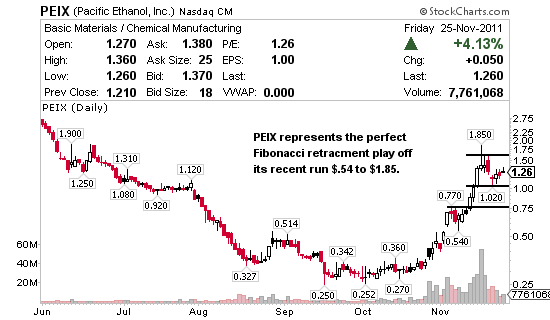

Pacific Ethanol (NASDAQ:PEIX) produces and markets low carbon renewable fuels in the western United States, primarily in California, Nevada, Arizona, Oregon, Colorado, Idaho, and Washington. PEIX has a market cap of $36 million. Technically I like PEIX here as a retracement play between $1.26 and $1.60 short term and would not be shocked if it traded as high at $1.90 – $2 in a bull market. Support is at $1.20 and $1.02. I traded PEIX successfully Wednesday into Friday for 13% and will look for another entry soon.

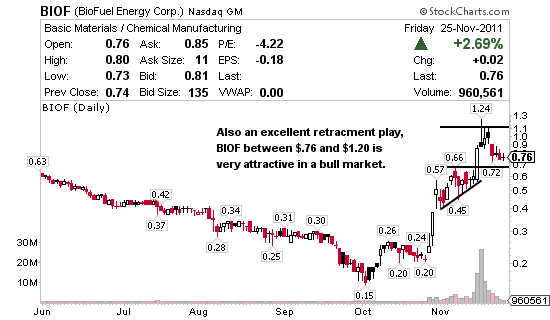

BioFuel Energy (NASDAQ:BIOF) engages in the manufacture and sale of ethanol and its co-products in the United States. BIOF has a market cap of $86 million. Also a solid retracement play I like BIOF from $.76 to $1.20 short term and would not be shocked to see it between $1.24 and $1.50 in a bull market. Support is at $.72 and $.65.

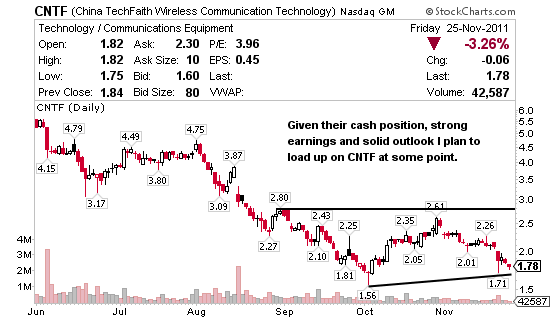

China TechFaith Wireless Communication Technology (NASDAQ:CNTF) operates as an original developed products provider that is focused on the original design and sale of mobile phones in the People’s Republic of China and internationally. CNTF has a market cap of $77 million. I’d already be in CNTF last week if I didn’t have 6 open swing trades already. With support at $1.71 the upside here is $2.10 before resistance followed by $2.20 – $2.60 in the short term. It’s currently trading on $4.46 cash per share so if and when it gains traction I think CNTF could double if not triple from here.

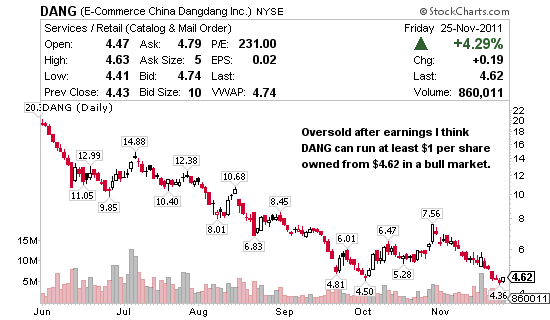

E-Commerce China Dangdang (NYSE:DANG) operates as a business-to-consumer e-commerce company in the People’s Republic of China. DANG has a market cap of $366 million. I said I liked DANG last week from these oversold levels and believe it’ll uptrend in a bull market from here. Support is at $4.62 and $4.36 with upside around $5.70 short term. This space in general has been beaten up and could bounce on short interest alone.

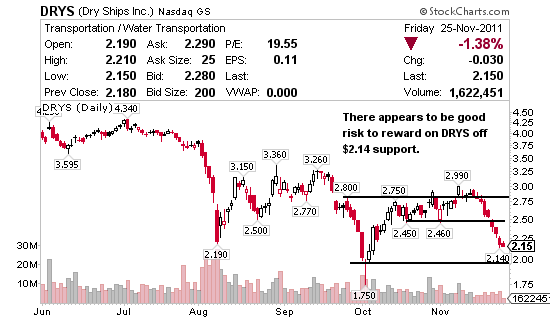

Dry Ships (NASDAQ:DRYS) engages in the ownership and operation of drybulk carriers and drilling rigs that operate worldwide. DRYS has a market cap of $842 million. I like DRYS on this turn here at $2.15 with resistancde at $2.60 before it could challenge $3 again in a bull market.

Hi There.

I am still wanting to know a little more about paying the fees to go in and out and what firm you recommend to do that for you. I am very interested in joining up with your program. Just need a little more information on these things. I am from Ontario and would like to know if this makes any difference if I intend to enroll with you. I woule love to hear back from you by my e-mail. Ida Stadder

iTrade is the electronic brokerage arm of the Bank of Nova Scotia or Scotia Bank as it’s commonly referred to. You’ll need to call them to see what they charge to trade the American exchanges.

iTrade https://www.scotiaitrade.com/pages/home/main.shtml

Questrade http://www.questrade.com

jason what is the charge for your text messages to my cell if you go over 100 text messages per month? Also I’m 5 hours behind the east coast so how can you help me compensate the time difference with buy and sell recommendations? Also I just recently subscibed to your service, is there anywhere on your site that shows me your 2011 overall trade results? Aloha Steve – Hawaii

There is no additional charge if I exceed 100 per month. The note is just a general idea of how many you can expect. Your time zone doesn’t matter, you’ll receive all alerts in real-time. Here are all my trades http://profit.ly/user/jasonbond since I’ve started in March.