There’s one question that’s been on many of my readers’ minds…

Why do stocks gap up after the weekend…

And how can I take advantage of that?

Well, when it comes to Monday mornings…

There are news headlines and catalyst events that happen over the weekend…

As well as technical factors…

That can cause specific sectors and stocks to pop.

When it comes to spotting stocks that can potentially gap up after the weekend…

It’s important to be able to identify catalysts and chart patterns ahead of time and develop a plan.

Today, I want to reveal to you my thought process as to why stocks gap up after the weekend and show you a case study of one of my recent Monday Movers stock picks.

[Revealed] How I Play The Monday Morning Gap Up

Now, if you’ve ever seen a stock price open significantly higher (or lower) than the previous close… that’s considered a “gap”.

Many traders wonder why this occurs, but it could really range from technicals or fundamentals.

For example, if a stock releases earnings… chances are it’s going to gap. If there’s a specific catalyst that happens overnight (or over the weekend), then the stock or sector can gap up or down.

This can actually happen with chart patterns too… and that’s why I developed my latest breakthrough strategy, Monday Movers.

With this strategy, my goal is to find stocks on Friday that I believe can gap up come Monday morning due to a news event or technical pattern.

Of course, the move doesn’t always happen on Monday… and some stocks need the time to develop a pattern or catalyst for the move to happen.

Monday Movers Case Study

For example, last Friday… there was one major catalyst developing for Digital Ally Inc. (DGLY)…

And I figured the catalyst would still develop over the weekend.

Not only that, but the stock had a strong support level around $0.80 – $0.85… so I figured it could catch a bounce this past Monday.

Of course, a lot went down last weekend… and DGLY was the talk of Wall Street…

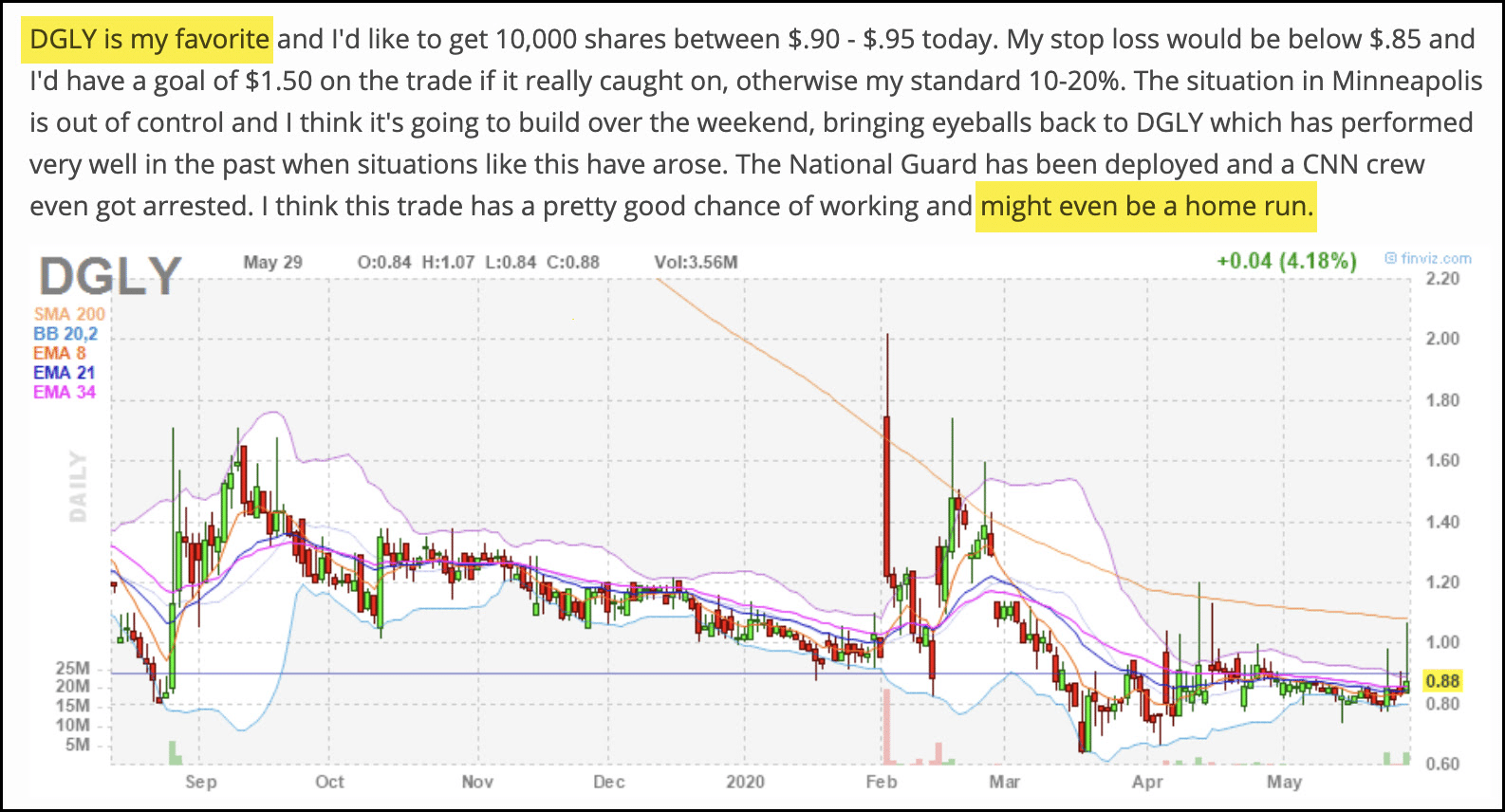

Here’s what I sent out on Monday morning (early in the pre-market) to Monday Movers subscribers…

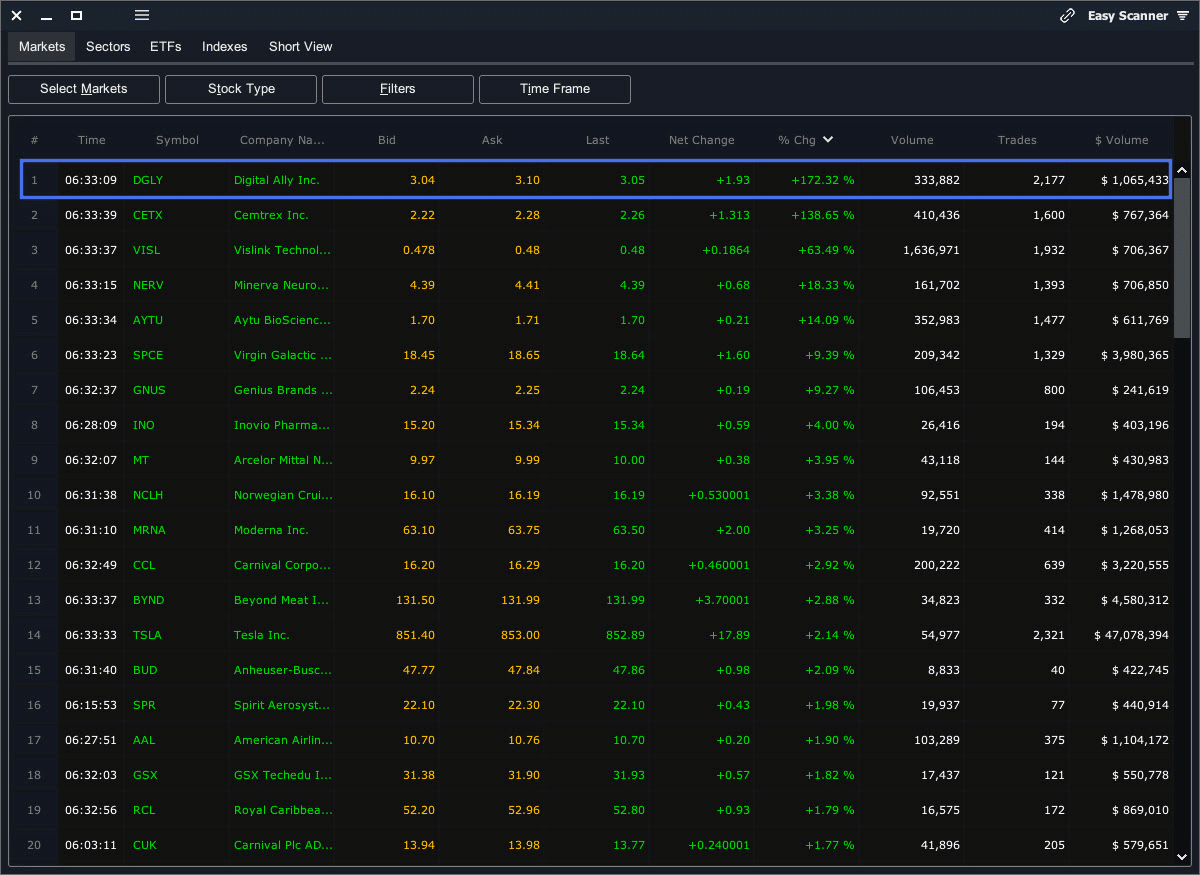

From the time of my alert to you, to this moment as I type, it’s run 474% from $.88 to $5.05 and is Wall Street’s #1 stock sorted by % gain with a minimum liquidity of $200,000 at 6:32 a.m. ET in the premarket. DGLY has already had 2,177 trades on $1,065,433 volume.

It was the top stock on my momentum hunter scanner on Monday.

When it comes to identifying potential gap ups after the weekend… I believe there are two main factors to focus on:

- Catalysts

- Chart patterns

This weekend, there will probably be some major catalysts in specific sectors, as well as patterns developing…

And I’ll be looking for what I believe to be the best stocks that can gap up come Monday morning.

If you want to receive my latest Monday Movers watchlist… join now because I’m dropping it in just a few hours.

When price crossed ( sma) simple moving average above most likely price goes up ,the key is not to think about only one stock it will work well, I know it sounds crazy but if you have 4000$$ and you found 14 stock’s crossing sma above just divide those 4000$$ in 14 (4000$$÷14) buy them market order Sunday night at the and of the week (Friday most likely you Will have some profit