The market’s wild run has got me thinking…

It seems as if traders are in a state of euphoria…

And chasing alpha at these levels.

Right now, the QQQ is sitting near all-time highs… and IWM is more than 50% off March lows.

In this market environment… I want to remain patient and nimble.

Why?

Well, I’m a firm believer that traders who are nimble when the market is wacky…

Are in a position to succeed.

So how can traders remain nimble at these levels and develop that mindset?

How To Be Nimble When The Market Is Wacky

For me personally, my strategy allows me to be nimble.

Why?

Well, I’m really just looking for base hits when I trade momentum stocks.

It also helps that I’m focused on stocks that may not necessarily move with the overall market… additionally, I’m not biased when it comes to the directions of where the market can head.

I just focus on the price action and my bread-and-butter setups.

My strategy is designed to allow me to trade with a clear mind, remain relaxed and confident in my trade plans… as well as move swiftly when things change on a dime.

I think the best way for you to understand the importance of having a nimble mindset is with a case study.

[Case Study] Maintaining The Nimble Mindset

On Friday, stocks were catching a pop… but I wasn’t ready to play into the euphoria.

Instead, I wanted to remain patient until I saw a clear pattern.

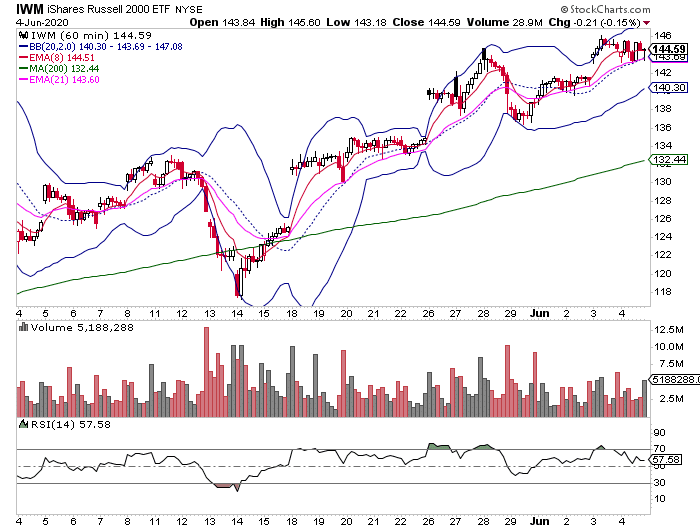

Heading into yesterday, the iShares Russell ETF (IWM) had already made a massive move…

Chart Courtesy Of StockCharts

To me, if I tried to chase on Friday… I could’ve got hurt.

So as I was planning for the trading day… I noticed IWM was extended and gapping up significantly higher, as there was a surprise surge in jobs.

That caused more traders to pile in and bet on the economic recovery.

Of course, I didn’t want to remain on the sidelines all day… because I did think there would be a pullback in stocks after the strong gap up.

So on Friday morning…

I mentioned to subscribers that I wasn’t ready to buy any stocks at these levels… but I was looking to buy IWM puts to try to play the potential gap fill.

Was I expecting IWM to give up all its gains?

Heck no…

I just thought there would be a pullback in the cards on Friday.

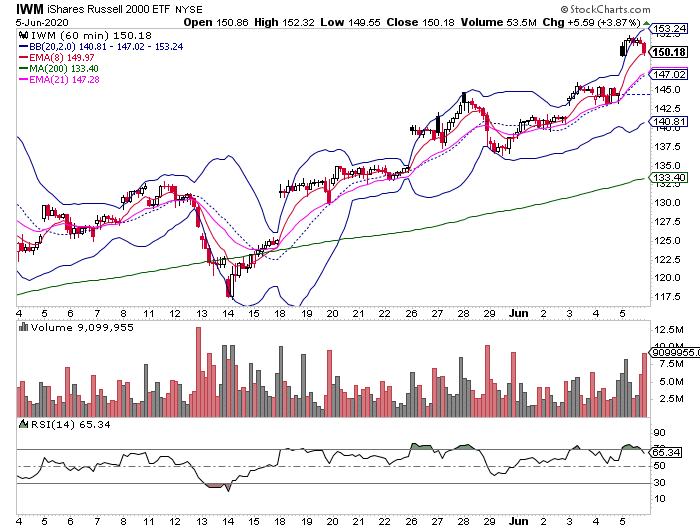

About an hour after the opening bell, I noticed IWM was getting a bit tired, and there was a resistance level at $155.

So what did I decide to do?

Well, I actually purchased IWM $152 June 20 puts.

Why did I believe IWM could pull back?

If you think about it, with such a large gap up… traders may look to start taking profits. Additionally, heading into the weekend, some traders like to get flat.

Moreover, there could be bears piling into place a contrarian bet.

Basically, I thought there was going to be selling pressure…

Chart Courtesy Of StockCharts

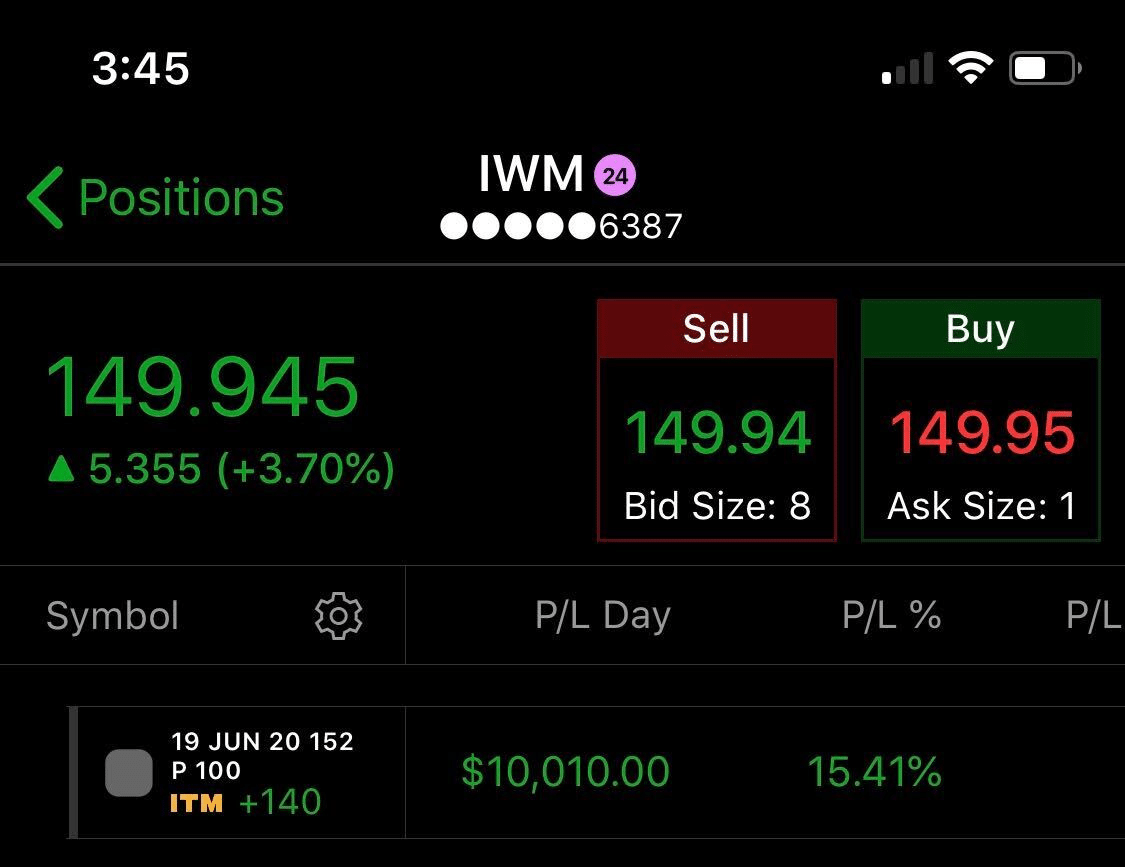

Well, during power hour (the last hour of trading) on Friday… IWM actually started to pullback…

And I was able to lock in a 15% winner.

Of course, I stuck to my plan… I could’ve held into the weekend, but that would go against my strategy of locking in base hits.

In this market environment, I believe it’s important to not overstay your welcome and have a nimble mindset.

If you want to learn more about my trading methodology and how I’m able to trade momentum stocks on a part-time schedule… click here and watch this exclusive training workshop.

DISCLAIMER: To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer

0 Comments