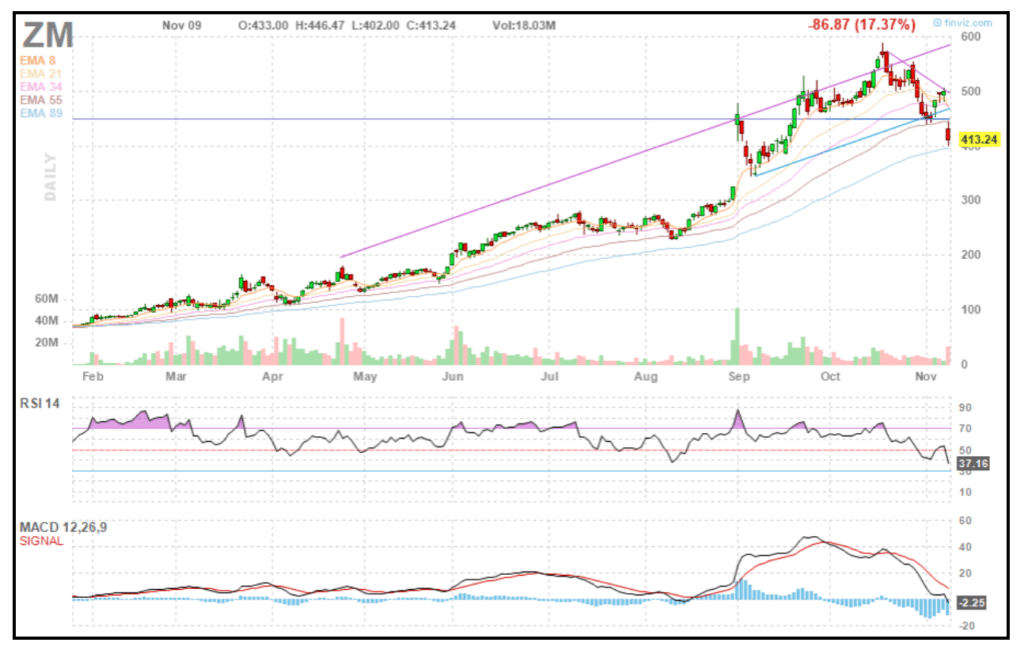

Here’s what I sent out at 7:05 AM ET on Tuesday.

ZM has fallen to the 89 EMA on vaccine news and I believe there’s a bit of an overreaction here evident by the RSI which is quickly approaching oversold levels. Businesses aren’t likely to go back to normal anytime soon and even when they do, I’d imagine online meetings are here to stay. I’m monitoring the $400 level closely Tuesday into Wednesday…

Usually when these stocks get rocked, they don’t whipsaw back on day one but there’s 2-3 days worth of bleeding. Once the overreaction is established, I like to try for a dip buy, in this case selling puts to traders continuing to chase the move down. As long as I get in at a reasonable level, any bounce would deliver a decent win on the trade.

I also mentioned what my trade plan was…

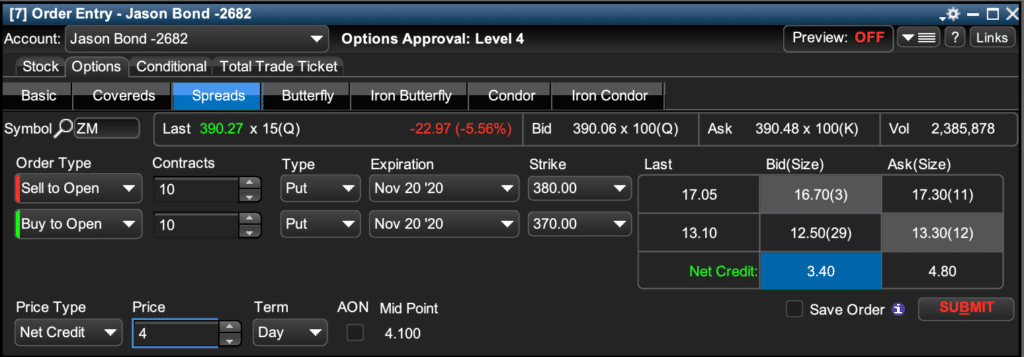

I’m monitoring the $400 level closely Tuesday into Wednesday and looking for a $10 wide bull put so $400 / $390, lower if it wants to go there today. I’ll go out a few weeks on the trade so right now that means November 20 expiration. Goal is $4-$5 premium on the $10 wide and exiting the trade with 30-50% of the premium would be ideal.

That day, ZM actually dropped more than I expected, and I wanted to take advantage of that.

At 9:46 AM ET on Tuesday, I sent this out…

ZM bull puts. sold 10 nov 20 380 / 370 vertical put spread for 4. risking 6k to make 4k

So I sold the $380 puts and simultaneously purchased the $370 puts. This play pretty much said I believe ZM would stay above $380 by the expiration date, and of course, that’s a bullish bet.

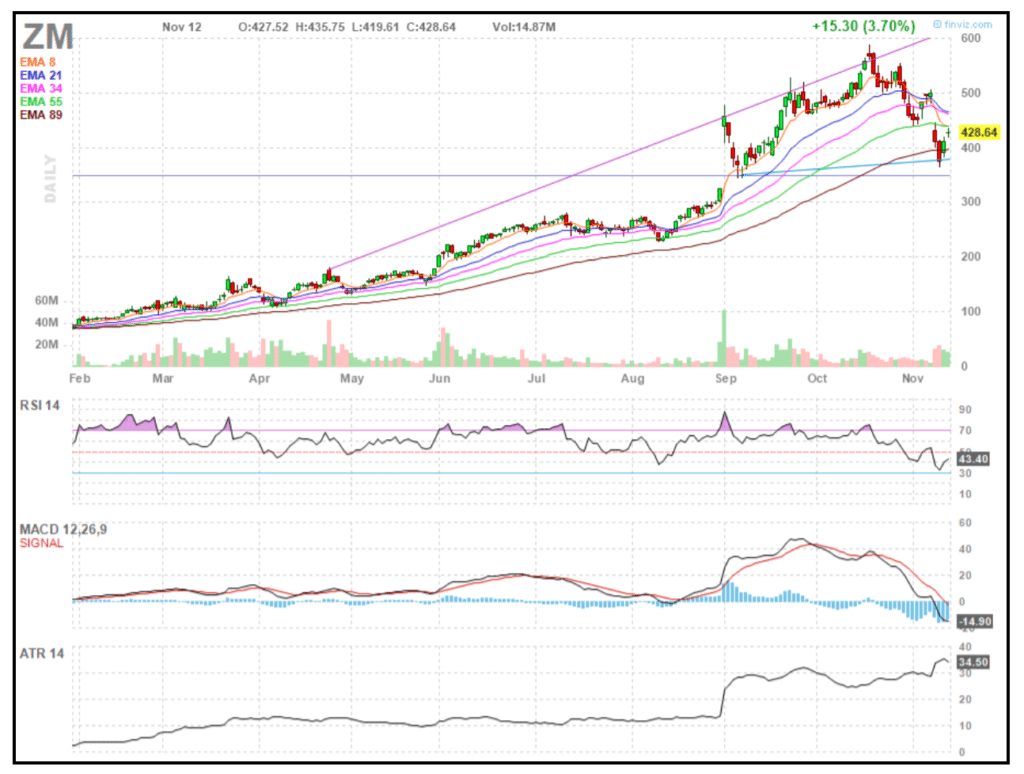

That 89-day exponential moving average (EMA) actually held up well…

And the stock did what I expected.

By Thursday, I was locking in about $2,500 in gains.*

That’s exactly why I love to use spreads. I didn’t need to use a lot of capital outlay, and I wasn’t over-levered. This type of strategy is great for me because I can go to bed knowing exactly what I’m risking… and that time value isn’t moving against me.

If any of this sounds confusing to you, make sure to shoot me a text at my community number here: +1 (410) 210-4522.

My team will collect responses they believe will be most beneficial to beginner options traders, and I’ll answer them in my next AMA (Ask Me Anything) series.

0 Comments