I can’t remember the last time I’ve seen a market as crazy as this. To be honest with you, I don’t know how long stocks will be like this. Despite all the volatility in the market, I believe now is the best time to learn how to trade momentum stocks.

Why?

There are so many momentum trading opportunities out there, and I’ve developed a step-by-step system that’s allowed me to hunt down high-probability setups.

Since stocks are moving so fast and by a larger magnitude than normal, I believe it’s important to understand the ins and outs of scalable and repeatable patterns. Today, I want to show you one of my favorite setups and how to use it to your advantage in this market environment.

The One Pattern I’m Stalking In This Market Environment

I believe it’s of the utmost importance to have a few reliable patterns that work in nearly any market environment. For me personally, the bull flag / pennant patterns is my go to.

I know what you’re thinking, “Jason… we’re kind of still in a bear market, how could this pattern possibly work?”

Well, I pick and choose the bull flag / pennant patterns I see out there because it’s very easy to get faked out. That’s why I filter down all the hot stocks out there down to just a handful and come up with a trade plan.

Once my scanner picks up a few names, I look for the trusty bull flag / pennant pattern. Before I walk you through how to avoid getting faked out by this pattern, I want to show you what a textbook setup looks like.

[Case Study] A Textbook Bull Pennant Pattern

With this specific setup, I want to wait for an explosive move, followed by an area of consolidation (choppy price action between to levels). In other words, I want to buy when it’s within the “flag” or “pennant” portion of the pattern.

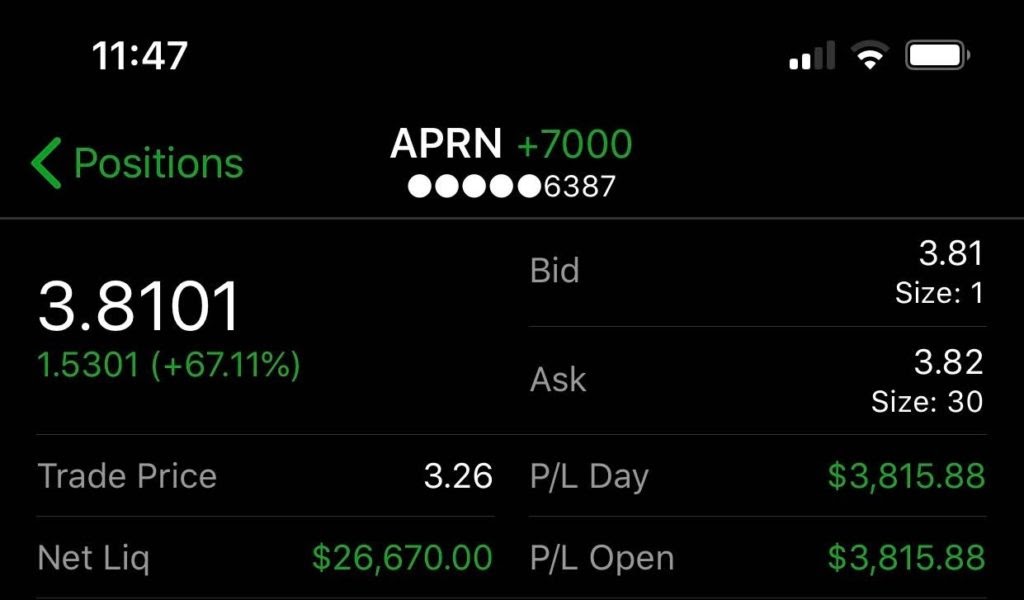

If you look at the chart above, this is a real money trade I had in APRN. As you can see where I issued the buy alert at the time, it was right in the pennant portion of the pattern.

I bought 7,000 shares of APRN at $3.26, and looked for a 5-10% move the same day, or overnight. I wasn’t looking for a whole lot here…

…and if you look at the chart, you could see my plan worked out perfectly.

If you want to learn more about my trade in APRN, you can read the full story here.

Of course, with every pattern there are signals that indicate the setup may not play out.

Here’s exactly what I’m talking about.

Look Out For This Telltale Sign With The Bull Flag / Pennant Setup

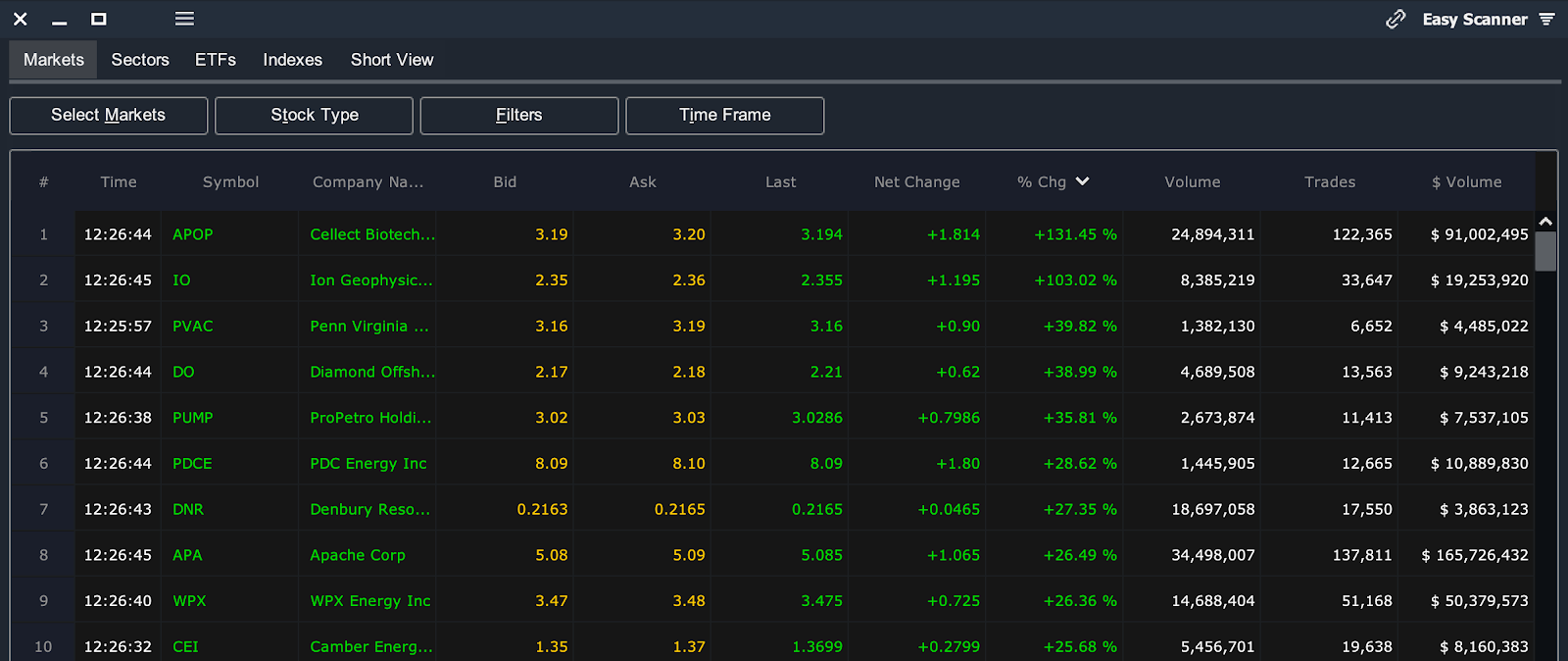

One day, APOP was at the top of the board as the stock was up 131% at the time and about $91M in liquidity when I spotted it.

When I looked at APOP’s chart, it was in a bull flag / pennant intraday.

However, something didn’t sit right with APOP. Normally, I would take this setup in a heartbeat, but here’s why I didn’t buy it above $3.

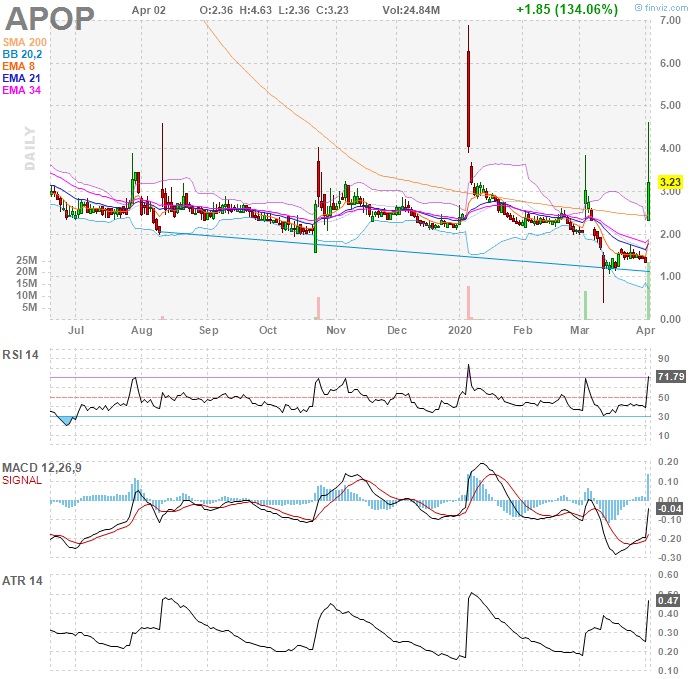

A quick look at the daily chart illustrates that nearly EVERY pop this stock had was met with aggressive selling.

At the time, I thought to myself, “Could this be the time it runs high of day and gaps? Certainly.”

The thing is, my goal is to stack odds in my favor so before I take these momentum trades, I check that daily chart.

As you may know, I’m not into shorting momentum stocks, but with APOP, I thought it would be interesting to watch and learn from to see if the stock crashes into the close or bucks the historical trend of pop / drop and runs high of the day.

Based on my teaching, probability says it goes lower and that’s why I’m not interested in this intraday bull flag, despite it meeting much of my criteria. Of course, at the end of the day, I checked on APOP…

Guess what happened?

The bull pennant pattern didn’t play out, and the stock didn’t reclaim its high of day.

Now, when you know how to conduct due diligence with chart setups, as I’ve laid out… it could potentially help you uncover high-probability setups, even in this market environment.

If you really want to learn how to spot momentum trading opportunities, join Jason Bond Unchained and learn how to trade some of the hottest stocks in the market with my trader’s education value, the scanner I use daily, my watch list, and ADVANCED notice trade alerts.

I want to learn your trade’s method for sure.