Many articles have been written about the comparison between the sour gold market of today with the one in 1976. In Aug. 1976 sentiment for the yellow metal reached an abysmal level following gold’s 20-month bear market slide of 50 percent from the Dec. 1974 high of $200 per ounce.

Today, investors’ sentiment for gold continues to deteriorate, now 60% off its bullish sentiment high during the bull market’s melt-up peak of $1,917.90 on Aug. 23, 2011, down 36% in price.

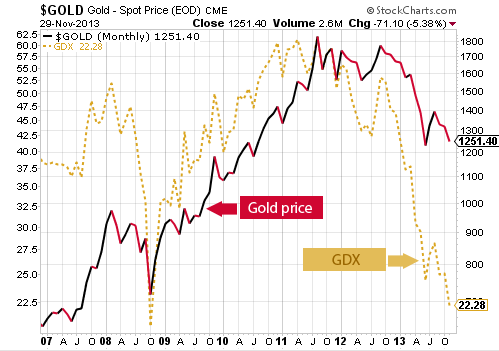

Gold stocks, as measured by the Market Vectors Gold Miners ETF (GDX), have fared far worse since Aug. 2011, cratering 63% through 27 months.

Anyone following the gold market as closely as I do knows the high level of negative sentiment in any market nearly always precedes a rally, which is especially true of the potentially explosive gold market.

And as if on cue, Goldman Sachs’ recent “slam-dunk-sell” recommendation for the gold price could very well turn out to be the butt of future commentary for years to come, if my bullish outlook for the yellow metal is correct.

In my opinion, gold and the gold stocks are truly the contrarian play right now while the market is riddled with overvaluations in most equities and an increasing number of companies issuing cautious guidance.

One of my favorite contrarian investor is founder and chairman of Dreman Value Management, David Dreman, who once said, “I buy stocks when they are really battered,” but cautioned that hated stocks turn around “slowly, even glacially.”

Unless you’re in the camp which foresees the world’s most powerful central banks reversing their Zero-Interest-Rate-Policy (ZIRP) course and expecting the banking system to survive on a diet of normalized interest rates, the contrarian should really analyze the panoply of battered gold mining stocks for potential bargains.

There is no evidence to suggest that the Fed will actually slow its debt securities purchases, contrary to media insistence that it is now time for the US central bank do so. Therefore, further dollar debasement from the Fed’s QE programs should provide the needed lift to the gold price in the long term as foreign central banks accumulate more gold to offset their massive dollar reserves.

Gold Supply

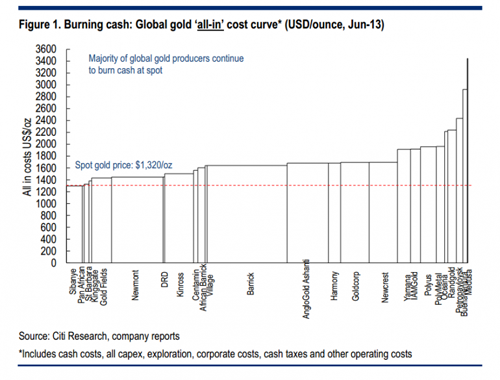

Give or take, $1,200 per ounce gold looks very attractive from a fundamental and technical prospective. Miners become marginally unprofitable at the $1,200-$1,300 range, with the world’s large gold miner Barrick Gold (NYSE:ABX) serving as a perfect example of the entire industry.

In August, the Canada-based gold miner announced the closure of 12 of its 27 mines, citing rising operating costs of more than $1,000 per ounce of gold at those 12 mines. But, according to Citi analysts, Barrick isn’t an outlier—it’s the norm.

In Citi’s early-August report on gold miners, analysts based their ‘buy’ recommendation for the sector, for the most part, with data revealing the costs of mining one gold ounce at 25 of the largest gold miners of the world. See chart, below.

From the report, Citi demonstrates why the gold supply from mining (approximately 60% of total supply) may be negatively impacted in the coming months, or longer.

From the graph, of the 25 major miners researched by Citi, all 25 will experience write downs from mine closures, squeezed margins and severely depressed stock prices, as investors discounted several quarters of negative guidance from the bear market in gold.

Essentially, $1,250 gold isn’t a high enough price to profitably mine at many locations, globally.

Though global mine production for the second quarter weighed in at 732 tons, up 4% year-over-year, according to the World Gold Council (WGC), led by production increases by smaller miners in China, Dominican Republic and Barricks’ Pueblo Viejo mine in Brazil, future mining supply won’t likely be taking off anytime soon with the gold price declining another $175 from an average per ounce price of $1414 in the second quarter.

The other 40% of total global gold supply comes from consumers who turn in jewelry for recycling. Of that segment, 308.3 tons were recycled during the second quarter, 21% less tonnage year-over-year, the fifth consecutive quarter of year-over-year declines.

In total, the second quarter saw a drop to 1,025.5 tons of gold supply, or a decline of 6% from the second quarter of last year, due to the impact on mining and recycling supply declines in line with much lower gold price from the prices achieved in the years 2011 and 2012.

It’s not a stretch, therefore, to infer that the decline in mining production and recycling will most likely continue at a sub-$1,300 gold price.

Gold Demand

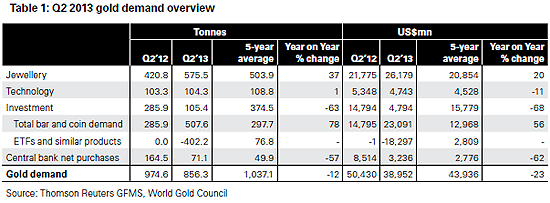

On the demand side, the World Gold Council reports that consumers of jewelry and central banks continue to be strong buyers of gold, maintaining rates higher so far this year than the 5-year average.

Collectively, central banks raised their holdings of gold by 1.7 million ounces, down from last year’s rapid pace, but still higher than the 5-year average. The WGC expects the 3-year trend in net buying from central banks to continue for 2013 and will remain within the 70 to 160 ton range, marking 10 consecutive quarters of net purchases by bankers.

Demand for gold from “Technology” dropped 11.3 and wasn’t a significant entry to the report.

But what is a significant and an interesting development noted in the chart is “Investment.” For the second quarter of 2013, total bar and coin demand soared to $23.1 billion, while demand for Exchange Traded Funds (ETFs) crashed by $18.3 billion.

The apparent anomalous discrepancy between the two investment categories comes from investors selling ‘paper gold’ (a security that replicates the performance of tangible gold) for tangible gold. In other words, investors have come to distrust ETFs as an investment vehicle in real tangible gold.

If gold supplies were to ever run dry, investors fear that the largest gold ETF, SPDR GLD, will not be able to deliver tangible gold in the event of a run on the gold market, leaving large investors of more than 100,000 gold ounces worth of GLD shares the only option of cash settlement in the case of a force majeure, or default. That risk defeats the purpose of owning gold as an insurance against a currency crisis in the US dollar.

Summary

With the gold price and GDX dropping 36% and 63%, respectively, the contrarian play is to own both gold and the gold stocks.

Supplies from mining and recycling are expected to be constrained at a sub-$1,300 gold price.

Demand, on the other hand, continues to rise above trend line, led by Asian consumers of jewelry and central banks.

Negative sentiment in the gold market is at historically very high levels.

As the Fed continues to provide banks with near-zero interest rates, gold will remain in demand as an insurance against further debasements of the US dollar.

Investors of gold stocks have already heavily discounted the shares from mine closures and tightening operating margins.

0 Comments