Around this time last year, social media stocks were creating buzz on Wall Street. Companies such as Renren Inc. (NYSE:RENN), LinkedIn Corp. (NYSE:LNKD), Zynga Inc. (NASDAQ:ZNGA) and Groupon Inc. (NASDAQ:GRPN) had listed their shares amid huge expectations. Meanwhile, investors waited for the IPO of social networking giant Facebook Inc. (NASDAQ:FB). However, the social media craze ended soon after Facebook listed its shares.

Almost all social media stocks, excluding LinkedIn, were hammered post Facebook IPO. While some questioned the business model of social media companies, others said that the valuation assigned to some of the companies was too much. However, over the past few weeks social media stocks are once again finding favor among investors and analysts. One such social media stock is Renren.

Based in China, Renren is often called the “Facebook of China”. The company operates a real name social networking Internet platform in China. Renren had completed its IPO back in May 2011. The stock has fallen more than 80% since its IPO. However, the huge drop in Renren shares since the IPO is not justified, given the company’s business prospects.

The Facebook of China and More

Renren’s main social networking website is Renren.com. It is also the largest social networking website in China since Facebook, the world’s largest social network, is blocked in the country. Renren’s other platforms include Game.renren.com, an online games center; Numoi.com, one of the leading social commerce sites in China; and 56.com, a video-sharing website.

Q3 Results and Outlook

Last month, Renren reported its third-quarter financial results, posting total net revenue of $50.4 million, up 47.2% over the same period in the previous year. While total revenue growth for the third quarter was impressive, the company’s online advertising revenue fell 13.7% to $17 million. The drop in online advertising revenue was mainly due to lower advertising spending by brand advertisers in a softer macro-environment. Online advertising revenue for the quarter also dropped due to increasing competition and continued migration of Renren’s traffic from PC to mobile.

Despite the decline in online advertising revenue, Renren’s total revenue was at midpoint of its guidance. This was mainly due to strong growth in online game revenues, which rose 120.2% on a year-over-year basis to $24.2 million. Numoi’s net revenue for the quarter was $4.6 million.

Meanwhile, Renren’s third-quarter operating and net loss were below forecast due to tighter cost controls.

Renren, last month, also provided guidance for the fourth quarter. The company expects fourth-quarter revenue to be between $45 million and $47 million, which represents a growth of between 37% and 43% over the fourth quarter of 2011. Renren has been cautious with its outlook for the fourth quarter, mainly due to weakness in brand advertising business.

In fact, the brand advertising business is the biggest challenge for the company going forward. At a conference call, following the release of third-quarter results, the company acknowledged this fact.

CEO Joseph Chen said at the conference call last month that the key factors affecting the advertising business are slowdown of the economic growth, a rising competitive environment and the continuous shift by users to mobile, which the company is yet to monetize. While Chen believes that mobile advertising solutions will ultimately be a must have for advertisers, he suspects that there will be a lag between where users spend their time and meaningful budget allocation for advertisers. He noted at the conference call that historically adaption by Chinese advertising customers tend to lag behind the developed markets when it comes to new media such as internet, social networking and mobile.

RenRen CEO Joe Chen

Strong Growth Prospects Despite Challenges

While the online brand advertising business remains a challenge, growth prospects for Renren remain solid. This is because Renren’s other businesses are growing at a brisk pace. In fact, in the third quarter, online gaming revenues accounted for nearly half of the company’s total revenue. And this business is experiencing exponential growth. The growth has come despite the fact that the company’s gaming unit currently operates on iOS platform and the PC. Once the company’s games are available on the Android platform, online gaming revenue is likely see even stronger growth.

Chen last month said that at the company’s conference call that Nuomi, the group-buying business, continues to show encouraging signs on all metrics.

Chen also said last month that the company’s focus and investments will continue to shift towards the mobile opportunities and challenges ahead of it.

While Renren is increasing its focus on mobile, signs of improvement in the Chinese economy also augur well for the company.

Valuation

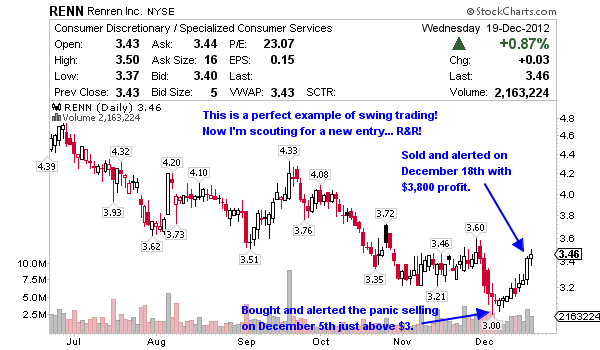

As I mentioned earlier, Renren shares have lost 80% of their value since the company’s IPO in May 2011. The stock is currently trading around $3.35. At the end of the third quarter, Renren had cash and cash equivalents, term deposits and short investments totaled around $890 million, which is roughly $2.40 per share. This basically means that Renren’s business is currently being valued at less than $1 per share, which given the company’s prospects is very low. On December 5th I bought Renren and sold it yesterday, December 18th for a solid 10% profit and now I’m looking for another entry soon because I think this is an excellent opportunity to buy Renren heading into 2013.

Disclaimer: I am long ZNGA.

Jason, any thoughts on the TVIX reverse split? I would love to see an article come out ASAP as I am one of the holders that got left holding almost nothing. Is there a return on this stock, or should we pull out while it came up above $1 ($10, but only because of the reverse split).

Please, you’ve gotta be kidding me with this? Why on earth would I do an article on TVIX? If you are holding you’re a bag holder, that has nothing to do with me. Take control of your trades and grow up. It’s not a stock, it’s an ETN and we were up $15,000 on the trade before taking a loss. UVXY split too and they will again. It’s a play on volatility and will erode, if you didn’t look into that by now you’re ignorant and shouldn’t be in the market.

Wow…touchy subject I guess. I was just curious what your thoughts were, because I respect your opinions on such matters. I guess I’ll take that somewhat rude comment as a “no”. Obviously I am going to learn from this bad trade, but I didn’t think it warranted name calling and harsh words concerning such.

You’re not a client, why would I do a report for you? We’re not in TVIX and have not been for 9-months. This is a swing trading service, not bag holding service. Please stop wasting my time.

I was a client for a few months, and I enjoyed your service, but do to other events, I am unable to trade with you or at all right now. I enjoy reading your articles, and since I see articles about things like the “fiscal cliff” etc, I thought maybe it was a good topic. Anyway, sorry to step on toes, it was not my intention, and I look forward to trading with you in the future.