I’m constantly on the hunt for solid swing trades like YONG, HOV, COCO, URRE, ROYL, PRMW and DEXO. Normally I try to position before the move like I did with HDY recently at $3.06 before it ran about 30% the following day, however, sometimes swimming with the current is an easy way to grab quick profits too. Swing trading, for those of you who are unaware, is a speculative activity where stocks are repeatedly bought or sold at or near the end of up or down price swings caused by price volatility. A swing trading position is typically held longer than a day, but shorter than trend following trades or buy and hold investment strategies that can be held for months or years. My filter for the stocks on this list is between $.25 and $5 with 300 trades or more. The following stocks could deliver some decent profits moving forward if they continue so here’s what I’ll be watching for.

Yongye International Inc. (NASDAQ:YONG) engages in the research, development, manufacture, and sale of fulvic acid based liquid and powder nutrient compounds for plants and animals, which are used in the agriculture industry in the People’s Republic of China. I like YONG here because it is holding ground no doubt due to the substantial short interest at 16.44 days to cover per the last settlement date 11/30/2011. If the price action can squeeze some then a break of the 20 and 50 Moving Averages is possible on its way to $5.

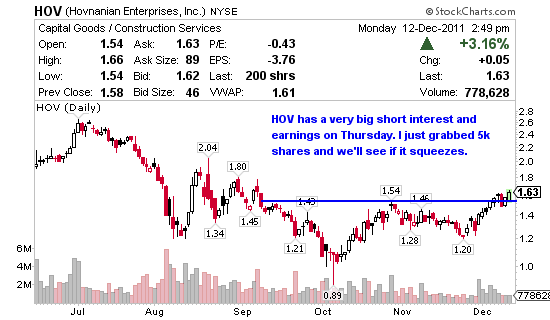

Hovnanian Enterprises Inc. (NYSE:HOV) engages in homebuilding and financial services businesses in the United States. HOV is set to report earnings Thursday before the bell and appears as if it wants to breakout today. The short interest is monstrous at 20.90 days to cover is is no doubt holding the price action up. If $1.62 breaks here I wouldn’t be shocked if the price action hit $1.78 – $2.04 before earnings. I just picked up 5,000 shares at $1.62 and we’ll see where it goes.

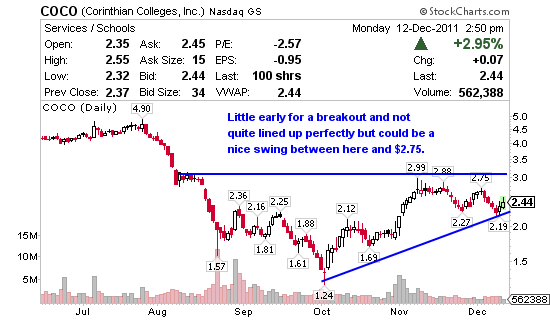

Corinthian Colleges Inc. (NASDAQ:COCO) operates as a post-secondary education company in the United States and Canada. It offers various diploma programs; and associate’s, bachelor’s; and master’s degrees. After a recent 20% pullback from $2.75 to $2.19 COCO is bouncing off the 50 Moving Average but pulling back from the 20 at $2.52. I’m looking for entry with a swing between $2.40 and $2.75 to $2.90 short term. The short interest on COCO, like the stocks above is fairly large age 23.93 days to cover.

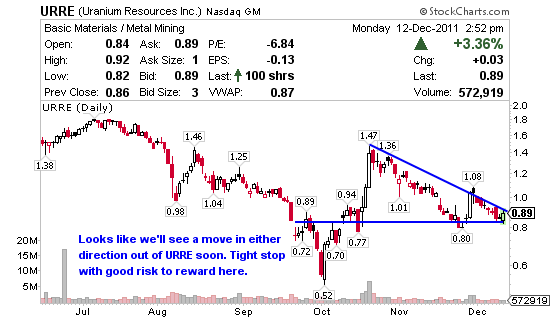

Uranium Resources Inc. (NASDAQ:URRE) engages in the acquisition, exploration, development, and mining of uranium properties, using the in situ recovery or solution mining process. I like the descending triangle pattern here with entry just above $.77 – $.80 because it creates for a tight stop loss should the stock continue down. Again short interest here is 13.66 days to cover per the last settlement date on 11/30/2011 that could assist URRE should it continue to hold $.80. Resistance ahead is at $.91, $.98 and !.08 before URRE could break the current downtrend.

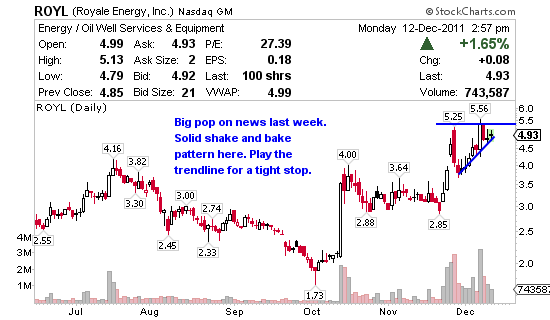

Royale Energy (NASDAQ:ROYL) operates as an independent oil and natural gas producer in the United States. Big news ROYL sure looks like it wants to head higher as it shakes out the profit takers from it’s last 26% move from $4.25 to $5.35 last week. If shares hold this bull flag and pop we could easily see $6 or $7 in the short term. There won’t be any help from shorts on this one though at 1.22 days to cover.

Primo Water Corp. (NASDAQ:PRMW) provides multi-gallon purified bottled water, self-serve filtered drinking water, and water dispensers in the United States and Canada. PRMW bounced this morning, almost looked like a short squeeze early on but then settled pulling back from resistance. Not much short interest here either at 3.15 days to cover so I’ll be interested to see if the price action continues to creep up on the $3.50 range which could lead to a breakout.

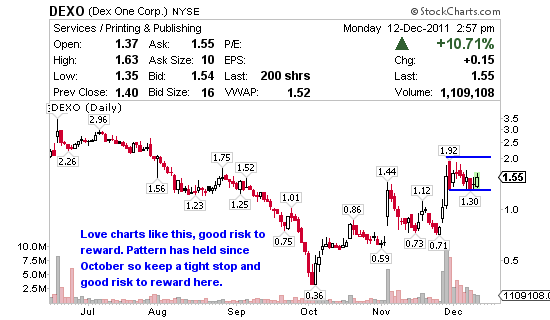

Dex One Corp. (NYSE:DEXO) operates as a marketing solutions company. Solid bull flag pattern here we could definitely see DEXO make another run soon if it creeps up on $1.92. The short interest on DEXO is only 1.92 days to cover.

I am long HOV

URRE is today at $0.8854 bid – $0.8846 ask , is it too late to see entry at $0.77-$0.80 ???

Good question John. Normally I wait for the entry at a price I like close to support. So if URRE doesn’t pullback a bit then it’s not for me and I’ll get it next time. In this way I keep my stop losses tight to support so if I’m wrong my losses are small. I did this last week when I spotted ARNA at $1.40… bidding $1.30 and missed the big run. So sometimes it helps me and sometimes it hurts me but more often than not it’s a pretty good strategy I think.

Sure I understand. That’s exactly what I’m selling with my paid newsletter. I send all buy and sell alerts in real time so if I make a trade subscribers would get a message like, “Bought 5k XXXX at $1.62, goal $1.80, stop $1.56, runup play into earnings” etc… The watch list you’re looking at is just a grouping of ideas based on my scan of the market either in the evening, morning or during the day depending on when I put the watch list out. Those watch lists are not buy and sell recommendations, they are just what I’m looking at / possibly considering if that makes sense.

Thanks, makes sense.

Its just sometimes I have a difficult time understanding what being said unless the wording or terminology doesn’t say exactly “buy at x amount and sell when it reaches z amount due to resistance”.

Right now I’m looking at URRE. And as I understand, the entry point is between $0.77 and $0.80 ???

Got it !!!

Thanks

I am planning on becoming a subscriber soon but before I did so I followed you in on HOV and bought 2600 shares @ 1.65. It is down 14% today but do you think I should sell and take the loss or is there a chance that this is going to bounce back before the earnings report.

Hi Sarab. I sold HOV for a loss today when it didn’t bounce this afternoon. I never hold through earnings as they are too volatile for me even. Maybe it bounces tomorrow before Thursday’s report but I couldn’t chance that with the broader market the way it is.