Here at Jason Bond Picks we’re constantly scouting about 100 liquid small caps between $1 and $5 with market caps between $50 million and $2 billion. The goal is to use 3 easy to follow video lessons and apply the same swing strategy over and over. Today ZNGA, DRWI, OCZ, GEVO and HEK stock all match video lesson number one or two and I’m confident there’s several winners on this list which I will be buying from.

I’m not just blowing smoke here, I put my money where my mouth is unlike most of the other stock newsletters out there and recently hit 24% on KWK stock for $11,202 and 23% on ATPG stock for $10,604 using this exact same strategy. No I don’t win them all, but I win more than I lose and the portfolio is up 36% since inception 16 months ago using this strategy. The goal is ALWAYS 5-10% rinse and repeat.

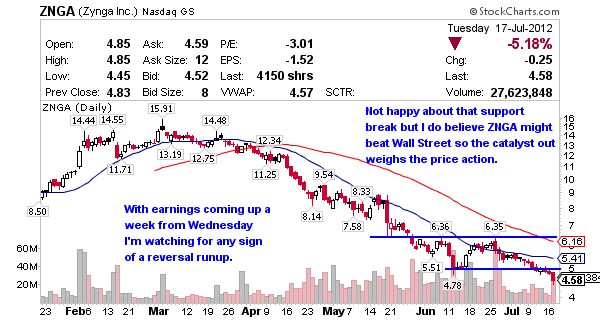

Zynga Inc. (NASDAQ:ZNGA) – Earnings are 7/25/12 which is next Wednesday, between now and then there’s a really good chance I’ll be in this trade. It’s going to be a day by day assessment due to Facebook’s pull etc… but there’s probably a solid 30% winner here soon.

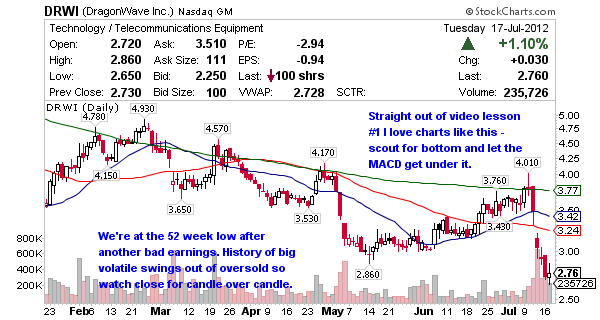

Dragonwave Inc (NASDAQ:DRWI) – Not sure the 34% drop here is bottom but I’m watching because DRWI’s $98 million market cap makes for big moves once bottom has been reached. As with any struggling company beware of offerings and swing the technical pivot and squeeze when it’s ready. With the earnings wash in, the only question is will the 52 week low of $2.70 hold or is another wash coming before the turn? Good risk to reward here at $2.76 since it offers a tight stop.

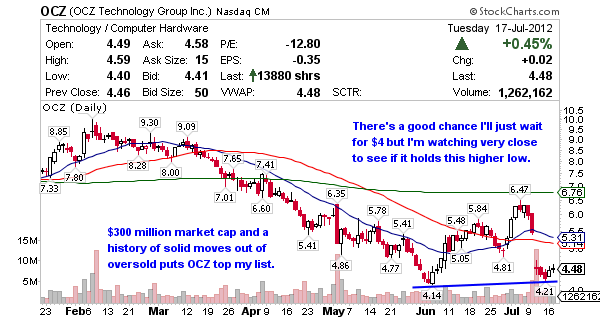

Ocz Technology Group Inc (NASDAQ:OCZ) – Love this company and their solid state drive is what I use for storage on my machine (My latest multi-monitor setup). Monday was candle over candle and I’m upset I missed it but it wasn’t on the Master Watch List, however it is now. Tuesday’s doji is where I’d have been looking to take half and let the other half ride so I’m watching to see if a bigger move into the gap is coming – if yes it should open and hold over $4.48.

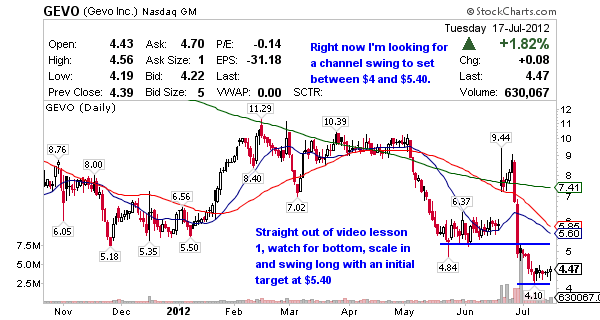

Gevo (NASDAQ:GEVO) – Still scouting for swing entry but would like to see a curl toward $4.60 or wash to deep oversold before on the RSI before making my move. I believe a reversal is more likely than another was and the swing long potential is excellent so I’ll be watching daily. I don’t think we’ll see more bad news and good news potential could start a runup.

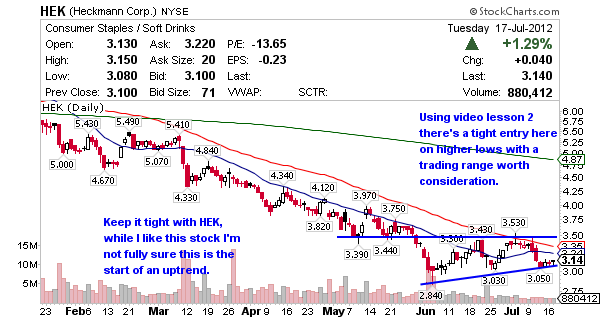

Heckmann Corp. (NYSE:HEK) – As natural gas plays like KWK and ATPG come back into the spotlight it’s possible this one will finally find an uptrend. The recent low was $2.84 followed by $3.30 and now $3.05 – using the$3.05 range as trendline support there’s a tight stop if the trend of higher lows breaks and excellent upside to $3.50’s and if it gets bullish the upper $4’s which I do believe is possible but probably not on a swing time frame, like HL this one moves slow.

Jason, YOU ARE THE BEST !!!! Since your always so nice to throw all of us a free bone every once in a while, I want to tell you about a very predictable stock chart that I have found , its Pandora or p is the ticker, trust me look at their chart pattern , I have never ever seen such a predictable pattern. Good luck with it !!!! Thanks for all that you do !!!!