It’s been ANOTHER perfect week in Weekly Windfalls so far!

I’m telling you, ever since my Masterclass on trading psychology — what I said would be my most crucial class of the series — I’ve really turned my trading around.

I’ve re-identified my trading edges, and feel I’m at the beginning of another HOT STREAK!

In case you weren’t aware, when I first started this service, I went 19 for 19…

Am I going to do it again? I can’t promise that for sure.

However, if I can continue to review my trades and focus on my process… then I’ll put myself in a position to win more times than not.

And to keep the momentum… I want to take this time to review with you a recent winner I had in FAANG stock Apple (AAPL).

And once again, it demonstrates that you HAVE to take more than one swing when you’re seeing the ball well — and I am.

Continue reading to see how I knocked in a run on AAPL.

AAPL Winner

Last Friday morning, I alerted my paid Weekly Windfalls subscribers that I liked the bullish consolidation developing in AAPL shares.

I told them I was establishing a bullish credit spread on the stock, by selling the weekly 2/14 320-strike put, which means I expected AAPL to stay above $320 in the short term.

In order to “insure” my position against a massive loss, I limited my risk by simultaneously buying the 2/14 317.50-strike put.

The trade was opened for a net credit of 76 cents, which is the most I could’ve made on the trade.

My risk was $1.74, or the 2.50-point difference between my sold and bought strike, minus the 76-cent credit.

Then, as AAPL shares dropped throughout Friday’s session, ultimately breaking below $320…

I didn’t panic.

Instead, I trusted my trading instincts… and I DOUBLED DOWN.

See, I noticed that Apple stock was trading right around a pair of key moving averages.

Specifically, I felt the 8-day and 21-day exponential moving averages (EMAs) were coming into play.

I’ve mentioned this duo of moving averages before in this space and beyond.

A moving average basically reduces the day-to-day noise of a stock’s trajectory over a period of time.

It will appear as another line on the charts, and can often emerge as an area of support or resistance.

That’s because many traders use trendlines as levels at which to buy or sell a stock.

There are two types of moving averages: simple and exponential.

A simple moving average (SMA) is basically a straightforward average of the stock’s price over a certain timeframe.

The 50-day and 200-day SMAs are two of the most popular trendlines watched on Wall Street.

An EMA gives more weight to recent price action, so it changes directions faster and is often used as a momentum indicator.

EMAs are often used by day traders or short-term traders like me.

So… why the 8-day and 21-day EMAs?

Those numbers sound arbitrary, don’t they?

Well, there are a couple of reasons that many traders look at those particular EMAs; one is the Fibonacci sequence.

And if you don’t know how much I rely on Fibonaccis, well…

In addition, the 21-day EMA is really the middle Bollinger Band.

So, if you think about mean-reversion, this trendline often acts as a good BTFD (Buy The Friggin’ Dip) zone.

However, keep in mind that these EMAs are best used when there’s a strong trend in place.

That said… AAPL HAS been in a strong uptrend, as you saw on the chart above.

So when I saw the shares testing their 8-day and 21-day EMAs, I knew I couldn’t give up on my bullish position.

I took a risk and initiated yet ANOTHER bull put spread, this time going out another week, and adjusting my strikes to 317.50 and 315, to align with those moving averages.

As I told my paid Weekly Windfalls subscribers, I’m almost ALWAYS a seller of puts on AAPL when it dips to the 8-day EMA.

Give me a dip to the 21-day EMA? I’ll go even MORE aggressive.

A dip to the 34-day exponential moving average? I’m RAVENOUS.

That’s because AAPL and stocks of other strong companies get bought aggressively off these levels — meaning they’re bound to go higher.

Selling put options in and around those levels not only provides a great game plan for entries and exits, but has been a reliable CASH COW.

This time was no exception.

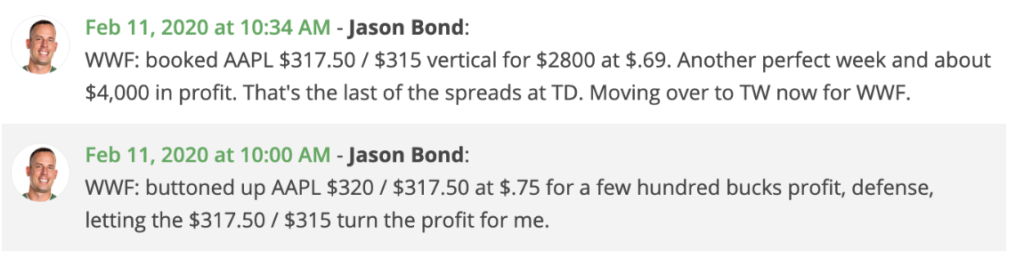

Because I doubled down on Apple, the gains from my second credit spread handily exceeded the minimal losses from my first credit spread, making my overall position a HUGE WINNER:

And while there are also stocks in downtrends on which I could sell calls (the bearish version of this strategy), I don’t do that much, because I’d still be fighting this broad-market uptrend.

Instead, I target strong stocks in which the EMAs are stacked — like AAPL — wait for dips, and get aggressive.

Especially when I’m in the zone and seeing the ball perfectly, like I am now.

So what are you waiting for? You’ve read this much… You clearly WANT to make weekly windfalls of your own. There’s never been a better time to sign up!

0 Comments