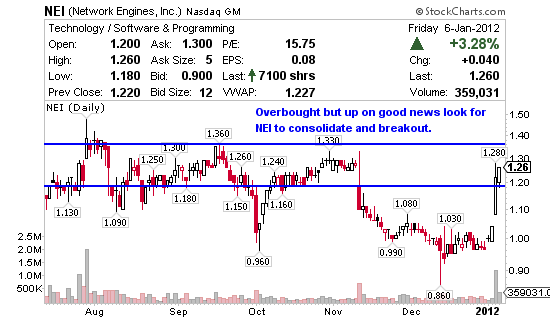

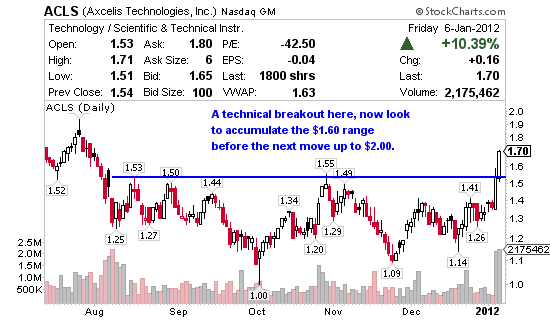

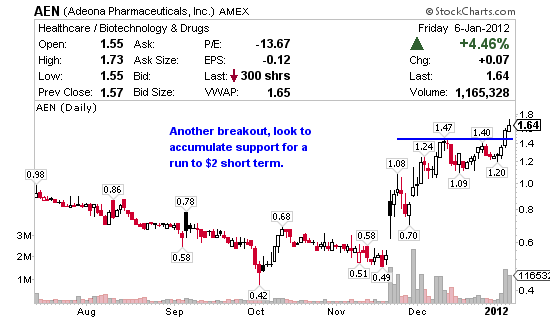

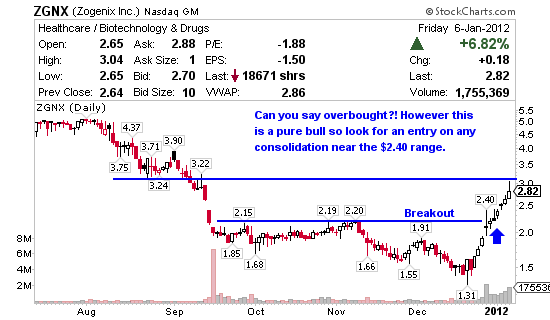

Stocks like NEI, ACLS, AEN, MTSN, GTHP, LWLG, and ZGNX are already up quite a bit and many are overbought so it’s particularly important you know and understand both daily and intraday technical analysis to score these swings. Continuation patterns are what to look for here. Normally I try to position before the move like I did with HDY recently at $2.36 before it ran about 24% five days later for $5,718 profit, however, sometimes swimming with the current is an easy way to grab quick profits too.

Swing trading, for those of you who are unaware, is a speculative activity where stocks are repeatedly bought or sold at or near the end of up or down price swings caused by price volatility. A swing trading position is typically held longer than a day, but shorter than trend following trades or buy and hold investment strategies that can be held for months or years.

Many of the charts below will be short lived opportunities, however, back-testing on this filter shows some push forward considerably despite being overbought. The following stocks could deliver some decent profits moving forward if they continue so here’s what I’ll be watching for.

Network Engines Inc (NASDAQ:NEI) designs and manufactures application platforms and appliance solutions on which software applications are applied for enterprise and telephony information technology networks.

Axcelis Technologies (NASDAQ:ACLS) designs, manufactures, and services ion implantation, dry strip, and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and the Asia Pacific.

Adeona Pharmaceuticals (AMEX:AEN) operates as a pharmaceutical company that develops medicines for central nervous systems.

Mattson Technology (NASDAQ:MTSN) designs, manufactures, and markets semiconductor wafer processing equipment used in the fabrication of integrated circuits for the semiconductor manufacturing industry worldwide.

Guided Therapeutics (OTCBB:GTHP) a medical technology company, together with its subsidiaries, develops and offers products for the non-invasive cervical cancer detection and diabetes markets.

Lightwave Logic Inc (OTCBB:LWLG) is a development stage company, focuses on the development, production, and commercialization application specific electro-optic polymers and non-linear all-optical polymers for various applications in the electro-optic device market.

Zogenix (NASDAQ:ZGNX) is a pharmaceutical company, engages in the development and commercialization of products for the treatment of central nervous system disorders and pain.

Yes I do like this.

This year is Wild!!! Thank’s Jason for the PEIX and HDY. This year I am registering all my trades at http://profit.ly/user/MrAlonso

Awesome Mr. A, next week is going to be even better when we’re up and running on Profitly – cheers.

i am not a member yet… just tracking your picks to see if this is legit…. what are your thoughts on ALU?

Hi Adam, thanks for stopping by. My thoughts on ALU is the market cap is too big – moves too slow and not good for swing trading. I’m usually around $100 – $300 million market cap and if I wander it’s hardly ever over $1 billion.

sorry …

I also invested a little on your picks for ACLS and AEN yesterday..there not doing much? should i wait or dump?

I’m sorry Adam but I don’t have time to look at them right now.

Ok.. Thanks

During market hours is hard unless you’re in chat. ACLS and AEN look good to me but they’re overbought which I think I noted in the watch list. Nice continuation patterns on both, what’s your entry? Just so you know those were just watch list stocks, I’m very detailed in my entries and don’t buy everything from those watch lists as many of them don’t pan out. Thanks for stopping by.

How do you feel about ACHN and NEWN?

Ok Jason,

you’ve peeked my interest.. I’m a single father with 2 kids and am out of work… I am a novice stock picker and lost a bit in 2011 as a result of bank stocks.. I dabbled with your pick on ACLS entered at 1.65 and HDY entered at 2.55 sold today at 2.74 because got a little nervous .. stock is now at 2.83 … I made $900 !! I will sign up as a member in hopes you can continue to provide me with gains like this…

do you feel ACLS and HDY still have upward movement now?

Hi Adam, great look forward to having you on board. HDY chart looks solid today, bullish engulfing candle. ACLS needs to shake out profit takers here after the big move before it could continue.

I signed up but am unable to login to the chat room or videos for some reason?

is there someone i can call… im being asked for my user name / email addrees and password which is suppose to be a receipt number? i dont have a receipt number…

Adam please check your email – I’ll send it now. For some reason our server is delayed on sending the information. Sorry about that.