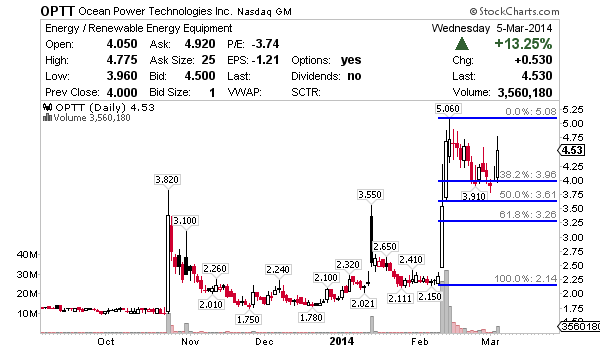

Big wins Tuesday on YOD, VIMC and OPTT totaling $12,300 profit leaving me up $17,080 in March so far.

2014 the portfolio is +24.17% +$72,503 compared to the S&P 500 +1.38%.

Join us in the stock chat for more action, over 720 in the stock chat room Wednesday.

Here’s today’s watch list.

>>> Premium clients get real-time swing trade alerts by email, text and chat as well as access to Wall Street’s biggest stock chat room. JOIN TODAY. <<<

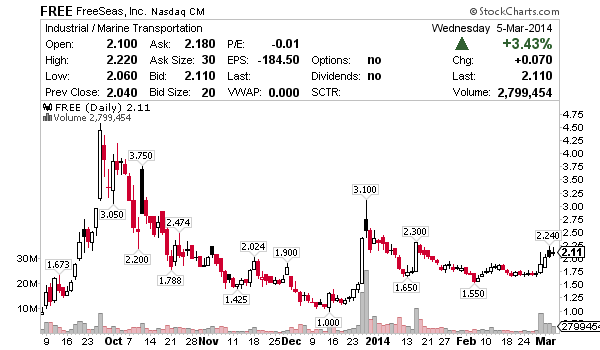

FREE – Shippers are rallying as is FreeSeas. Looking for entry above the 200 Moving Average of $1.93 for a breakout move above $2.30.

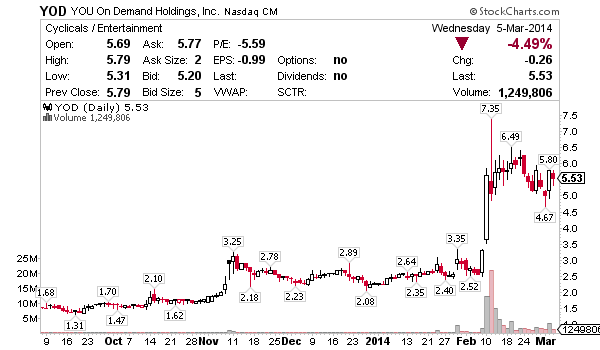

YOD – In play above the 20 Moving Average $5.20 for the next wave up into the $6’s. Good news in early February but quiet since so I’m thinking another strong press release could be coming soon.

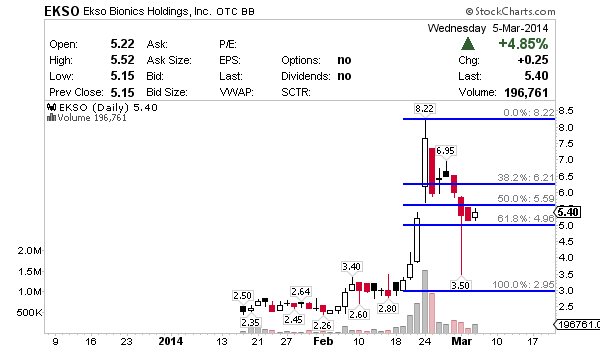

EKSO – Candle over candle in the continuation pattern if $5 continues to hold I’m a buyer. Textbook Fibonacci Retracement here from the video lessons. This is a story stock as discussed in the The Basics of Swing Trading. The probability of bigger headlines could bring momentum back to the trade.

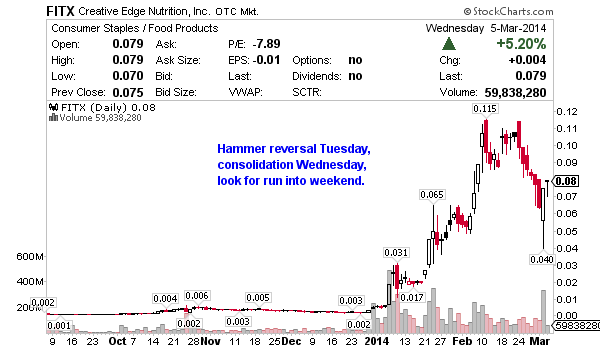

FITX – Big move off the bottom Tuesday, consolidation Wednesday, I think a move above $.10 before the weekend. It’s in play for me if Wednesday’s low of $.07 holds up. Lots of eyeballs on this one after the Business Insider article.

OPTT – Hit a big win on this one Wednesday and do not think the rally is over. The deal with Lockheed Martin is huge and is likely to lead to more headlines soon. I’m working up an article on this one and think it’s in play for me above $4.40’s for a breakout move into the $5’s.

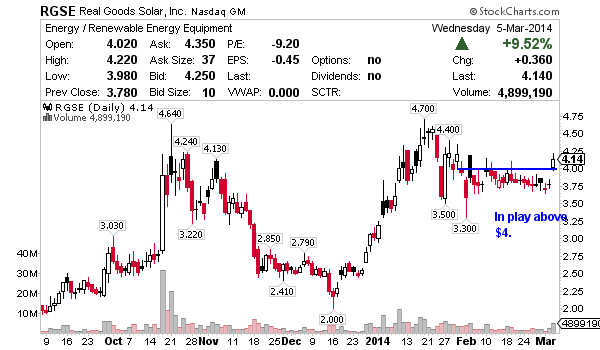

RGSE – On the move after news I hate chasing Wednesday’s 10% rally but if the broader indices stay strong like I think they will, solar is in play and Real Goods Solar has range to $5. Because it’s midrange I’ll be looking for it to hold $4 support conservative, the 20 Moving Average around $3.80 aggressive.

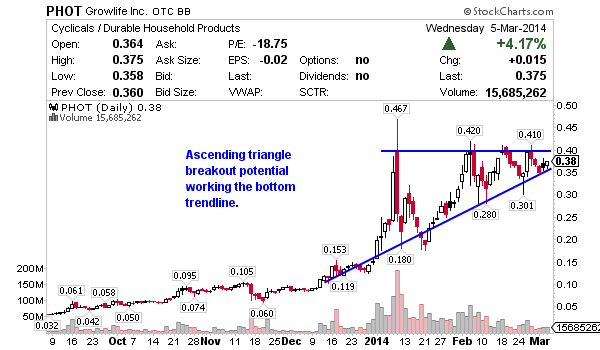

PHOT – It’s no secret this is my favorite marijuana stock and it’s building an ascending triangle perfectly. The range between here and low $.40’s resistance isn’t good anymore for a swing trade risk / reward so if I take this one above the 20 Moving Average around $.36 I’m looking for the breakout move into the upper $.40’s. Any big sector news and this will be my first move.

Hey JB! Great job on this watch list!

above on the FREE you said you are looking for entry above the 200 Moving Average of $1.93. Since the stock hasn’t reached your entry point yet and the 200 MA has changed to $1.92 and as the trading days go by it may move further from your predetermined entry price. Question; Does the moving 200 MA change your entry point strategy?

Hi Dave, the shipping sector was weak Thursday so I wasn’t really watching it. I don’t put orders in though, I look for overall market, sector then the individual stocks.

HEY JB

HOW DO I BUY STOCKS?

Get a broker first. Watch my lessons next.

So we have to hire a broker for this to work

You can open an account at a broker like E*TRADE.

Puts and shorting increases the risk.