The daily wrap-up for Wednesday covers my core strategy which made me another +$5,000 today on MM and is PERFECT for busy professionals looking to actively swing trade a few stocks each week. If you take nothing else away from Jason Bond Picks, make sure the 4 videos mentioned here are understood because they are proven money makers.

For those of you looking to hit the books tonight, compare how similar Wednesday’s daily wrap-up is to my +$10,000 winning swing on MM just about a year ago. And if you really want to see how effective my core strategy is, watch how I made over +$40,000 on a trade at the end of 2013.

By simply watching all 4 of those videos either tonight or this weekend you’re going to have an edge over most traders on Wall Street. You’ll also probably start to see better entries on your stock picks.

The portfolio is flat into Thursday. Here’s Thursday’s watch list.

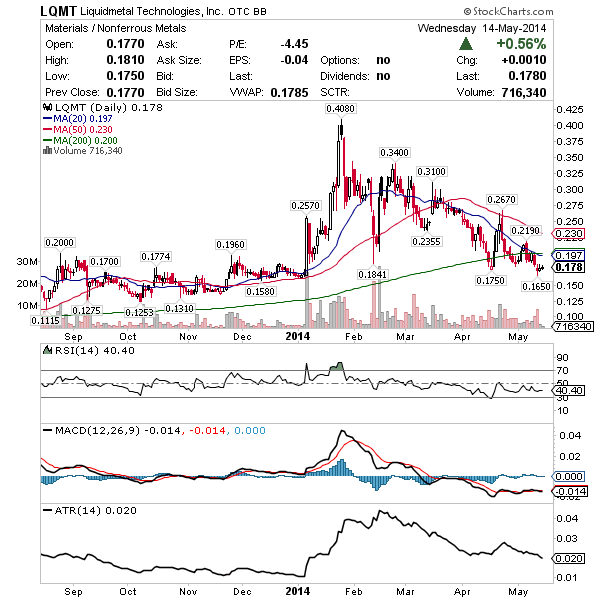

LQMT – The iPhone 6 is going to be one of the most talked about Apple product launches in ages. That said, I expect liquidmetal, which Apple has a licensing agreement with, to be in many of those headlines in the coming months. My next entry here will be a long term hold. I’m thinking $30,000 in stock and I’ll let that ride for a possible double over the next few months as those headlines develop. This story stock has been a winner for me over and over again, here’s a good website to bookmark and read as the story starts to build in the coming months.

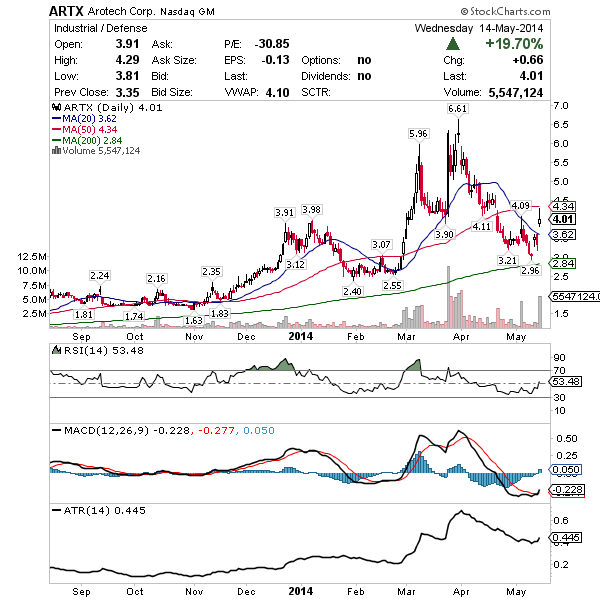

ARTX – Earnings winner and heavily short I’m interested in an entry above the 20 Moving Average as I suspect this will rally into the weekend hitting as high as $5 as shorts cover and momentum traders bid up the juicy $.445 ATR. Up +20% Wednesday trades like this are volatile so only consider it if you can watch a bit closer.

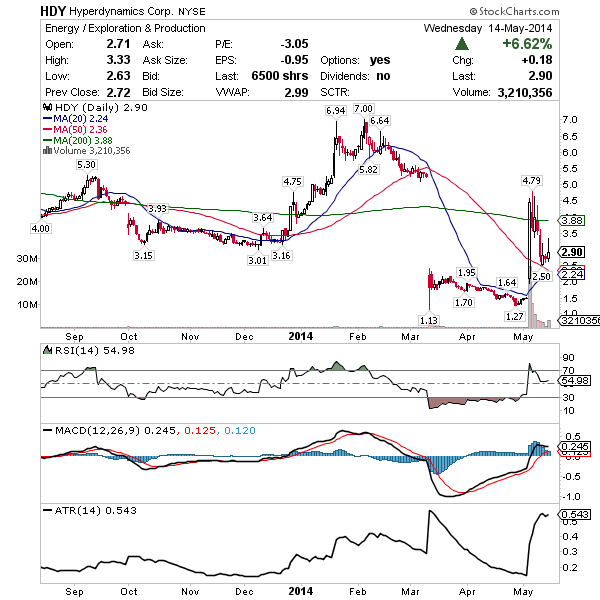

HDY – Fibonacci retracement in full effect here. I’m interested around this price for a move to the 200 Moving Average into the weekend. Tight stop this time if I’m wrong and shares go against me, the pattern needs to maintain these levels above $2.60’s for me to stick around. The ATR here is $.543 and it’s only a $3 stock illustrating how juicy the move can be if on the right side of the trade.

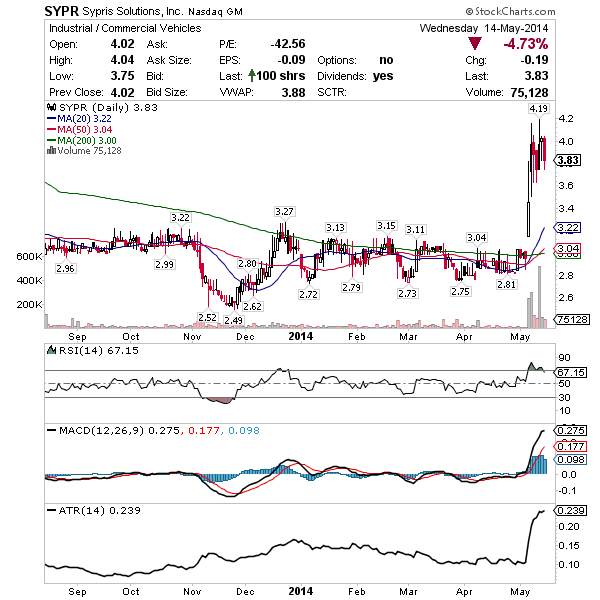

SYPR – Hit a nice win on this last week and looking to enter around $3.80 again for what I think will be a breakout move above $4.20. The range between is a good swing by itself but given how few sellers there are and how high it’s holding after the huge move on big volume, I’m inclined to bet the breakout. Earnings winner with more and more eyeballs each day it trades up here.

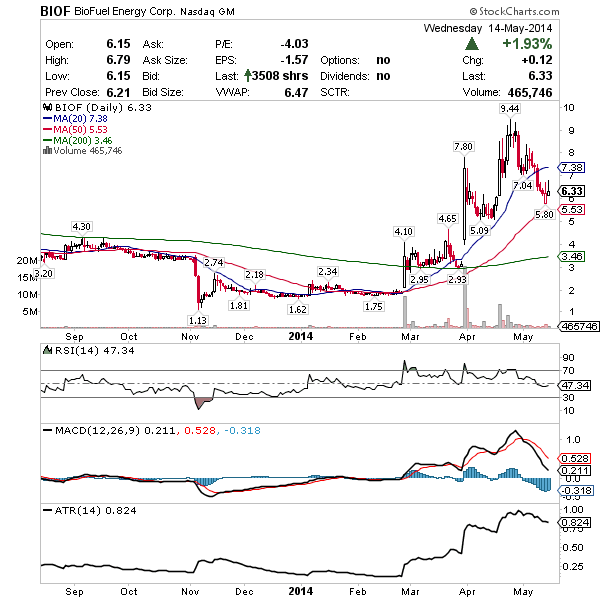

BIOF – Was bidding $6.30’s in the afternoon but couldn’t get filled and pulled the bid. I’m watching this above $6 for a move above $7 and believe it has range to $8 again. Delisting doesn’t worry me here, it makes sense given how they sold their ethanol business, it’s Einhorn’s ongoing interest that makes this an interesting play. The ATR of $.824 illustrates why I like it so much but commands using tight stops or it can bury you fast.

Jason. Does LQMT’s recent insider selling not worry you? It appears there have been a lot of shares sold.

No it doesn’t concern me. The catalyst coming is a pure story stock play, I’ve seen it play out countless times with this one.

are you still long on LQMT with this price action?

I’m not in but watching for entry.