One of the most profitable trading techniques we’ve found comes way of wrong-thinking psychology. And Sirius XM Holding (SIRI) remains as a classic example of this flawed human trait of not doing some due diligence after the data are clear. Jason Bond has worked the math on SIRI, and the bulls should be in for a treat.

“For those holding SIRI for longer-term capital appreciation, the stock offers one of the best opportunities to outperform the S&P 500 – and by a country mile,” said Jason.

Expectations of Accelerated Revenue and Profit

Expectations of an acceleration of revenue and profit for SIRI sounds somewhat wild for those not considering management’s well-executed business plan, carefully, and soberly. With name recognition of the Sirius brand firmly rooted in the consumer’s mind, the company’s market penetration potential, excellent cash flow from operations, expanding profit margins, and management’s stock buyback program, will all conspire to drive SIRI higher and higher throughout the coming months and years.

Expectations of an acceleration of revenue and profit for SIRI sounds somewhat wild for those not considering management’s well-executed business plan, carefully, and soberly. With name recognition of the Sirius brand firmly rooted in the consumer’s mind, the company’s market penetration potential, excellent cash flow from operations, expanding profit margins, and management’s stock buyback program, will all conspire to drive SIRI higher and higher throughout the coming months and years.

Here’s what Jason has come up with to illustrate his thinking on Sirius. The used-car market revenue potential at Sirius is under-appreciated by the marketplace in shares of SIRI.

Don’t Listen to the Bears. Here’s why.

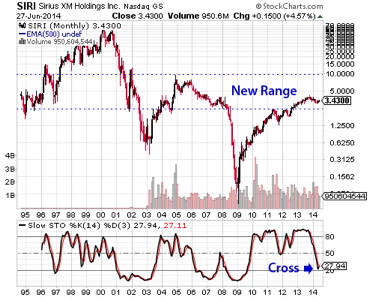

Talk of a slowdown in revenue at Sirius is just that: talk. This meme has spread quite wide among analysts who need a reason to be bearish on the stock at critical price levels, with $3 per share serving support since the entire month of April.

With the U.S. used-car market reaching three-times the volume of the new-car market, according to Sirius executives, the company’s venture to expand offerings to the used-car consumer will most likely ramp up revenue. In fact, our expectations of higher revenue and operating revenue is predicated upon the management’s aggressive move into the most lucrative market for Sirius: used cars.

Though sales of new cars modestly climbed post-2008 financial market meltdown, used-car sales began to jump from years of declines. The trend of rising real estate prices and number of Home Equity Loans (HELO), taken out to purchase new cars, is over. Used-car sales are making a strong comeback, and should make up the bulk of total U.S. car sales for years to come.

Frankly, analysts watching new-car sales won’t get Sirius, while those who’ve caught on to changing trends in the car market will understand that worrying about revenue growth at this stage in Sirius’ rebound is a waste of mental energy.

We believe future, and superior, revenue growth will be generated from Sirius’ entry into the used-car marketplace.

“We [U.S.] have 60 million cars [old and new] on the road today,” Sirius CEO David Frear said in a conference call to investors. “It’ll be 150 million in 10 years. It’ll be 120 million in roughly five years. And so the prospects for long-term growth are quite strong.

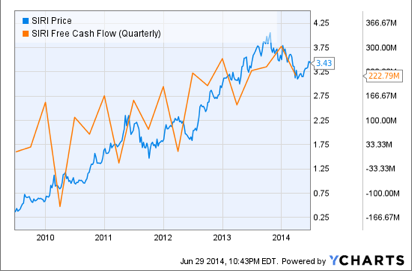

So, based on Frear’s expectation of total cars on the road by 2019, we run the numbers to ballpark whether Sirius’ present revenue growth is sustainable. According to the chart, below, since Q2 of 2009, total revenue has risen at a CAGR of 10.7%, to approximately $1B from $600MM, during the past five years.

The number of subscribers has reached more than 25.8 million, from 18.4 million at the end of Q2 2009.

The number of cars anticipated to be on American roads will double within five years, according to Sirius management. That’s a compound rate of 14.9% of the number of cars on U.S. roads, implying a massive change in the retail auto market in favor of used cars, similar the the decade of the 1970’s.

If Sirius’ revenue growth rate is running significantly lower than the marketplace expected increase in total autos sold, how would someone conclude that the Sirius’ revenue rate will likely decline? In fact, we see the opposite.

Moreover, do the bears see the trial-to-purchase conversion rate dropping? If so, there is no evidence of that trend at Sirius. According to the company’s latest 10-Q, the vehicle penetration rate increased to 70%, up a hefty 3%, year-over-year. Another fact, now that Sirius is moving into the used-car market, the company will have a second shot at the same, or new, subscriber any time a new car is traded in for resale in the after-market.

And what will continued double-digit revenue increases do for free cash flow? It should soar, as the gross margin of more than 60% will pass through to free cash flow rate, which is presently rising at an already nosebleed rate of 61.5% (today’s $222MM, from approximately $20MM of five years ago). Of course we don’t expect a continuation of a 61.5% growth rate in free cash flow into the future, but the rate should easily justify SIRI’s 28-times forward P/E for some time.

Profit margin is also rising (see graph, below).

News

Sirius XM (SIRI) is back in the news, as the satellite radio operator got a boost from Google’s announced deal with Sirius to launch YouTube’s newest concept – YouTube 15.

Under the agreement, Sirius will offer the new Internet-based music ‘station’ to subscribers. Hosted by Internet personality, Jenna Marbles, the programming will begin July 11 as part of Google’s new big idea – music! And no doubt, Google will promote YouTube 15 in a big way, too, as the Internet behemoth seeks to remake YouTube beyond the website for catching the latest viral videos.

We alert traders of SIRI as a stock to watch, and as a reminder of the company’s aggressive comeback from the dark days of late 2008 and early 2009. And Google’s announcement serves as the latest evidence that Sirius’ management is up to the task of diversifying and strengthening its content for the under-served under-29-years-old demographic.

Note: YouTube viewer median age is under 29 years.

Final Thoughts

Jason Bond suggests focusing upon Sirius’ fundamentals of internal growth potential as the company’s entry into the used-car market takes root. The news of the Google – Sirius agreement provides the clue of an aggressive expansion going on at Sirius’. Jason believes that the old metric of recalculating operational internal rate of return with the reliance upon new-car sales statistics is now inoperable. Because most investors have not considered the potential of the used-car market to Sirius’ future profitability, there is a sense that an under-appreciated condition exists in the marketplace for SIRI stock.

As long as the company continues providing high quality content, and continues to execute its used-car market plans, the shorts will provide that additional future buying as SIRI investors realize the enormous potential for growth still to come to the bottom line.

As we move into July, traders of SIRI will focus upon earnings, scheduled for July 24. Jason will glean the data to assess whether the company’s trajectory is still on course, and will provide investors an update on this most interesting stock at that time.

Considering the 10%+ short position held against the longs, those running against the uptrend in SIRI may provide additional fuel to the continuing bull rally in SIRI.

Looking for another big Turnaround Stock?

To get a heads-up on other stocks we feel will better your rate of profit, start by joining our mailing list (top of the page). Or, take the next step now by joining Jason’s community of dynamic and active traders with a subscription to Jason Bond Picks.

Click here for 2013 Performance Record.

0 Comments