I made 4-trades Monday so let’s do a quick review. Moved out of HL +$600 Monday despite being swing long because I felt strongly silver (SLV) should have advanced more on the Cyprus news. Silver gapped up nicely but was weak across the session. I also read Bernanke isn’t looking to take his foot off the stimulus pedal just yet which means we might not see the move on gold and silver into Wednesday’s close I was looking for. Add in some uncertainty with this overbought market and I figured +$600 in the pocket is a good way to reduce exposure. Also sold my remaining JVA for a small loss. There’s a video lesson coming Monday night on how I missed earnings Friday but did okay on this trade following my rules, out with half at 5% Friday on the squeeze before the call… total loss on Coffee Holding was -$140, overall I’m disappointed with myself on the JVA trade. This brings my 2013 profit to $75,064 in less than 3-months. Those were the sells, I also bought 2-stocks to include a new position in Boyd Gaming diversifying the real money mobile gaming catalyst and more Zynga. You can read more about both those buys in my open trade analysis for Tuesday.

Special Offer – 30 Day Trial – Limited Enrollment

The market gapped down big on the Cyprus news and it looked like anyone in VIX plays, gold or silver would do well but the market shrugged off the news and found buyers on the dip. The S&P 500 rose steadily across the trading session making higher lows but was unable to run high of day with a small dip into the close. Tuesday’s economic data is light with housing starts at 8:30 a.m. EST and be sure to pay attention to the The Federal Open Market Committee announcement Wednesday at 2 p.m. EST followed by Bernanke’s press conference 30-minutes later.

——————————————————–

THE DAILY WATCH LIST

——————————————————–

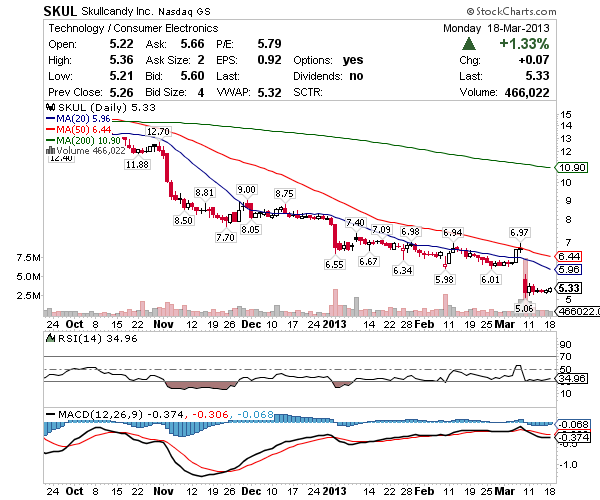

SKUL – up nicely on a down day forming the curl I look for on the chart before a potential squeeze and for good reason, turns out they named their new CEO after the close and he’s from high profile Nike which is almost sure to send shares higher Tuesday. I anticipate a gap here so I’ll look for entry off any early morning profit taking around $5.30’s which would be gap recovery.

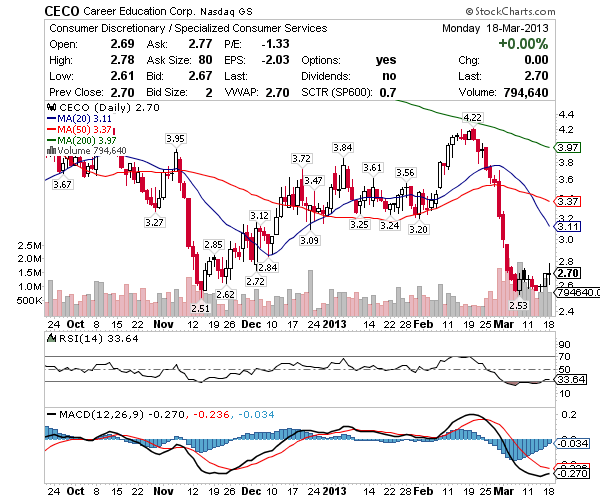

CECO – Doji and up on a down day suggests the move to the low $3’s is in play this week, especially with the MACD (black) about to cross the signal line (red) Tuesday, possible alert here if I’m right. Not my favorite company but $.30 / share is money in the pocket, don’t need to love the company.

MCP – above $5.86 definitely interests me so I’ll watch Tuesday for an entry after Monday’s 2% dip, if the overall market heads back up in the middle of this week Molycorp to $7 is reasonable before Friday. There’s a lot of big shorts looking to cover this trade and I’d like to be in before they do, look for the curl above $6 Tuesday.

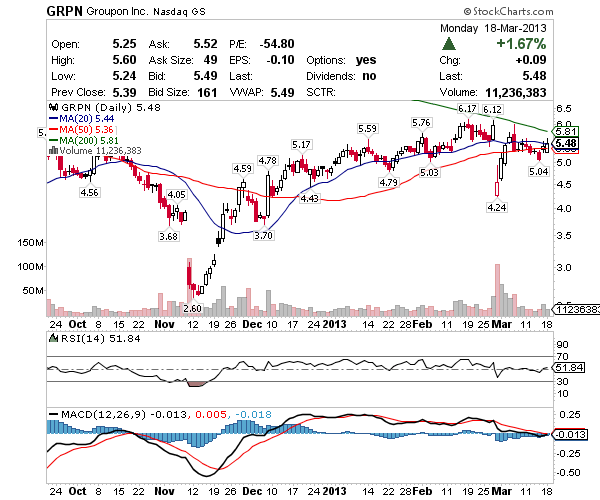

GRPN – tangled in the 50 and 20 Moving Averages up 2% on Monday and gearing for a move to the low $6’s before pushing into the gap, I like this trade here. I’m interested above $5.40’s Tuesday, out if it goes below and I’ll buy back lower above $5.10.

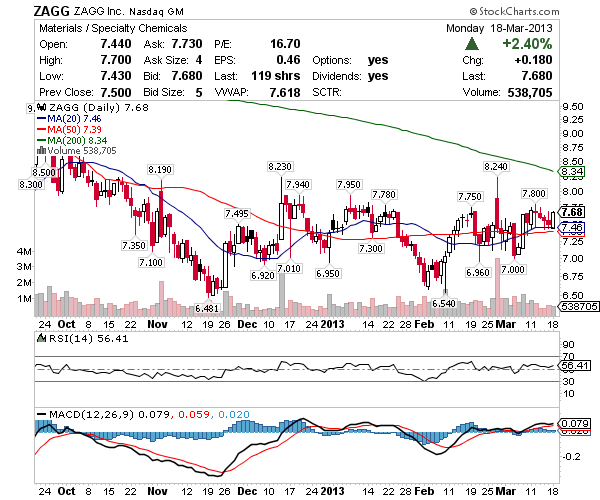

ZAGG – found buyers Monday too up 3% and I’d be shocked if it didn’t continue to the $8.20’s where it should slow or dip before a move to $9’s, this is one of my top trade ideas right now and while it might look boring as of late, this quarter I think shares trade above $10 in a breakout move. Entry around $7.60 would be desirable.

Special Offer – 30 Day Trial – Limited Enrollment

——————————————————–

THE SWING TRADE STALKER

——————————————————–

Oversold – SKUL, CECO, FLOW, AKS, CEDC (Charts)

Tuesday – SKUL was up nicely on a down day forming the curl I look for on the chart before a potential squeeze and for good reason, turns out they named their new CEO after the close and he’s from high profile Nike which is almost sure to send shares higher Tuesday. CECO Doji and up on a down day suggests the move to the low $3’s is in play this week, especially with the MACD (black) about to cross the signal line (red) Tuesday, possible alert here if I’m right. FLOW was down 1% Monday but it’s definitely still in play given the volume was light and it held above $3.36 support which means it’s still candle over candle but I want to see it curl now. AKS was down a half percent Monday which is to be expected given the market, it’s candle over candle at $3.46 but I want to see an open above $3.59 Tuesday suggesting a move to $3.90 is possible this week. CEDC let go of the $.39 low after an early bounce to $.42 suggesting it’s not done selling yet, continue to watch for news from the company that has its finances in order.

Monday – SKUL is on short squeeze watch above $5.06 is in play and there appear to be buyers above $5.20 so let’s start by watching for a curl early this week, 30% of the float is short here. CECO is carried over from last week’s oversold list and appears to be setting up for a move to $3, chop and settle at $3.20’s. FLOW pulled on earnings but they did okay so I’m looking for the stock to settle and I’ll take this trade, despite the low volume, the 200 Moving Average followed by $3.36 are my current markers. AKS candle over candle confirmation Friday, this is in play above $3.46 with chop at $3.77, $3.88 with a goal at the 50 Moving Average just above $4. CEDC is a wild card i.e. buyer beware but honestly given the bull market there’s not a lot of good stocks oversold so I’m just watching the stock for news it’s not pricing for bankruptcy.

Continuation – OCZ, MWW, REE, VRNG, MCP (Charts)

Tuesday – OCZ I actually bought Monday but only got 10,000 filled at $2.12 before it started to squeeze, wanted 20,000 at $2.10 so instead of chasing I flipped it out for about $200 at $2.14 and will try again later this week off the 50 Moving Average if it holds. MWW pulled about 3% with the market which would be expected, key the 20 Moving Average $5.20 Tuesday, if that holds this could be a good swing up to $6 but is likely to take some time without news. REE held the 20 Moving Average nicely Monday up on a down day so I’d expect this to go higher in a bull market, Monday’s news looked okay too, though nothing game changing. VRNG reports earnings on Thursday after the close but it’s the call after that should tell the story here, maybe a runup into Thursday’s close so I’ll watch for signs of accumulation. MCP above $5.86 definitely interests me so I’ll watch Tuesday for an entry after Monday’s 2% dip, if the overall market heads back up in the middle of this week Molycorp to $7 is reasonable before Friday.

Monday – OCZ is a stock I think is going above $3 soon on a short squeeze so I’ll probably look to get in this week if it curls off the 50 Moving Average candle over candle at $1.93. MWW above the 20 Moving Average of $5.21 is in play this week for a move to $5.50’s and chop followed by a push to $6. REE light volume trade but I like the chart a lot above the 20 Moving Average of $2.37, swing to the 50 Moving Average of $2.90 where it slowed on the last bounce. VRNG is pending court news so like CEDC this isn’t for the faint of heart but you guys and gals know me, I like some speculation from time to time so I’m watching above $2.83. MCP to $7 is reasonable given last week’s news so watch $6.33 as the pivot and I think it’ll settle in the low $7’s.

Breakout – HOV, KEG, MITK, GRPN, ZAGG (Charts)

Tuesday – HOV continues to hug the 20 Moving Average and it’s hard to argue housing isn’t improving so I think it’s just a matter of time before $6.20’s fall and $6.60’s gets tested, watch Tuesday’s data, anything positive about housing usually bumps Hovnanian. KEG was weak with the market but held the 20 Moving Average so watch for entry Tuesday if $8.44 holds up, swing to the upper $9’s. MITK on the curl off the 20 Moving Average Monday up 2% on a down day with light volume suggests no sellers which means the move to $5 and possible breakout is coming this week, watch close because it needs more volume, that’s the key. GRPN is tangled in the 50 and 20 Moving Averages up 2% on Monday and gearing for a move to the low $6’s before pushing into the gap, I like this trade here. ZAGG found buyers Monday too up 3% and I’d be shocked if it didn’t continue to the $8.20’s where it should slow or dip before a move to $9’s, this is one of my top trade ideas right now and while it might look boring as of late, this quarter I think shares trade above $10 in a breakout move.

Monday – HOV is in play with housing data Monday and Tuesday… I think we’ll see Hovnanian test the $6.20’s again and chop in the $6.60’s. If the housing market continues to improve which I anticipate it will, especially if the FOMC commits to keeping rates low, it’s a possible a test of $7.43 is coming. KEG is gearing up above the 20 Moving Average with $9.55 ahead before resistance, followed by a breakout… check out the MACD, nice setup for a push right?! MITK is hugging the 20 Moving Average just off that $5 breakout, keep this pattern on watch because this triangle is close to the apex. GRPN if the $5.50’s break then it’s into the low $6’s and as hard as this is to believe I truly think it’s going to breakout and cover the gap from back in August, CEO out has renewed confidence in this $3.55b company. ZAGG I’ve been tracking for a long time and I feel strongly that a move to $10 is coming. I’m a buyer off the 20 or 50 Moving Average this week which is $7.45 and $7.38 respectively. I’m pretty good at predicting news and have a feeling good news will lift this trade soon. Earnings winner too, so bidders are likely to walk it up.

——————————————————–

VIDEO – Tuesday March 19, 2013

——————————————————–

0 Comments