The tragic incident that occurred at Sandy Hook Elementary School in Newton, Connecticut last month has once again sparked off debate about stricter gun control laws in the U.S.

Shares of Smith & Wesson Holding Corporation (NASDAQ:SWHC), one of the biggest manufacturer of firearms, fell sharply after the tragic event amid talk about tighter restrictions on future gun sales. However, renewed talk of limit on firearms is in fact likely to benefit firearm manufacturers such as Smith & Wesson.

U.S. Gun Checks Surge in December

According to data from FBI, the number of background checks required for Americans buying guns set a record in December 2012. This suggests that renewed talk about stricter gun laws has in fact boosted demand for firearms.

The FBI reported 2.78 million background checks during the month, compared to 2.01 million checks in November. In December 2011, the FBI had performed 1.86 million background checks. While the FBI data does not represent the number of firearms sold, the high number of background checks suggests an uptick in firearm sales.

For all of 2012, FBI background checks totaled 19.6 million, which is an annual record and a 19% increase over 2011.

So why has there been a surge in background checks and possibly firearm sales despite the tragic incident in Newton? The reason perhaps is that concerns that lawmakers might ban certain firearms in fact boosted demand for guns.

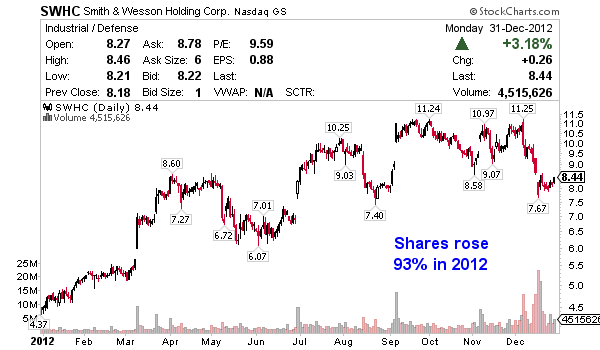

Had an Excellent Run in 2012

The increasing demand for guns in 2012 as shown by FBI data is reflected in Smith & Wesson’s performance last year.

For the second quarter ended October 31, 2012, SWHC had reported net sales of $136.6 million, up 48% over the same period in the previous year. The company’s gross margin for the quarter improved from 26.7% to 35.5%.

SWHC’s operating income for the quarter was $26.6 million, up from $3.4 million reported for the same period in the previous year. Net income for the quarter was $16.4 million, or $0.24 per share, compared to $948,000, or $0.01 per share reported for the same period in the previous year.

For the third quarter of fiscal 2013, Smith & Wesson expects net sales to be between $126 million and $131 million. GAAP earnings per share for the quarter are expected to be between $0.19 and $0.21. Given the uptick in demand for firearms in December, SWHC could post a positive surprise on the earnings and revenue front for the third quarter.

Smith & Wesson shares, meanwhile, rose more than 93% in 2012, despite falling sharply in December.

Can the Strong Performance Continue in the Present Environment?

While Smith & Wesson’s performance in 2012 was outstanding, the question is whether the company can sustain this performance given the present environment. The answer is yes. Although there is talk that Vice President Joe Biden’s Gun Violence Task Force could lead to tighter restrictions on firearms ownership, it would be difficult to pass any legislation through the Congress. At the same time, concerns over firearm restrictions could boost demand in the short-term, benefiting SWHC and other firearm manufacturers.

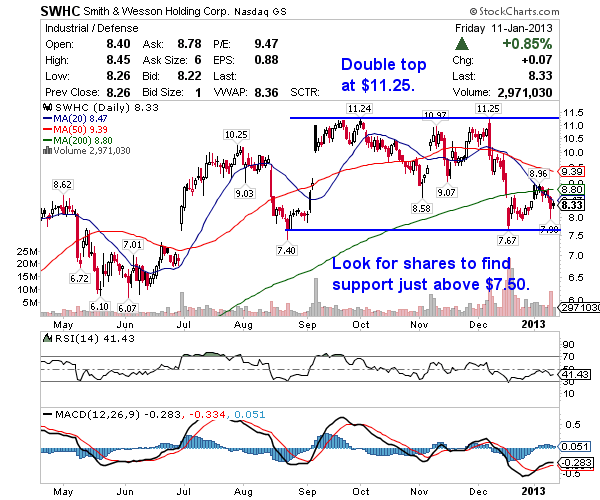

Should You Buy Smith & Wesson

Smith & Wesson shares fell sharply last month as gun control talks intensified. Between December 14, 2012 and December 31, 2012, SWHC shares fell 11.53%. However, as the FBI data suggests, firearm sales probably picked up in December and are likely to remain strong amid the ongoing debate over gun control.

I expect Smith & Wesson’s strong financial performance to continue. The stock is currently trading at a P/E ratio of 9.70, which is attractive. While the issue of firearm sales remains controversial, talk of stricter laws is certainly benefiting firearm manufacturers in the short-term and for this reason, I am bullish on Smith & Wesson.

Great analysis Jason. But we need to be little cautious about hedge funds that are dumping gun makers from their portfolios.

Yes, I agree… right now let it settle and setup and then position because numbers are likely to be good, which should pop the stock. Outlook on the other hand will depend on policy, which appears to still be up in the air.