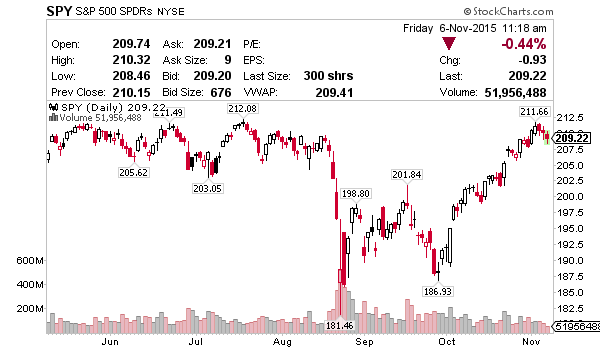

Options trade on SPY.

This will be a spread, so we’ll sell calls closer to us and then buy some farther out.

I had to buy the farther out ones first since we don’t have enough margin.

The play there is a net credit to us of .75 – .44 = .31 (x100 contracts) if it works.

That’s $3,100 if SPY closes next week under 213.

Our risk is capped since this is a spread, meaning we sold the 213 calls, but then bought the 214 calls behind it.

Hopefully $3,100 profit to us. Also our losses are capped if SPY decides to go into more overbought conditions. Then we just do the same thing the following week.

This doesn’t require much margin.

I was hoping to just sell 50 contracts of the 214’s but E*TRADE wouldn’t allow it.

You can see in this deal now, the credit spread only requires us to keep $10k on margin for the trade since our risk is limited.

Spreads are good for 95% of traders since they don’t take a lot of margin and the risk is lower.

100 shares per contract. 100 contracts = 100 x 100 shares = 10,000 shares!

So you control over $2m in SPY stock with that little trade. That’s why this stuff is dangerous!

We’ve got about 2x at risk for what we could make with spreads usually.

In this case, it is 214.44 – 213.75 = .69 is our risk if my math is right so $6,900 max loss if SPY goes to 250 next week.

But our GAIN is limited too. We can only make $3,100 no matter how low it goes.

215, 250, 300… doesn’t matter how high SPY goes over 214.44

We bought the insurance on top of our trade. Lowers the amount we could make, but also lowers the amount we have at risk.

So what I usually do is sell the first leg like the 213’s first at the price I want. THEN I buy the 214’s later when the price is lower (hopefully)

But with margin requirements we needed to buy the back end first (214’s) and then could sell the 213’s

It sucked since SPY dropped about $1 right after I got the first part of the trade on. Then I had to just hope it would bounce back to get the 213’s filled at the price I wanted.

But it all looks pretty good now. hopefully SPY just treads water or goes a little lower this week.

Hopefully we’ll just let both of these contracts expire.

Spreads are for a vast majority of guys / gals just for safety sake. Even if they have a big account to cover it.

When trading SPY I use spreads too. It can really blow you up if you’re wrong.

Trying to sell calls against SPY the last few weeks as it went straight up shows you that. Could have killed you if you were naked.

These aren’t covered calls. That is when you own actual SPY stock then sell a call option on it.

But you can flip this around on puts too when you think something is done going lower.

The SPY trade here is a “credit spread”

The 214 call protects us if SPY breaks out.

I think the math on it is 214 – 213 = $1 difference between the calls. Then deduct the .31, which gives us $.69 potential loss.

.69 x 100 contracts = $6,900

Or if we’re right, .31 x 100 contracts = +$3,100 ☺

0 Comments