They say the proof is in the pudding and I tend to agree. What do Audience (NASDAQ:ADNC), Kit Digital (NASDAQ:KITD), Ocz Technology (NASDAQ:OCZ), Supervalu (NYSE:SVU) and Formfactor (NASDAQ:FORM) all have in common? They’re in my pudding today.

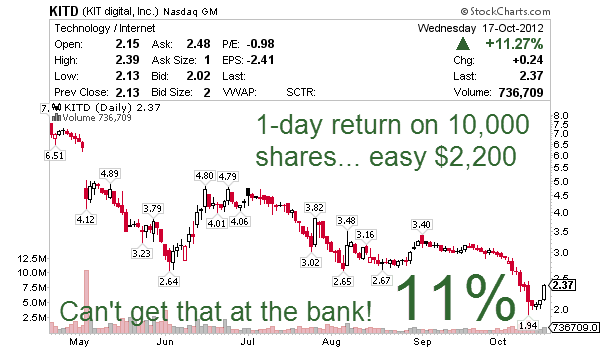

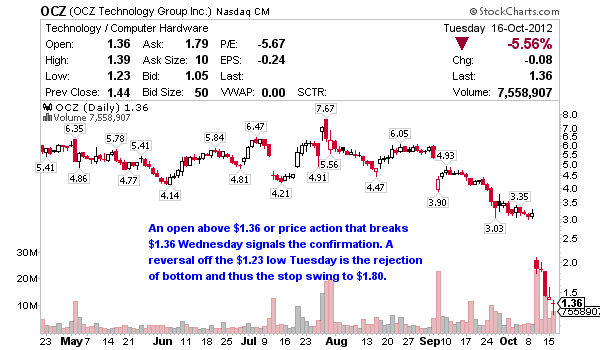

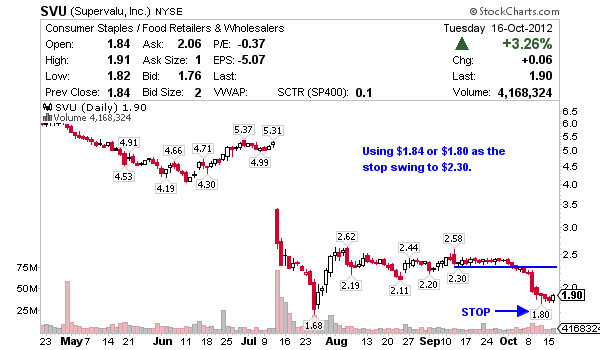

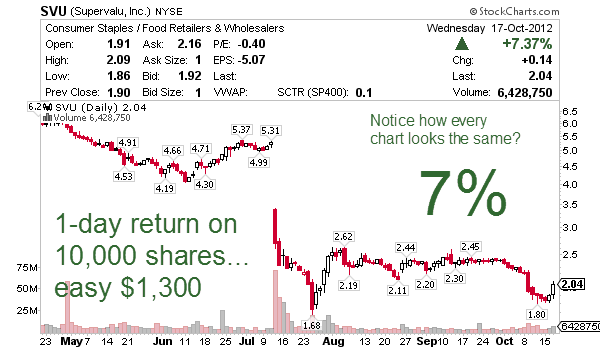

What you see below is exactly what I sent my premium clients for Wednesday straight out of video lesson #1. My strategy is easy to learn and even better, I do all the heavy lifting for clients. It’s no mistake that 4 out of 5 or 80% confirmed for nice wins ADNC 13%, KITD 11%, OCZ 10%, SVU 7% and FORM 0% – not bad when the only loser breaks even, right?! I teach the same thing over and over and will give you a brief lesson right now as to how I went 4/5 Wednesday for 41% top to bottom and can do this all day everyday.

Mini lesson – whether the trend is up or down, there are times when a stock’s price temporarily falls to unreasonably low levels. When this happens, short sellers push the price down and price falls until buyers step in and buy the stock on fire sale. At that point, the short sellers must cover their position and buy and the buyers are also stepping in, so the price can bid up very quickly. This is important, though: I only pick stocks that have a history of bouncing off the lows. That means stocks with ready buyers following them. I do not trade the oversold pattern on dud stocks that no one cares about, because without demand, it won’t work.

Below is exactly what I sent my clients for Wednesday. I’ve also included the ‘after’ chart for easy viewing. IMPORTANT – notice how every chart pattern is exactly the same… I have this mastered and down to a science.

Watch list from Wednesday October 17, 2012

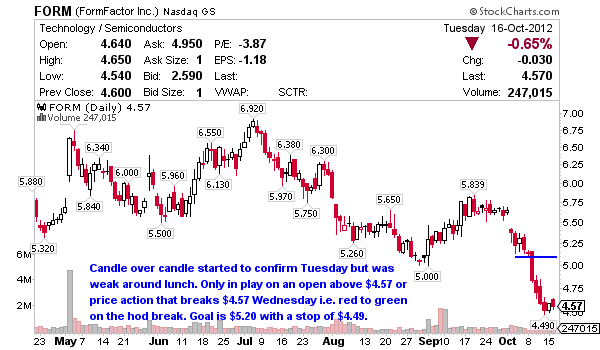

“In addition to the stocks I stalk from the master watch list, I’ll be introducing daily scans matching what I teach in video lesson 1 (oversold) and video lesson 2 (continuation). This morning I’m highlighting 5 oversold stocks all straight from video lesson 1. The key thing to look at is the setup which in most situations is a small reversal after a significant pull landing the stock into oversold. Another key is the tight stop it provides with candle over candle Tuesday and potential for reversal confirmation today. This are not trades you marry, but rather 5-10% technical turns after panic selling. Using the 52 week history I determine if there’s bounce potential out of oversold with a simple scan of the chart. Keep in mind the market was hot Tuesday, so many of these small bounces could flush again in a bear market. Watch for short cover if the spin and seal confirms and look to take profit into strength, rinse and repeat.”

BEFORE

AFTER

BEFORE

AFTER

BEFORE

AFTER

BEFORE

AFTER

BEFORE

AFTER

If you’re just passing by and want more watch lists like the one seen above, get on my daily mailing list right away!

Disclaimer: I have no positions in any stocks mentioned, but may initiate a long position in ADNC, KITD, OCZ, SVU, FORM over the next 72 hours

KITD 2,15 bought, 2,44 sold, if i only didnt wait with buying @ 2.0…

BOUGHT SCMR at 4.90 and sold at 6.30 last week. Wasn’t on your lis tbut was a real nice one. Most of these stocks that gap down over a dollar have a 3 day profit time frame until the monthly 50 day moving average falls down on to of the price and starts pushing it down farther. I call it the kiss of death. The 50 day moving price average and the actual price are always either running awayfrom each other or towards each other. Just like a guy chasing a girl. When they meet up. It’s a kiss. Where you either start your trade or close it.