Good morning.

I hope you enjoyed your weekend.

Let’s dig into the Swing & Long Term trading game plan for this week. But first, a quick recap of this week’s market action and my observations.

A nearly perfect week of “risk-on” trading treated U.S. market participants to significant gains to stock prices and a crashing VIX by the close of trading Friday. For the week, the DJIA, S&P 500 and NASDAQ added 2.13%, 2.28% and 3.44%, respectively, as each of the three indexes also closed above their respective 52-week moving averages concurrently with a rapid 13.7% drop in the VIX.

Now for an important observation that needs addressing.

I noticed an interesting divergence between the price of dollar-gold and the Bitcoin market. As Chinese investors stampeded into Bitcoin during the week, the gold market suffered its largest weekly decline since mid-March. What doesn’t make sense to me is the flight to the U.S. Treasury market and Bitcoin didn’t include a run higher in the dollar-gold price as would be expected if the Fed’s reasoning behind a rate hike was consistent with the economic data.

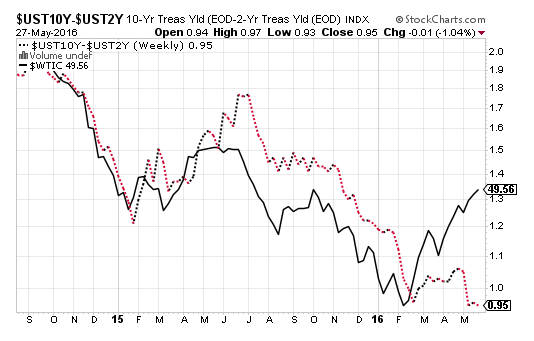

The chart, below, shows the divergence more clearly between the two most deep and important markets, the U.S. bond and oil markets. Without getting into the boring details of bond market dynamics, you just need to know that the falling dotted line in the chart indicates a significant move by institutions to dollar-denominated cash, while the solid line (oil price) indicates expectations of increased growth, capital investment and demand for energy—a dollar negative trend.

So, why the divergence (confusion)?

There’s only one reason why I bring this situation up: my subscribers may hear analysts coming out of the woodwork with bad analysis in the coming weeks about what this divergence implies. As I see it, the straight-forward reason for the divergence between the oil and bond markets is due to fears of the upcoming results of the “Brexit” vote on Jun. 23. The divergence is temporary. The bottom line is: it’s all good for U.S. stocks for another three weeks! And since I expect the financial media to hype this Brexit situation to death and predict the end of the world from a ‘no vote’, I’ll save you the time of emailing me to ask me to respond to what so-and-so bearish analyst from such-and-such research firm said on CNBC that might rattle you. Fair enough?

So, let’s move on to my stock ideas. I’ve added two long plays, one you may be familiar with and the other, a surprise idea; and I’ve narrowed my focus to three stock ideas I think should be “on deck.”

This Week’s JBP Stock Ideas

Net 1 UEPS Technologies (UEPS)

I pulled the trigger on Net 1 UEPS Technologies (UEPS). As you know from my email alert Wednesday, I bought 2,000 of UEPS at $10.76. Though I waited for a break below support at $10.25, in retrospect I see that strong hands came in on May 19 to support the stock above $10.25 and the subsequent deteriorating volume and higher prices following a bounce off the 50-day moving average suggested to me that the likelihood of a short-term bottom was in. However, I’m not giving up on my $10 target just yet, and may buy another 2,000 at $10, if the stock hands me another crack at lower prices.

Square (SQ)

On Wednesday, I also bought 5,000 of SQ at $9.88. I saw the range of $9.25 and $10.25 as the zone to strike, as I observed from volume statistics that prices below $9.50 may never come. Since my objective (which may change) is to unwind the position at somewhere near $11, as this target is the most conservative longer-term price point between the gap I expect to be filled somewhere within the $11 and $13 range (see chart, below).

An overly bearish outlook by analysts (nearly always and after the fact) and one-time expenses related to the company’s lawsuit initiated by Robert E. Morley of approximately $100 million trashed Q1 earnings. I expect an easing of bearish sentiment surrounding the stock and the huge overhang of shorts (a whopping 31.3%) to cover through time, as the latter should provide buying pressure into Q2.

FutureFuel (FF)

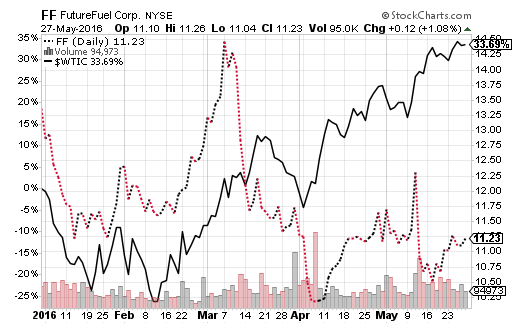

New to my watch list is FutureFuel (FF). Here’s a bio-based specialty chemical maker whose stock price has been decimated from what I believe is poor analyst coverage, a recent disappointing earnings report (fully understandable) and a relatively unsexy business model.

For the life of me, I cannot figure out why this stock trades at close to its liquidation value of approximately $11.21 per share, just on the basis of netting current asset from current liabilities, never mind the net value of FutureFuel’s plant and equipment in event of liquidation. For the sake of argument, let’s assess a value of $0 to the liquidation value of the company’s plant and equipment. Investors are offered the proposition of buying a company whose cash and liquid assets total $11.21 per share, which calculates to almost to the penny the stock’s offered price of $11.23. You won’t see that often.

Note: notice the gap between FF’s price and the oil price. The strong correlation broke down between FF and WTIC following the company’s earnings, the latter of which didn’t affect the company’s net-asset valuation one bit.

Obviously, valuations must account for risk of future quarterly losses and/or expected impairments and/or a deteriorating market environment. I looked; there’s nothing there. In fact, the gross and margins expected for Q2 will most assuredly increase, and that’s off a baseline of an 18.6% net income (excluding favorable tax credits). And this is no exception to FutureFuel’s past financial results, as the company has maintained a positive free cash flow for the past eight-plus years!

Even if Congress eliminates the biofuel tax credit scheme, the company swims well anyway. The company’s EBITDA margin rate has been close to its net income margin consistently quarter after quarter, with a tiny deviation to this streak coming in Q3 of fiscal 2015 in an amount of 2% of revenue. Big deal.

You may ask: why not go for the stock now? It’s a good question, but I have a better answer. As long as traders are overlooking the stock’s depressed price, the expected short-term pullback in oil prices I see as a probable event in June, I’ll wait for the stock to sell-off a bit along with the oil price before striking.

I’m targeting the previous low of the stock’s cycle of $10.50 as a rock-bottom price. I’ll send an email alert if I see $11 is the price the market will actually give me.

Energous (WATT)

With all the mystery and intrigue surrounding Energous’ “WattUp” technology, I had to dig deep to wrap my head around whether this stock is a complete loser or potential ‘jackpot’ play. I came to the conclusion that the stock is somewhere in between, as far as I can tell, but closer to a jackpot play than a ‘goose egg’.

Energous develops technologies for wire-free charging systems at a distance from the power source. The idea is to eliminate cable assemblies in the process. Of course, wireless ‘everything’ is the direction consumer and industrial products will inevitably take, with the first to market reaping the rewards of an open market as well as immediate and high-margin revenue streams (licensing).

With the announcement of a signed contract to supply the technology to $171 billion Taiwan-based Pegatron (4938.TW), Energous’ heralded technology immediately initiated rumors that Pegatron’s biggest customer, Apple Computer (APPL), was interested in adopting the technology to its hundreds of million of iPhone users. Whether the interest is coming from Apple or not, Pegatron’s customer base includes the largest electronic device makers of the world. With WATT’s market capitalization already at $170 million (with no meaningful revenue), the market has already priced-in a 10% probability that WATT is a $1.5 billion company.

Initial articles about Energous (stemming from Seeking Alpha) focused upon the company’s technologies and speculation by engineering “experts” of the impossibility of the company ever delivering a low-price and workable product. It may be a silly question from an engineering layman, as I am, but why would a massive supplier such as Pegatron take any interest in Energous if the technology is not marketable?

And look at the staff of Energous, the collective engineering credentials of the company’s senior executives and board members rival the most tech savvy research and development enterprises on Wall Street, including Martin Cooper, the pioneer of the wireless communications industry. I’m not an electrical engineer, but I do know that when a new technology comes to market, casual observers who are steeped in their profession but have no direct knowledge of the “secret sauce,” if you will, comment on a subject that they may not fully know. I ask, Isn’t that what technological breakthroughs are all about? And why would the most famous inventor and visionary of wireless communication become a board member of Energous unless the company has something grand to offer a $1.4 trillion marketplace?

Read here about this new technology (Qi inductive charging is the present standard) and the players incorporating inductive charging to mass market product lines.

From wiki:

As the Qi standard gains popularity, it is expected that Qi Hotspots will begin to arise in places such as coffee shops, airports, sports arenas, etc. The Coffee Bean and Tea Leaf, a major US coffee chain, will install inductive charging stations at selected major metropolitan cities, as well as Virgin Atlantic Airways, for United Kingdom’s London Heathrow Airport and New York City’s John F. Kennedy International Airport. Tulsa International Airport has already implemented chargers in half of the airport. Furniture retailer IKEA introduced lamps and tables with integrated wireless chargers for sale in 2015. Also starting in 2015 the Lexus NX will come with an available Qi charging pad available in the center console.

In conclusion, I find the banter about this stock amusing, but take seriously the potential implications that not only a successful regulatory hurdle may already be planned by Energous, a new and improved technology may be born by the company. And I may want a piece of that action.

At the moment, I’ll become very interested in the stock at the $9.50 and $10 range, with an initial target of $12 on the unwind.

Groupon (GRPN)

And to end this week’s watch list of ideas with a bang, I come to Groupon (GRPN, a stock I love to trade for its volatility, which at the moment is approximately 5.2% during any given month. And the volatility may markedly increase, if I’m assessing the potential impact of a successful turnaround strategy will have on the stock’s price accurately.

On Apr. 28, Groupon reported Q1 revenue of $732 million and EBITDA of $31 million, both beating Wall Street estimates. Management reiterated its 2016 revenue guidance of between $2.75 billion and $3.05 billion, while increasing EBITDA guidance to a range of $85 million and $135 million.

Since the appointment on Dec. 16 of new CEO Rich Williams to Groupon’s executive team, the company has not wasted any time in its turnaround effort. Groupon has shutdown 17 underperforming markets and two lackluster joint ventures, including two businesses in the Japanese and Brazilian markets. According to the company’s earnings call, one prong to the turnaround strategy involves eliminating non-core functions from what the company has shown works for them.

The second prong involves executing a strategy to boost marketing spending and efficiency of that spending. As outgoing founder and CEO Eric Lefkofsky stated in the news release of his departure, “Cracking the code in local commerce is not easy. ” And it’s not, as I see it. Relying upon one-time revenue catches from discounting and “couponing” has neither help to build a loyal consumer base nor a higher-quality participating merchant clientele as much as Lefkofsky had envisioned.

In other words, it appears that Groupon’s core customer is more concerned with high-quality products and the service they get from merchants than discounted pricing alone. So, where have we heard this marketing fiasco before? Correct. JC Penney!

JC Penney made the mistake of conditioning its customers to wait for discounted merchandise before winning a sale. And look what happened to JC Penney’s attempt to stop the hemorrhaging for long enough to downsize its operation. The iconic retailer got clobbered. It appears to me that Groupon has learned that lesson and is taking another path, a path I believe that will serve them well enough for me to make a profit from the surprise turnaround I see in the coming quarters from the new CEO.

My target entry is $3.25, with a goal of $4.00 as we move toward the company’s Q2 earnings report scheduled for July. But I hope to get some shares within the next week or two. I’ll alert my subscribers of any moves I make on GRPN, of course.

Good luck to all of my subscribers!

Jason Bond

0 Comments