We saw a weak start to the second quarter yesterday, following the Dow’s worst first-quarter performance in history. This morning we saw jobless claims double week over week to a whopping 6.6 million… and it just goes to show you how the coronavirus has crippled the economy.

Many traders are wondering whether Q2 2020 will be filled with bloodbaths. I can’t tell you where the market is headed next… all I can tell you is that the market sentiment is ugly right now.

However, just because stocks are getting destroyed, that doesn’t mean your account has to suffer. Today, I want to provide you with my do’s and don’ts for this market environment.

I also want to show you there are momentum stocks moving every single day — ones that I hunt down using my simple and high-probability setups.

Can this environment change?

Of course, it can, but it can also get a lot worse.

I’m not implying that history is going to repeat itself. However, I am saying it’s beneficial to be prepared for the worst — that means remaining nimble in this environment.

For me personally, I’ll stick to my bread-and-butter setups and focus on momentum stocks, and remain highly-selective when it comes to my Weekly Windfalls options trades.

Now, I’ve put together a list of the top 3 “do’s and don’ts” — that could not only position you to profit but potentially save you a lot of money too.

My Top “Do’s and Don’ts” For Volatile Markets

First things first…

I believe it’s important for market participants to trade with risk capital.

What does that mean?

It’s money you can afford to lose. As an adult, you should know what that means. That being said, let’s jump right into a quick guide for this wacky market environment.

DO: Trade Stocks Not Correlated to Macro News

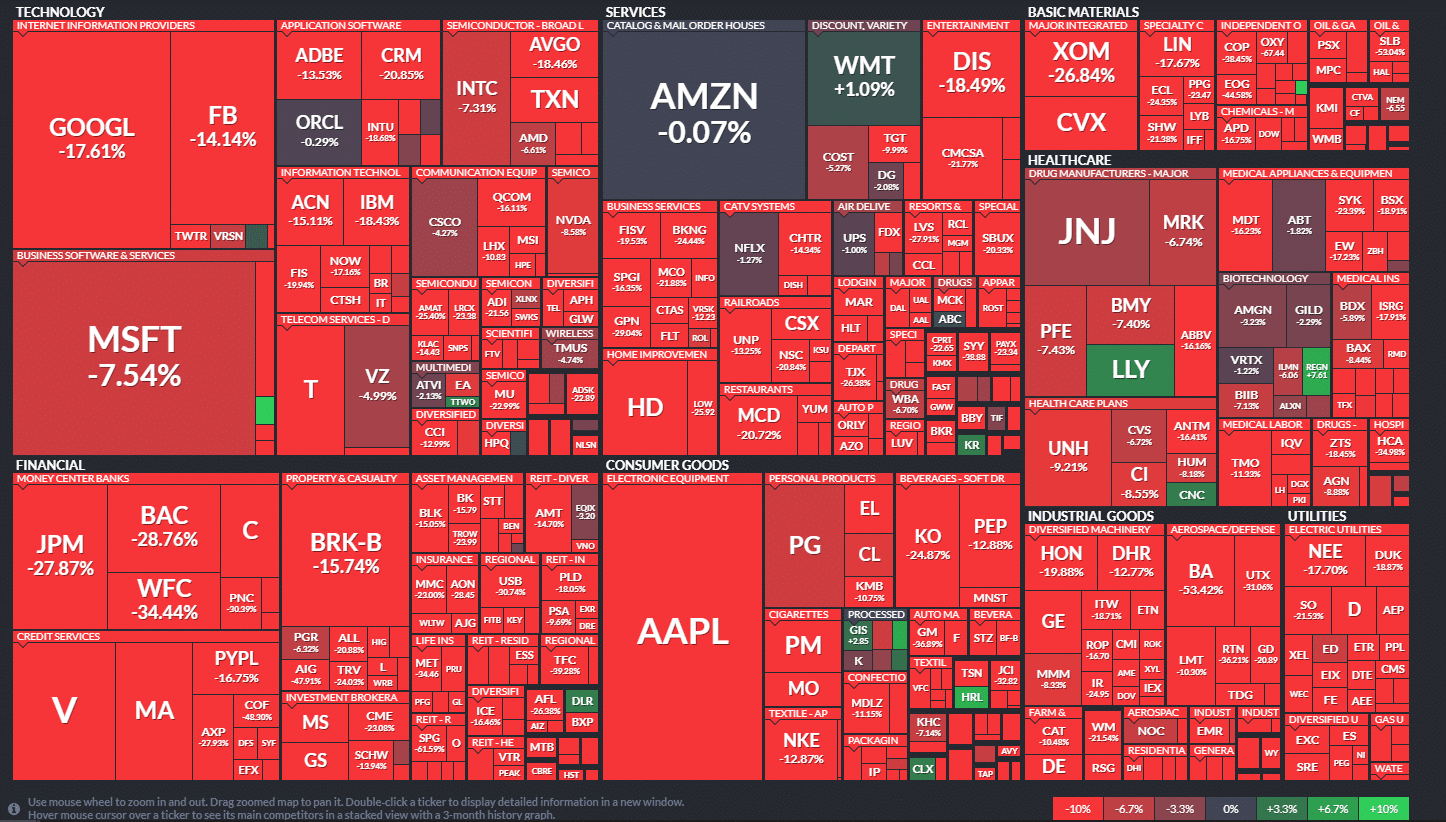

The market has been hammered over the last few weeks… just take check out the heat map for the S&P 500 in March.

(You’d be hard-pressed to find a large-cap stock that finished March strong)

However, what if you looked elsewhere– like momentum stocks – what my Jason Bond Picks service specializes in – you’d be amazed at how many stocks move opposite from the overall market.

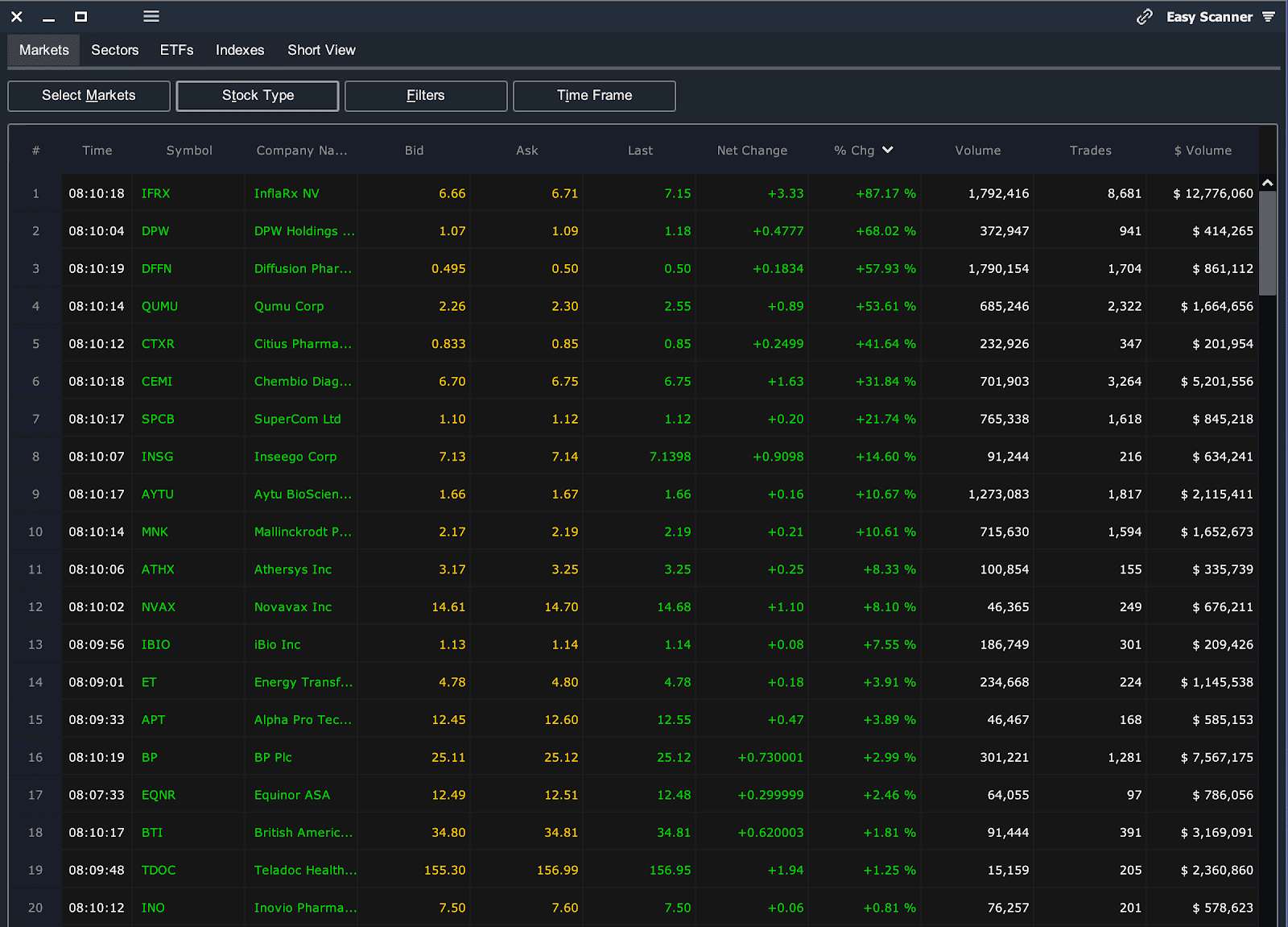

For example, take a look at the stocks that led Wall Street yesterday:

(The leaders consisted of momentum stocks, my bread, and butter)

Remember when I mentioned how market sentiment is bad?

Good.

When the overall market is selling off, typically, we see an influx of traders looking to momentum stocks to chase alpha. I believe this is one of the best areas to find high-probability setups.

Don’t Panic

A lot of what is going on right now is sentiment-based. Just a few weeks ago everyone was celebrating a rate cut from the Fed, as well as the massive $2T stimulus.

Who is to say the Fed doesn’t do something radical again to stimulate the economy… or the scientists don’t find the cure to the coronavirus very soon?

If that does happen, the market could experience a massive bounce. Now, I’m not saying that you should expect that, but sentiment can turn around fast, as it’s proven. And because of that, you shouldn’t panic.

If you are uncomfortable with your exposure, then it may be helpful to lighten up on the position size.

They say the market takes the stairs up and the elevator down. Well, if that’s the case, then stocks may experience a violent sell-off, but it will be short-lived if anything.

DO: Stick to Defined Risk Strategies

While my Weekly Windfalls strategy isn’t perfect, I can go to sleep at night knowing exactly how much I can lose on every single trade– right down to the penny.

And the beauty behind the strategy is that it isn’t based on a particular market trend. You can structure bearish and bullish trades and they can be equally as effective and profitable.

Watch this to learn more about it.

Don’t Try To Be A Hero

I don’t know any traders who have made their living by picking tops or bottoms – as romantic as it sounds.

The market clearly isn’t rational, so why try to trade like it is?

Don’t jump out because you think it’s going to get worse and then believe you’ll have the skills to get back in before the turnaround.

DO: Make Adjustments

Stocks are moving faster and are experiencing larger swings. So consider reducing your position sizing on trades.

For example, let’s say you typically give yourself a $0.50 stop on a trade.

However, the increase in volatility means you have to give your trade more room– so you adjust the stop to $0.80.

But to make it work, you MUST decrease your share size accordingly.

Adjusting your share size (or contract size if you trade options) and modifying your stops are two steps you can take to potentially improve your trading right away.

However, there are other improvements you can make too.

For example, consider changing your trade hold time. What I mean is, if stocks are moving off news headlines – which we have no control over– then why not just take profits quicker when you get them?

Another adjustment is for those who have portfolios. If you must hold overnights then consider having a balance of longs and shorts. An idea that should work exceptionally well for my Weekly Windfalls service.

In other words, become more nimble.

Don’t Beat Yourself Up

I leave you with these words of encouragement: You are in control. If you don’t like this market then go to cash. No one is forcing you to trade.

However, I’ll be trading stocks and options… and excited about the opportunities this market volatility will give us.

If you’d like to trade momentum stocks alongside me, you can – when you join Jason Bond Picks, you’ll gain access to my daily watchlist of hot stocks, ADVANCED notice of trades, receive my trade alerts in real-time… and that’s just the tip of the iceberg.

However, if you’re interested in trading options with me, then you’ve got to go with my Weekly Windfalls service.

That is if you want something that has a risk-defined strategy and potentially a high-probability of success. If so, then click here to join now.

0 Comments