Have you ever been to a casino before, walked to the roulette and dropped your chips on your favorite number… thinking if it hits, you’ll make 35X your money?

The ball rolls around and gets close to your number, your heart races… seconds later, it lands on a dumb spot.

You think to yourself, “Wow… that was a complete waste of money, but let me try my luck at it again, what’s the worst that can happen?”

Then you shove all your chips onto one magical number… and you end up losing it all to the house.

By design, the casino doesn’t lose… and they have games for suckers.

When it comes to options trading… the elite traders use strategies that allow them to become “the casino”… and suckers who take the opposite side of the trade.

Imagine you could instantly increase your success rate in the options market and consistently lock in mind-boggling returns.

I’ve actually uncovered a strategy that allows you to do just that — some weeks I’ve achieved a 100% win rate. Heck, I’ve been able to lock in $113,752.34 over a short period…

… so what’s the casino strategy and how does it all work?

The Casino Strategy

Weekly Windfalls leverages the power of a strategy that’s often referred to as “the casino”… and right from the jump, you put yourself in a position to succeed.

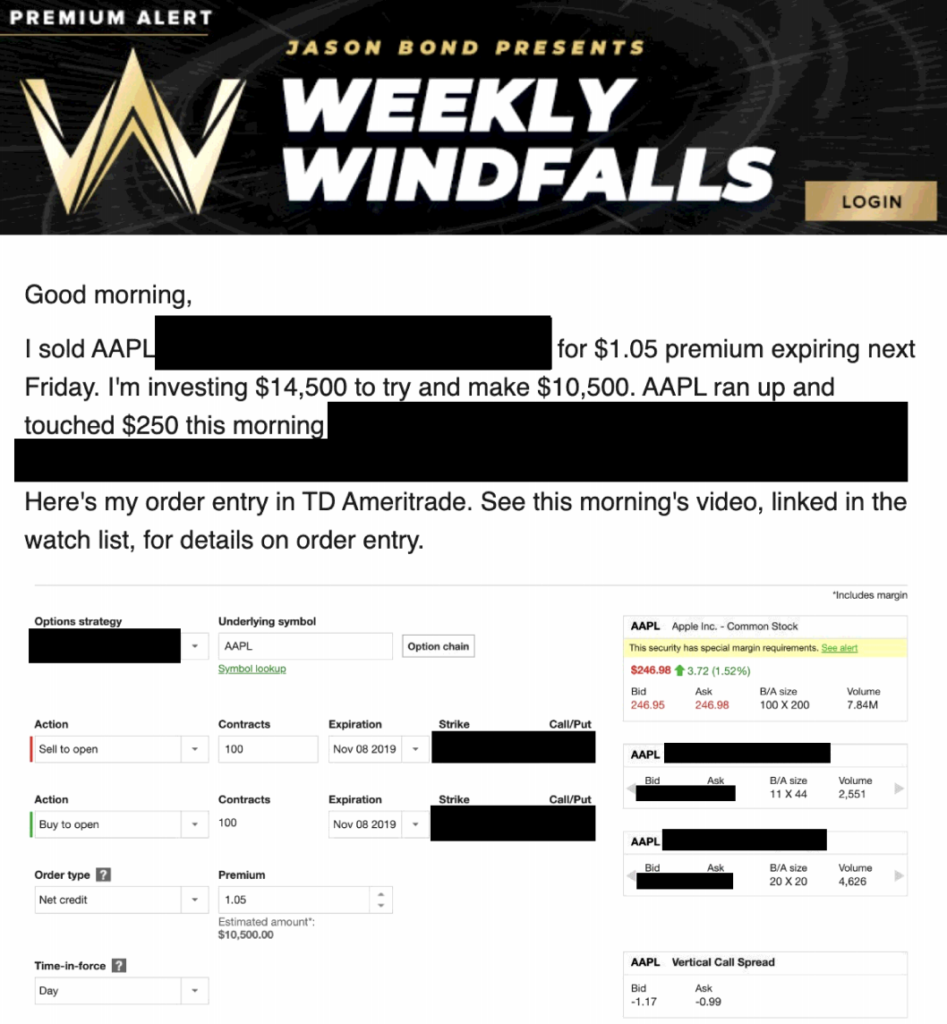

You see, I’m selling options premium and hedging my bets. That way, I know how much I’m risking and how much I can make… just like the casino does.

It’s simple, really.

All you’re really doing is selling options with a specific strike price… and simultaneously buying options at another strike price (this is an insurance policy) so you don’t get blown out the water.

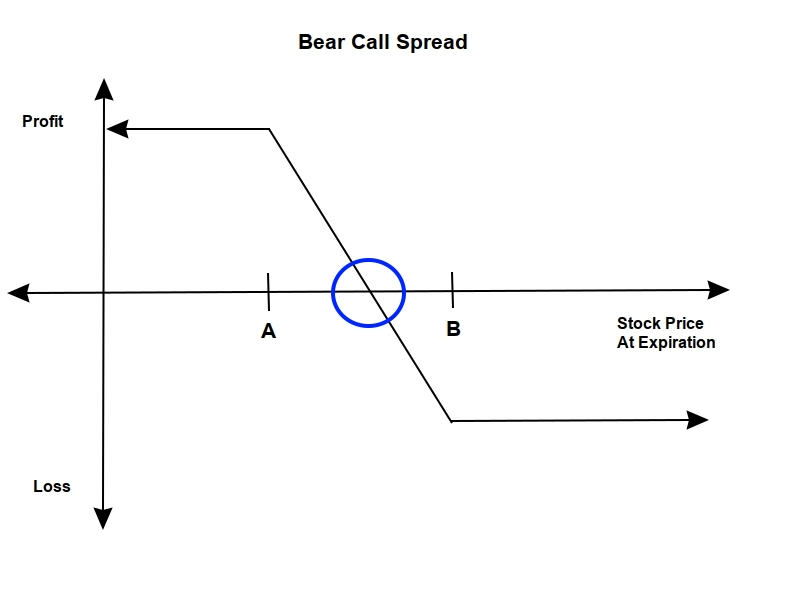

Check out the profit and loss (PnL) chart for one of the strategies I use.

That’s known as the bear call spread.

Basically, what this strategy does is allow you to place a directional bet against the stock… without the need to short the stock (this can get expensive if you’re trading large-caps like I do).

You see, someone who buys a call spread is saying, “I think the stock can run up and get to this level.”

On the other hand, the trader on the other side is betting the stock could drop…

However, those who sell call spreads are actually at an advantage.

Why?

- Time works for you when you sell options premium. Options have an expiration date… and as every day passes, those options lose value… and that just adds money to your pocket (all else being equal).

- There are three different ways to profit.

If the stock stalls and just stays below the strike price of the short options position.If the stock stays in range (and below the short options strike price)If the stock drops… you can get to your max profit potential fast.

When Kyle Dennis heard about this strategy, he knew he had to join in on the action.

Why?

Because it doesn’t take a whole lot of time to set up (just a few minutes a day)… and he really didn’t need to worry about it. More importantly, the odds are stacked in your favor.

So when he saw my Weekly Windfalls alert in Apple Inc. (AAPL), he knew he had to get in.

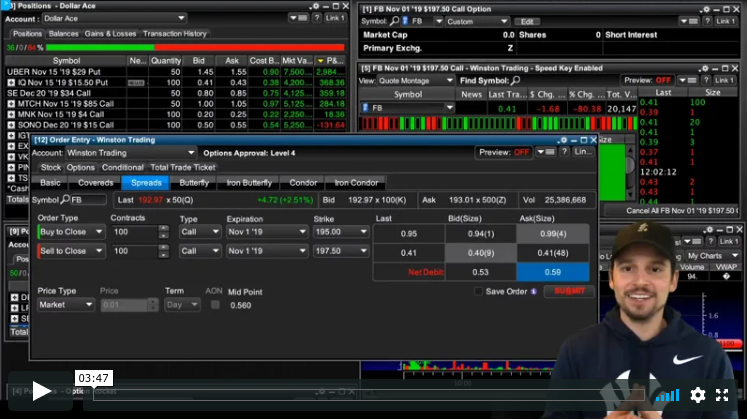

Literally, in less than 2 hours after he placed the trade… I got a text from Kyle.

Kyle actually was kind enough to make a video explaining why he took the trade and how he raked in $3,953 in less than two hours.

0 Comments