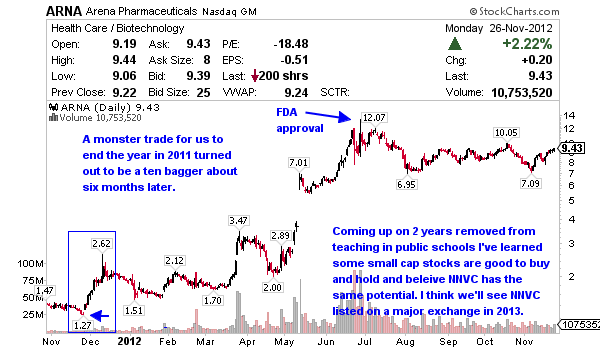

It was almost a year ago to this date when I made a strong recommendation and alerted Arena Pharmaceuticals (ARNA) around $1.30 in our old Skype chat. About half a year later it proved to be a ten bagger above $13. I made a solid profit on the trade but did not realize nearly as much as I could and should have. It was my first year away from teaching full time and I learned a very important lesson, when you think you have a ten bagger stock, stick to your guns. You won’t hear me talk about stocks with ten bagger potential much but I’m confident NNVC could be such a stock.

Investing in biotechnology sector can be extremely risky; however, if you back the right company then the potential return can be huge. One stock that has the potential to generate substantial returns in the long-term is NanoViricides Inc. (OTC: NNVC).

NNVC is a development-stage company that has designed an agent called a nanoviricide®, which as defined by the company is a nanomachine that is armed to destroy virus. If the company is successful in bringing this unique nanomedicine technology to the market, then it would represent the next great advance in immunotherapeutics, which are the existing antiviral strategies. For investors this would mean huge returns.

The Technology

NNVC is breaking new ground by applying nanomedicine technologies to the complex issues of viral diseases/ NNVC’s nanoviricide has been designed to fool a virus into attaching to the antiviral nanomachine, in the same way that a virus normally attaches to the receptors on a cell surface. Once attached, the nanoviricide glob wraps around the virus and traps it. As a result, the virus loses its coat proteins, which is needed to bind to a cell. Thus the virus is neutralized and effectively destroyed.

The technology permits direct attacks at multiple points on a virus particle. The result of such actions it is believed lead to the virus particle becoming ineffective at infecting cells. This is in contrast to antibodies, which attack a virus particle at only a maximum of two attachment point per antibody.

How it All Began?

NNVC was founded by Anil Diwan, who currently serves as the company’s Chairman and President. Diwan, who got a postdoctoral fellowship at the University of Connecticut, began developing the idea at New Haven, Connecticut’s Science Park. In an interview to New Haven Independent last year, Diwan said, “We have spent about $14 million. That contrasts with companies that are developing just one or two drugs, and they are spending $25 million a quarter.”

Remarkable Progress

Since its inception in 2005, NNVC has made remarkable progress. The company began with drug candidates against Influenza and then shortly added a drug candidate against Rabies. The company then began working on Ebola/Marburg viruses and developed drug candidates, which have potential for further development. NNVC followed this up with a drug candidate against Adenoviral Epidemic Kerato-conjunctivitis (EKC).

Back in 2008, the company further expanded its pipeline by adding anti-HIV drug candidates. The company has also developed new drug candidates against herpes viruses (HSV-1 and HSV-2) for the treatment of recurrent HSV skin infections, including cold sores and genital warts. The company added drug candidates that have been effective against Dengue viruses.

The total market size of drugs for the programs in which NNVC has lead drug candidates are estimated to be more than $40 billion in 2013.

Product Development Programs

NNVC has divided its product development programs into three categories; Commercially Important Diseases, Neglected Tropical Diseases (NTDs) and Biosecurity/Biodefense, and Advanced Technologies.

NNVC’s major focus is on Commercially Important Diseases as they have large market sizes. Apart from Influenza, the category includes HIV, viral diseases of the external eye, Herpes Cold Sores and Genital Herpes, and Dengue viruses.

According to NNVC, the market size for HIV is estimated to be $21 billion in 2013, while the market for influenza drugs is estimated to be approximately $7 billion. The market for other viruses in the Commercially Important Diseases category is also estimated to be in the billions of dollars.

FluCide

NNVC, initially, began developing three separate drug candidates against influenzas, which included a candidate for seasonal influenza, aimed to be very broad in its spectrum; a drug candidate for severe influenzas; and a third drug candidate for the then intense threat of H5N1, bird flu. Later, the company improved the three drug candidates significantly and now has a single drug candidate which it believes is capable of effectively tackling all forms of influenza A viruses, which includes swine flu and bird flu viruses among others. The influenza program is called FluCide™.

According to NNVC’s most recent 10K filing for the fiscal year ended June 30, 2012, the company selected a clinical candidate, called NV-INF-1, for FDA submission in its highly successful FluCide program. With the help of FDA consultants, the company is now developing certain addition information on the drug candidate for the pre-IND application to the FDA.

NNVC is planning two separate indications for NV-INF-1, a high strength dose form for hospitalized patients with severe influenza, and a single course therapy for the out-patients with less severe influenza.

Earlier this year, NNVC also reported that oral effectiveness of anti-influenza FluCide drug was seen in a lethal animal model. Some of NNVC’s anti-influenza drug candidates under the FluCide program, when administered orally, were found to as effective as when administered as IV injections.

All the data from the FluCide program show that both injectable and oral FluCide candidates are superior to oral oseltamivir (Tamiflu®), the existing treatment for influenza. In addition, no adverse effects were found during the study, which suggests that the FluCide dose could be increased to achieve significant greater levels of effectiveness.

NNVC believes that the anti-influenza drug candidates it has developed under the FluCide program should work against most if not all of influenza viruses.

Other Programs

NNVC’s other programs in the Commercially Important Diseases sector have also been progressing well. The company has limited its expenditures on socially conscious projects such as NTDs and Biodefense to the extent that participatory funding from third parties is available.

Other Developments

In the recent 10K filing, NNVC noted that this year it continued to improve its laboratory infrastructure. The company added number of new instruments and further chemistry capabilities.

In September 2011, the company announced the acquisition of an 18,000 sq ft building on 4 acres in Shelton, Connecticut through Inno-Haven LLC, a special purpose company formed to acquire the facility.

NNVC is also making progress in the development of its cGMP (current Good Manufacturing Practices) manufacturing capability for clinical product. Back in May this year, the company announced the appointment of Andrew Hahn to help with overall design and construction of the laboratory and cGMP pilot production facility. Hahn previously served as the Senior Director of Engineering, Pharmaceutical Facilities, Global Engineering at the Bristol-Myers-Squibb Company Worldwide Medicines Group (BMS).

While NNVC is making substantial progress on the operating front, the company is also making strides in raising awareness about its technologies. The company has been getting exposure through participation in conferences and forums. In September 2011, the company presented at the Rodman & Renshaw Annual Global Investment Conference in New York City.

NNVC believes that the presentations, resulting exposure, and related meetings and discussions have been extremely beneficial as they allowed the company to achieve significant amounts of financing in 2012.

The company was also issued a fundamental patent, on which its nanoviricide technology is based, in the U.S. in May this year.

NNVC has also been working towards improving its corporate governance. Earlier this year, the company appointed Stanley Glick, CPA, as an Independent Director and Chairman of its Audit Committee.

Sufficient Funding

The biggest hurdle for a biotech start up like NNVC is cash. However, NNVC has been successful in raising necessary funds, although the pace slowed down this year due to weakness in financial markets.

According to the recent 10K filing, investor firm Seaside 88 LP invested $22.5 million in the company. The company said in the filing that it has sufficient funds for more than eighteen months of further R&D and operating expenses.

A strong balance sheet has allowed the company to move forward in its drug development program.

Conclusion

Investing in biotech companies involves a fair share of risk, however, NNVC has the potential to generate significant returns. What is needed is patience and long-term outlook. NNVC’s financial position is robust, which has allowed the company to proceed with its drug development program. The company’s FluCide program has made significant progress and is inching closer towards the IND filing stage. Given the effectiveness of the company’s anti-influenza drug candidates, NNVC has the potential to become a major player in the influenza drugs market, which is worth billions of dollars. The company is also seeing decent progress in other virus programs. From a modest beginning, NNVC has come this far in a relatively short period of time. NNVC holds a lot of promise and has the potential to become a major biotechnology company. I’m looking to accumulate NNVC shares around $.40 and plan on holding about $20,000 worth of this stock long term.

Jason – Great analysis on these stocks – Bio’s and 10c stock are risk/reward but doing homework gives you a fighting chance. Your hard work is appreciated and is a great start for further analysis. FYI – glad your back on swing trades and these longer term investments rather than day trading.

Made some good trading profits on this one during the year. Grabbing it for a little longer term run in 2013!