Here at Jason Bond Picks I teach three easy to spot chart patterns, attempt to find a solid catalyst and time the market for 5-10% rinse and repeat. While my daily focus is on $3-$5 stocks, from time to time I like to put out a list of what I call ‘Account Builders‘ in which the swing trade cocktail is basically the same but I lower my price in the scan to $.25 – $1 or in this case $1 – $3 with at least $500,000 in volume on the day. MNI, COCO and SWSH were not only up on a down day but are heavily shorted with technical patterns that offer a tight identifiable stop and a trading range around 20% to maximize profit opportunity. Let’s take a closer look.

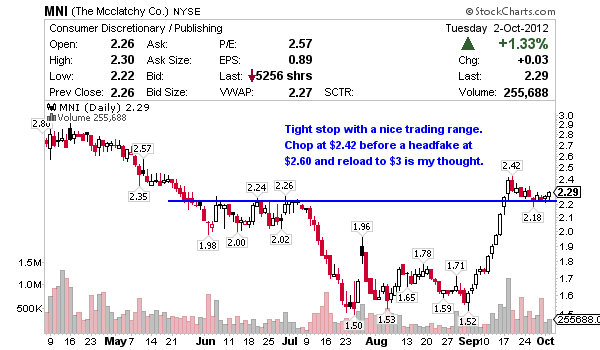

Mcclatchy Company (NYSE:MNI) operates as a newspaper publisher in the United States. The 52 week trading range on MNI stock is $1.05 – $3.04 with a Beta of 2.03 and a market cap of $196 million, right in my swing trade cocktail wheelhouse. Here’s where it gets interesting, although light volume $581,069 did trade hands today and the short interest here is 64.5 days to cover with 27.69% of the float betting against the stock. The continuation pattern just under $2.42 provides a tight stop at $2.18 conservative or $2.10 aggressive with $2.42 followed by $3 acting as resistance. While nearing overbought again, this does look like a squeeze play if you ask me but key the price action and broader indices, doubt it squeezes in bear market.

Corinthian Colleges (NASDAQ:COCO) operates as a post-secondary education company. It offers various diploma programs, as well as associates, bachelors, and masters degrees. The 52 week range on COCO stock is $1.40 – $5.21 with a juicy Beta of 3.24 and a market cap of $214 million. The first thing I see when looking at the chart is a nice continuation pattern up to $3 or about 20% on the swing with a tight identifiable stop in the $2.40’s or more aggressive at $2.38. This is no stranger to shorts either, contrarians love this play with 28.7 days to cover and 29.97% of the float betting against the stock. In a bull market this will likely be my first move on an open above and hold of $2.50.

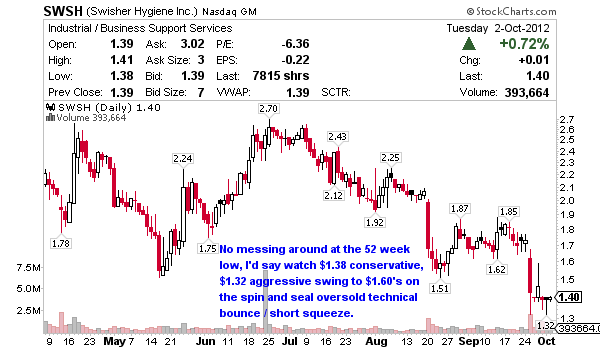

Swisher Hygiene (NASDAQ:SWSH) provides hygiene and sanitation solutions in North America and internationally. The 52 week range on SWSH stock is $1.32 – $4.87 with a Beta of -.08 and a market cap of $244 million. This stock presents an interesting opportunity having hit the 52 week low Monday at $1.32 but is certainly full of risk. Just off oversold I’d be looking to see if $1.38 holds conservative, $1.32 aggressive and swing to $1.60’s for a 15% profit if it burns and turns, which it has in the past 52 weeks, out of oversold status. The short interest here is 24.6 days to cover with only 9.55% now betting against the stock.

Disclaimer: I have no positions in any stocks mentioned, but may initiate a (long or short) position in MNI, COCO, SWSH over the next 72 hours.

0 Comments