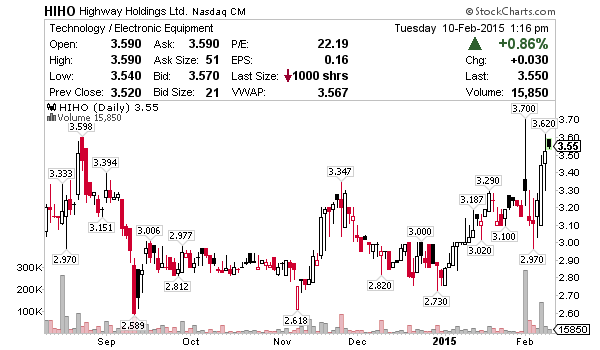

New York (JasonBondPicks) After trading within a wedge pattern since mid-August, shares of Hong Kong-based Highway Holdings Limited (HIHO) soared 29 cents to close decisively above the stock’s ‘wedge’ upper trend line at $3.44 per share, Friday.

And following Monday’s (Feb. 9) announcement of another dividend payout, the stock rose an additional 8 cents to close at $3.52.

A good earnings report issued Monday of last week (Feb. 2), kicked off an impressive rally that took HIHO to as high as $3.70 before an equally impressive volume of selling knocked the stock back down to $3.30 to end the trading day with a more modest gain of 15 cents.

Tuesday’s and Wednesday’s trading included more of the same, with HIHO dropping to successfully test its 50-day moving average of approximately $3.

After stabilizing with modest losses of mid-week, the stock rose Thursday, and again sharply Friday, moving as much as 40 cents higher before settling at $3.44, on 10-times-normal volume traded on the Nasdaq.

After a week of ‘bi-polar’ trading, what are we to make of HIHO going forward?

As we see it, the immediate and principal issue surrounding Highway Holdings’ ability to grow earnings during 2015 and beyond centers on whether, or not, the company will be able to move its manufacturing facility to Yangon, Myanmar, from Shenzhen Province, China.

The secondary issue is the company’s attempt to manufacture its own CO2 cleaning machine in order to be early to a promising, lucrative and relatively unexploited market.

“Concurrently, we are continuing efforts to develop a proprietary product that we can manufacture as a complement to our OEM business,” Roland Kohl, President and CEO of Highway Holdings, wrote in an opening letter to the fiscal 2014 annual report to shareholders. “Our goal is to supplement our steady, lower margin OEM business with a higher margin proprietary product.

“We believe that increasing international environmental awareness will naturally promote this cleaner and greener CO2 cleaning method in the near future. We are at the very early stages of this new venture, but we are hopeful that we will be able to materially diversify our operations by producing our own new, proprietary product.”

However, until more details regarding the latter issue of manufacturing a proprietary product become available, this article will only tackle the company’s strategic focus of relocating the majority of its production to the Myanmar facility.

We only mention Highway Holdings’ potential material event regarding the manufacture of CO2 cleaning equipment because the CEO thought the information was important enough to include it in his opening letter to the company’s latest annual report. The addition of manufacturing proprietary CO2 machines is the latest attempt to increase Highway Holdings gross margin, according to its fiscal 2014 annual report. As that information becomes available, we will update readers of the impact it may have on the share price of HIHO.

ABOUT HIGHWAY HOLDING LIMITED (HIHO)

Highway Holdings Limited is a manufacturing company that produces a wide variety of high-quality products mostly for large, global original equipment manufacturers — from simple parts and components to sub-assemblies and finished products. The Company’s administrative offices are located in Hong Kong, and its manufacturing facilities are located in Shenzhen in the People’s Republic of China. In June 2014, the Company acquired a 25% equity interest in a small product assembly facility in Yangon, Myanmar, and is arranging to purchase an additional 50% equity interest (which purchase, when completed, will give the Company a 75% ownership interest in the Myanmar company). Nearly all of the Company’s revenue is derived from blue-chip multinational corporations based in Germany and Japan.

THE ISSUE HOLDING BACK THE STOCK

According to the company, maintaining cost competitiveness has been the driving effort of management since June 2007, at which time the People’s Republic of China’s Congress passed the Labor Contract Law and began to more strictly enforcing existing labor laws. Essentially, under the new legislation, workers’ rights in China were beefed up substantially, including regulation regarding overtime pay, worker conditions, time off, severance pay, rights of collective bargaining, vacation pay, holiday pay, minimum pay and a European-style workers’ contract that bars employers from terminating an employee unless the employee has committed an infraction against the company’s rules (similar to the laws of some European nations).

“These increases in labor costs have increased the Company’s operating costs, which increase the Company has not always been able to pass through to its customers,” the company stated in its fiscal 2014annual report. “In addition, under the new 33 law, employees who have had two consecutive fixed-term contracts must be given an “open-ended employment contract” that, in effect, constitutes a lifetime, permanent contract, which is terminable only in the event the employee materially breaches the Company’s rules and regulations or is in serious dereliction of his duty. Such non-cancelable employment contracts will substantially increase its employment related risks and may limit the Company’s ability to downsize its workforce.”

In addition to Beijing’s sweeping labor reforms, inflation in Shenzhen, China, where the company’s main facilities have been operating since 1991, has soared by double-digit rates since 2008.

Moreover, Shenzhen recently passed a law that taxes companies by between 5% and 20% of each worker’s pay as a means of funding government-sponsored housing projects within the province.

Low labor costs, once the attraction of Highway Holdings to Shenzhen back in 1991, no longer exists, which now severely undermines the company’s workable business model of providing high-quality OEM products at low prices.

“The Company originally established its operations in China to take advantage of the low cost of operations in China, including in particular the low cost of labor,” the company stated. “However, during the past several years, the overall costs of operating a manufacturing facility have significantly increased. The Company was not always able to pass the increased costs through to the Company’s international customers, some of whom elected to move some of their OEM requirements to other, low labor cost, developing countries.”

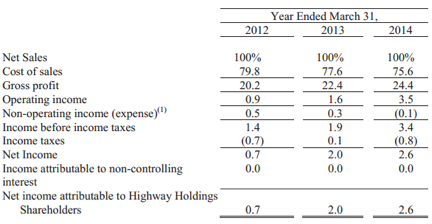

Despite the tremendous headwinds from China’s rapid labor reforms, ‘wage inflation’ and rising renminbi (currency used to pay labor) against the euro, dollar and yen (currency received as revenue), the company’s financial statements have survived during the four-year long ‘bite’ from all angles to the bottom line, and recently have indeed improved (see exhibit, below).

Source: Highway Holdings 2014 Annual Report

Through a reduction of its workforce in favor of automation, Highway Holdings says it has reduced its direct labor force by 75% to partially offset the massive rise in per-worker costs since 2008. In addition, Cost of Sales has also been capped by changing manufacturing hours to that part of the day when electricity is cheapest.

According to the company, there is little more the company can do to reduce costs further. Highway Holding has again reached a point where it must ‘jump’ to another more business friendly jurisdiction.

It was the company’s move to Shenzhen in 1991 that drove the company’s business for more than 20 years; now, the company seeks to move again to an area where cheaper labor costs will again drive the company’s bottom line: Myanmar.

“The Company has decided to shift some of its labor intensive assembly operations to Yangon, Myanmar (formerly, Burma), a developing country that has started to permit foreign investment in that country,” the company stated. “The cost of operating and assembly facility, particularly as a result of the low cost of labor, is significantly lower in Myanmar than in Shenzhen, China.”

In June, Highway Holdings announced its 25% stake in Kayser Myanmar, a manufacturing company that successfully completed various purchase orders for Highway Holding during calendar year 2013 and 2014. The initial 25% required minimal regulatory proceedings and approvals due to Highway Holdings’ minority status with Kayser Myanmar. However, the company now seeks to increase its stake to 75% and taking control of Kayser Myanmar, which requires approval from the Myanmar government.

“In June 2014 the Company purchased a 25% interest in that Myanmar entity from one of the two owners, and the Company is attempting to purchase the 50% interest owned by the other owner,” the company stated. “The consummation of the purchase of the additional 50% interest (which would bring the Company’s ownership stake in that company to 75%) is also subject to, among other things, regulatory approval by the Myanmar authorities.”

The company said it expects approval to purchase the additional 50% of Kayser Myanmar, but doesn’t know when the approval will be forthcoming, if approved. If/when approved, the remaining 25% will be retained by the two co-founders of Kayser Myanmar.

In our opinion, there is strong indication that the deal will be approved, as the military government of Myanmar has recently had European and U.S. sanctions lifted in 2013 due to the Myanmar’s relaxation of restrictions upon human and political rights under junta rule. The momentum in Myanmar can be compared to Vietnam’s momentous growth following war with U.S. In the 1970’s.

Myanmar now can export to the European market, from where more than two-thirds of its revenue is derived. Though sanctions have been partially lifted by the U.S. (who still won’t recognize the nation’s new name, still referring to the country as “Burma”), Highway Holdings exports very little to North America.

“Since early 2011, Myanmar/Burma has embarked on a remarkable path of political and economic reforms, departing from five decades of authoritarian rule,” the European Union said. “The government has committed itself to introducing genuine democracy, and some significant steps have been taken towards establishing a more open and equitable society. The reform process focuses on the transition to democracy, economic and social reforms, and efforts to make peace with a number of ethnic groups within the country.

“In July 2013, the EU reinstated Myanmar/Burma’s access to the Generalised System of Preferences (GSP), which provides for duty-free and quota-free access for the country’s products to the European market.”

THE OPPORTUNITY FOR TRADERS COULD BE SUBSTANTIAL

With a successful move to Myanmar, Highway Holdings will again relive 1991, when the company’s operating margins and profitability exploded. The company ‘went public’ five years later, in 1996, and began trading on the Nasdaq.

What used to by Myanmar-like wages in China, has since evaporated. Today, a minimum wage earned by workers in Shenzhen Province now exceeds $320 per month, according to Bloomberg, not including stiff taxes imposed on employers for each employee by the Shenzhen government, as well as the numerous other costs associated with Beijing’s Labor Contract Law of June 2007 (in effect, Jan.1, 2008).

Contrast China’s labor costs with Myanmar’s labor costs. The average manufacturing worker in Myanmar (not the minimum-wage worker in Shenzhen, cited by Bloomberg) draws a wage of approximately $90 per month, according to the 2012 report, entitled, Survey of Japanese-Affiliated Companies in Asia and Oceania. And that $90 per month doesn’t come with it steep taxes to wages and stringent labor laws. The difference between the cost of a Shenzhen employee and a Myanmar employee has gaped.

We view Highway Holdings’ strategic plan as a make-or-break proposition, with a success materially transforming this company’s bottom line tremendously.

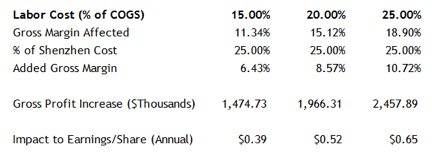

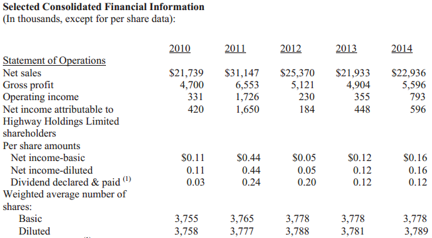

After running some ‘back-of-a-napkin’ estimates (because no specific or detailed data regarding Highway Holdings’ employee costs are available, except that the number of direct labor employees numbers 268, as of June 30, 2014, according to the company’s 2014 annual report), the exhibit, below, gives us very rough estimates of the impact to the company’s per-share earnings if a sharp reduction of labor costs were to materialize.

The labor cost, as a percentage of Highway Holdings’ Cost of Good Sold, is indicated along the top line of the exhibit. The second line is the estimated percentage of the company’s Cost of Good Sold affected as a percentage of revenue (using fiscal 2014’s reported 75.6% COGS of revenue). The third line is the estimated percentage of Myanmar’s labor cost when compared with Shenzhen’s labor cost (estimated at one-quarter of Shenzhen’s labor cost). The fourth line is the number of hundreds-of-basis-points added to the company’s Gross Profit percentage (using fiscal 2014 revenue of $22.94M, see below). The fifth line calculates the dollar amount of the added Gross Profit, based upon the percentage change to Gross Profit Margin. And the sixth line calculates the dollar impact to earnings per share.

Note: the potential impact to earnings per share does not include income taxes or extraordinary items.

Of course, first, the additional 50% stake of Kayser Myanmar must be approved by the Myanmar government ; second, the move to Myanmar could take several quarters to accomplish; and, third, not all of the company’s operations will move to Myanmar, only those product lines which entail high labor costs per unit sold.

But, all things considered, moving most of the company’s operations to Myanmar could greatly impact the bottom line over time.

Calculating a reasonable valuation of HIHO involves taking the per-share earnings and applying a multiple to earnings. With the S&P500 trading at 19.4-times earnings, HIHO could conceivably double in price on an initial knee-jerk reaction to a favorable announcement from the Myanmar government regarding the company’s Myanmar facility. Prospects of the company continuing to produce earnings beyond the latest two quarters could widen the stock’s estimated forward p/e, which now stands at less than 12 times our fiscal 2015 estimate of 30 cents per share.

An approval is that important and may also alert other journalists to finally cover this stock. Up until now, there exists almost no analysis, and the lack of coverage may account for the stock’s significant discount (in our opinion) when compared to the S&P500’s lofty market metrics.

Discloser: I am long HIHO

0 Comments