Cha-ching! Take a quick look at the open trade analysis for Wednesday because we’re up 24%+ on GEVO (+$8,600 for me already) and I think this is only the start of a much bigger move. Overall it was a boring day on Wall Street for the bulls as Cyprus continued to weigh on the major indices, despite the strong housing numbers.

The markets gapped higher at the open Tuesday but traded lower throughout the session but were able to gain footing into the close when news hit that the Cypriot parliament rejected the proposed financial bailout and the European Central Bank said it would provide liquidity.

Special Offer – 30 Day Trial – Limited Enrollment

Wednesday all eyes are on the FOMC announcement at 2 p.m. EST followed by Bernanke’s press conference 30-minutes later. Personally I think the easing will continue at the same pace but for whatever reason it doesn’t, gold and silver trades are where I’ll be looking.

——————————————————–

THE DAILY WATCH LIST

——————————————————–

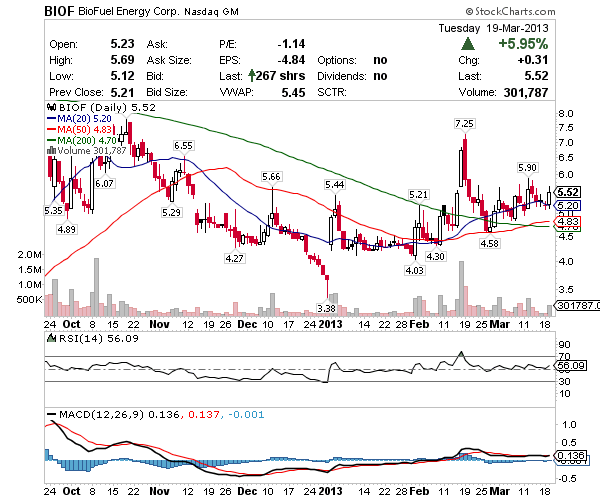

BIOF – Gevo had big news Tuesday after the close and I’m up almost $10,000 on that trade so watch BioFuel because it’s in play Wednesday morning as a sympathy swing trade. I’m thinking a break of the $5.70’s swing to just below $7. This is a low float trade and most of the shares are short so it could definitely run. Bids work best here due to the low float.

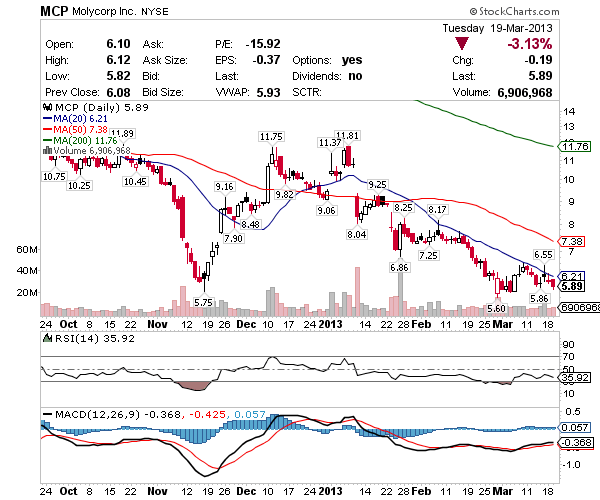

MCP – probably my top trade idea into Wednesday because I think this will turn and push $6.50’s soon, possible even $7 though I’d be out with profit before there. Key $5.86 Wednesday, I’d like to see it above there to test entry, otherwise it’s a waiting game for the curl above the $5.60 low from the end of February.

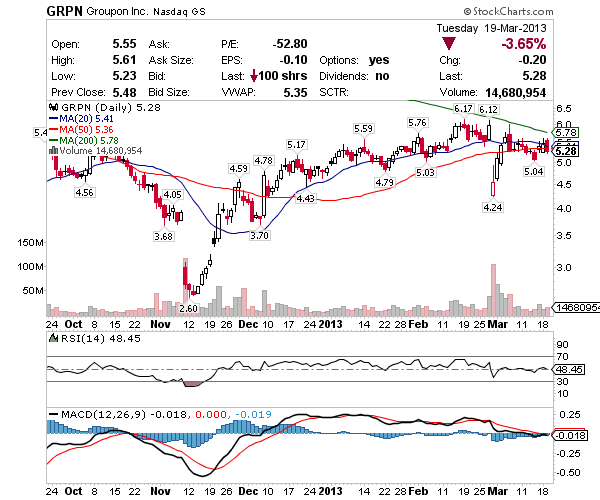

GRPN – weakness Tuesday expected in the bearish market but I think this trades higher soon, probably above $6, so I like it above $5.04 so if the market is bullish Wednesday I’ll be a buyer here for the move above the 200 Moving Average at $5.78, swing to $6 which will challenge the gap.

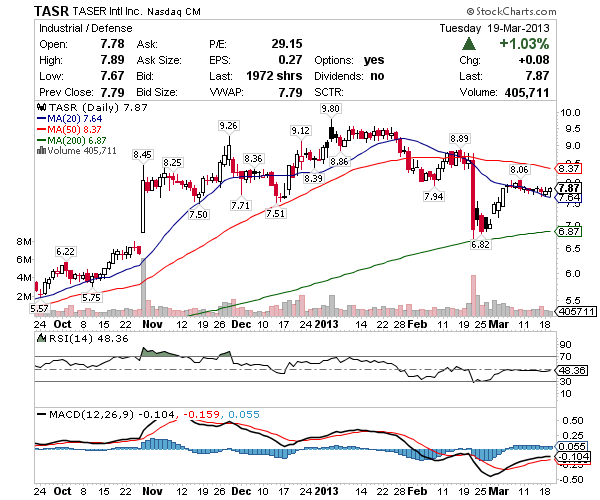

TASR – big fan here above the 20 Moving Average up on a down day Tuesday. If $7.60’s hold it’s in play for a swing to $9 with chop at $8, the 50 Moving Average of $8.37 before it hits pay dirt. If I take this trade I’m thinking 7,000 shares swing for about $.30 – $.50 / share around the 50 Moving Average, rinse and repeat.

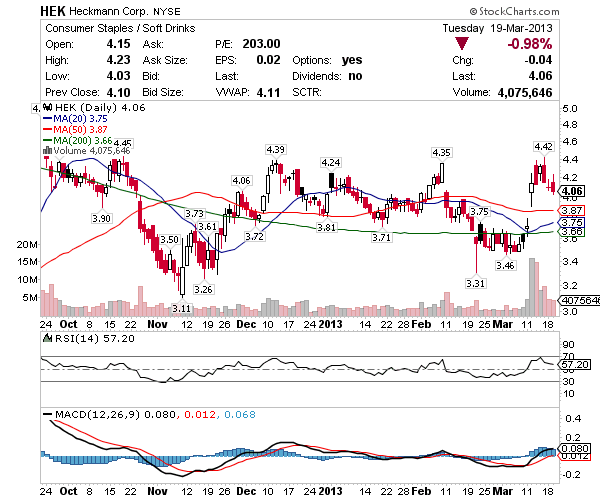

HEK – was hoping Heckmann would come in after the earnings win and it is so I’m looking to scale in here with some around $4 and more off the 50 / 20 Moving Averages and swing the next move to the $4.40’s, take half and let the rest ride for profit under $5. There’s a pretty ascending triangle developing here but I don’t think I’ll get an entry off the trendline so I’m looking to take it sooner, thinking anything around $3.90’s would be a desirable average. I really like this trade on the pullback, it’s just about finding the best entry now.

Special Offer – 30 Day Trial – Limited Enrollment

——————————————————–

THE SWING TRADE STALKER

——————————————————–

Oversold – SKUL, CECO, FLOW, AKS, CEDC (Charts)

Wednesday – SKUL big move Tuesday on the CEO news but it didn’t cover the gap around $5.30’s so no trade for me here, I won’t chase it up the chart… key $5.80 because if that falls a move into the low $6’s is reasonable into Friday… if it does dip and curl I’ll look for a candle over candle entry Thursday or Friday. CECO I took with Bond Blow Ups on the curl straight out of video lesson #1 and am looking for the move into the $3’s here. FLOW let go of support in the weak market so I’ll now just monitor for a deeper oversold turn before consideration, something closer to $3 is what I’m thinking now. AKS also weak which is expected in the bear market but it’s in play still above the recent low of $3.46, see if it holds $3.50’s Wednesday. CEDC I’ve removed from the master watch list and I’m done tracking this company… I no longer care what happens here, they’re just a train wreck that continues to separate investors from their money.

Tuesday – SKUL was up nicely on a down day forming the curl I look for on the chart before a potential squeeze and for good reason, turns out they named their new CEO after the close and he’s from high profile Nike which is almost sure to send shares higher Tuesday. CECO Doji and up on a down day suggests the move to the low $3’s is in play this week, especially with the MACD (black) about to cross the signal line (red) Tuesday, possible alert here if I’m right. FLOW was down 1% Monday but it’s definitely still in play given the volume was light and it held above $3.36 support which means it’s still candle over candle but I want to see it curl now. AKS was down a half percent Monday which is to be expected given the market, it’s candle over candle at $3.46 but I want to see an open above $3.59 Tuesday suggesting a move to $3.90 is possible this week. CEDC let go of the $.39 low after an early bounce to $.42 suggesting it’s not done selling yet, continue to watch for news from the company that has its finances in order.

Monday – SKUL is on short squeeze watch above $5.06 is in play and there appear to be buyers above $5.20 so let’s start by watching for a curl early this week, 30% of the float is short here. CECO is carried over from last week’s oversold list and appears to be setting up for a move to $3, chop and settle at $3.20’s. FLOW pulled on earnings but they did okay so I’m looking for the stock to settle and I’ll take this trade, despite the low volume, the 200 Moving Average followed by $3.36 are my current markers. AKS candle over candle confirmation Friday, this is in play above $3.46 with chop at $3.77, $3.88 with a goal at the 50 Moving Average just above $4. CEDC is a wild card i.e. buyer beware but honestly given the bull market there’s not a lot of good stocks oversold so I’m just watching the stock for news it’s not pricing for bankruptcy.

Continuation – OCZ, MWW, REE, VRNG, MCP (Charts)

Wednesday – OCZ continues to hold the 50 Moving Average so if it curls off that in a bull market I’ll consider buying but I’m not loving the chop at $2.16 and $2.30’s here. MWW let go of the 20 Moving Average so probably no trade for me now but if it curls above $4.94 later this week it might make for a nice swing back to $5.41. REE blah, in play still but barely… above $2.26 with a curl and maybe but if goes lower no trade for me. VRNG I’m probably not trading now before Thursday’s call, though I do think there might be a little runup in anticipation of what they might say after earnings. MCP is probably my top trade idea into Wednesday because I think this will turn and push $6.50’s soon, possible even $7… key $5.86 Wednesday, I’d like to see it above there, otherwise it’s a waiting game for the curl above the $5.60 low recently.

Tuesday – OCZ I actually bought Monday but only got 10,000 filled at $2.12 before it started to squeeze, wanted 20,000 at $2.10 so instead of chasing I flipped it out for about $200 at $2.14 and will try again later this week off the 50 Moving Average if it holds. MWW pulled about 3% with the market which would be expected, key the 20 Moving Average $5.20 Tuesday, if that holds this could be a good swing up to $6 but is likely to take some time without news. REE held the 20 Moving Average nicely Monday up on a down day so I’d expect this to go higher in a bull market, Monday’s news looked okay too, though nothing game changing. VRNG reports earnings on Thursday after the close but it’s the call after that should tell the story here, maybe a runup into Thursday’s close so I’ll watch for signs of accumulation. MCP above $5.86 definitely interests me so I’ll watch Tuesday for an entry after Monday’s 2% dip, if the overall market heads back up in the middle of this week Molycorp to $7 is reasonable before Friday.

Monday – OCZ is a stock I think is going above $3 soon on a short squeeze so I’ll probably look to get in this week if it curls off the 50 Moving Average candle over candle at $1.93. MWW above the 20 Moving Average of $5.21 is in play this week for a move to $5.50’s and chop followed by a push to $6. REE light volume trade but I like the chart a lot above the 20 Moving Average of $2.37, swing to the 50 Moving Average of $2.90 where it slowed on the last bounce. VRNG is pending court news so like CEDC this isn’t for the faint of heart but you guys and gals know me, I like some speculation from time to time so I’m watching above $2.83. MCP to $7 is reasonable given last week’s news so watch $6.33 as the pivot and I think it’ll settle in the low $7’s.

Breakout – HOV, KEG, MITK, GRPN, ZAGG (Charts)

Wednesday – HOV killed it early on the housing data, as expected, but the weak market prevented a move to $6.60’s slowing at the $6.43 high and settling at $6.19 up 4%, key a break of $6.20’s in a bull market and I think it’ll find $6.60’s this week. KEG not going to breakout in a bear market but it’s above the 20 and 50 Moving Averages still, so on watch for a bullish market and a hold of $8.40 if it’s going for $9’s this week. MITK is light volume but in play with no sellers in Tuesday’s bearish market, key an open above $4.60 Wednesday, if the market is heading higher watch for volume in this trade, if it’s there I think a swing to $5 is reasonable, definitely in play but limit order due to liquidity. GRPN weakness expected in the bearish market, like it above $5.04 so if the market is bullish I’ll be a buyer here Wednesday I believe. ZAGG nice move to $8 Tuesday but failed to hold the gains as the markets drifted lower, above the 20 Moving Average of $7.46 this is in play and a top trade for me so I’m watching close Wednesday.

Tuesday – HOV continues to hug the 20 Moving Average and it’s hard to argue housing isn’t improving so I think it’s just a matter of time before $6.20’s fall and $6.60’s gets tested, watch Tuesday’s data, anything positive about housing usually bumps Hovnanian. KEG was weak with the market but held the 20 Moving Average so watch for entry Tuesday if $8.44 holds up, swing to the upper $9’s. MITK on the curl off the 20 Moving Average Monday up 2% on a down day with light volume suggests no sellers which means the move to $5 and possible breakout is coming this week, watch close because it needs more volume, that’s the key. GRPN is tangled in the 50 and 20 Moving Averages up 2% on Monday and gearing for a move to the low $6’s before pushing into the gap, I like this trade here. ZAGG found buyers Monday too up 3% and I’d be shocked if it didn’t continue to the $8.20’s where it should slow or dip before a move to $9’s, this is one of my top trade ideas right now and while it might look boring as of late, this quarter I think shares trade above $10 in a breakout move.

Monday – HOV is in play with housing data Monday and Tuesday… I think we’ll see Hovnanian test the $6.20’s again and chop in the $6.60’s. If the housing market continues to improve which I anticipate it will, especially if the FOMC commits to keeping rates low, it’s a possible a test of $7.43 is coming. KEG is gearing up above the 20 Moving Average with $9.55 ahead before resistance, followed by a breakout… check out the MACD, nice setup for a push right?! MITK is hugging the 20 Moving Average just off that $5 breakout, keep this pattern on watch because this triangle is close to the apex. GRPN if the $5.50’s break then it’s into the low $6’s and as hard as this is to believe I truly think it’s going to breakout and cover the gap from back in August, CEO out has renewed confidence in this $3.55b company. ZAGG I’ve been tracking for a long time and I feel strongly that a move to $10 is coming. I’m a buyer off the 20 or 50 Moving Average this week which is $7.45 and $7.38 respectively. I’m pretty good at predicting news and have a feeling good news will lift this trade soon. Earnings winner too, so bidders are likely to walk it up.

Special Offer – 30 Day Trial – Limited Enrollment

——————————————————–

VIDEO – Wednesday March 20, 2013

——————————————————–

jason have u looked at GEVO AFTER HOURS WTF IS GOING ON THIRE THAT ONE IS TO LATE RAN UP 400% since closing bell on TOS

I like your style kp up the gd work I’m in znga ree an Bbry how come u dnt like Bbry lots of big green bars plus nice uptrend looking for 17-18$ on Bbry kp em coming

I be on the train, I be on the train.