Back in 2010, solar stocks were having an excellent run as renewable energy was seen as the next big thing. All that changed in 2011 as the solar industry was hurt by overcapacity. A number of companies suffered. In the U.S., Solyndra was one of the biggest casualties.

The downturn in the solar industry resulted in a huge sell-off in solar stocks since 2011. Investors have been right in dumping shares of some fundamentally weak companies. However, the bearish sentiment on the solar industry has also hurt some strong players in the industry. These fundamentally strong companies have significant potential in the long-term. One such company is Power-One Inc. (NASDAQ: PWER).

A Major Player in the Renewable Energy Industry

Based in Camarillo, California, Power-One is engaged in the design and manufacturing of inverters for the renewable energy industry. The company’s manufactures inverters that convert DC energy from solar panels and wind turbines into AC energy for customer use or the utility grid.

Power-One is the world’s second-largest provider of solar inverters. In addition, the company is one of the world’s ten largest providers of power conversion and power management solutions.

Improving Results and Strong Cash Position

While it is true that Power-One suffered due to the downturn in the solar industry, the company has been able to survive the challenging period without any major problems. In fact, one of Power-One’s competitors Satcon Technology Corporation (SATCQ) filed for bankruptcy earlier this year. Power-One has been to weather the storm mainly due to its strong balance sheet.

At the end of the third quarter of 2012, Power-One had $287.38 million in cash and short-term investments and no debt.

Meanwhile, the company has also seen an improvement in its quarterly results. For the third quarter of 2012, Power-One reported net sales of $284 million, up 16% over the same period in the previous year. Renewable Energy Solutions segment accounted for $216 million of the total third-quarter revenue. The segment benefited from strength in Europe and Asia Pacific. The segment had an operating margin of 22%.

Power-One reported net income of $21 million, or $0.13 per share for the third quarter. According to HIS, the company’s share of the worldwide PV (photovoltaic) market was 13% in the third quarter, up from 11% for the full year of 2011.

Outlook

For the fourth quarter, Power-One expects revenue to be between $210 million and $230 million. The cautious outlook is due to the fact that the company expects demand in Germany and Italy to moderate. Meanwhile, the company expects its Renewable Energy business in North America to increase from the third quarter and represent around 15% of total segment revenue in the fourth quarter.

Power-One is also likely to benefit from U.S.’s goal of reducing dependence on foreign oil. President Obama has always been a proponent of clean energy and his plans to achieve the goal of energy independence includes investment in renewable energy. President Obama’s re-election last month, therefore, is a positive for Power-One and the renewable energy industry.

Speaking at a conference call following the release of third-quarter results in October, Power-One CEO, Richard J. Thompson said that the global PV demand is shifting from the more mature European markets to the growth markets of North America, Asia Pacific and Latin America and the company is positioning its Renewable Energy business to be a strong global competitor, with a full complement of product offerings and service capabilities in every key market around the world.

Thompson expects total demand in Europe to decline in 2013 and rebound in 2014. Thompson also said in the conference call that research firm IHS expects the North American market to grow by more than 40% in 2013 and the company is well positioned to benefit from this growth with its very compelling ULTRA product and TRIO line. In Asia Pacific, Power-One expects market demand to be strong in 2013, driven by China, India and Japan.

Why Power-One is an Attractive Proposition?

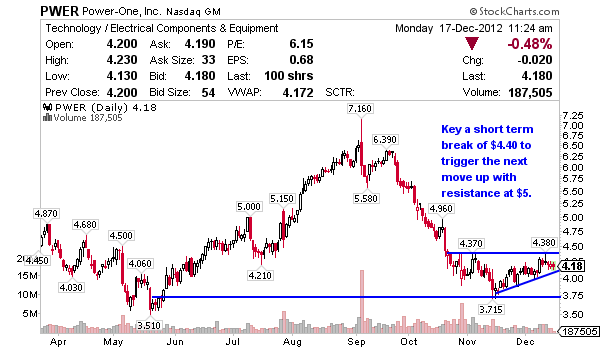

Power-One shares have fallen more than 58% January 2011. However, the stock’s performance so far this year has been significantly better. Year-to-date, Power-One shares have gained more than 8.57%, reflecting the improving operating environment.

As I said earlier, Power-One’s biggest strength is its balance sheet. The company’s cash position at the end of the third quarter translated to a little over $2 per share. In addition, Power-One is also positioned well to benefit from growth in North American market.

Given all these factors, I see Power-One as excellent long-term play.

Disclaimer: I am long PWER

0 Comments