Good morning,

I went 2 for 2 in September +18% +$2,500 on half my LQMT position across 23-days (still holding half) and +15% +$4,150 on ASUR across 8-days.

Here’s my performance tracking for the Long-Term newsletter for August and September.

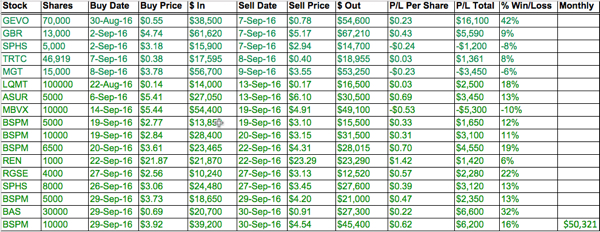

And here’s my performance tracking for the Swing Trade newsletter in September with the Long-Term results mixed in making up $6,650 of $50,321 in trading profits last month.

You can email me jason@jasonbondpicks.com for the spreadsheet if you’d like to use it yourself.

What a farce that took place this week—a farce, of course, that should be of no surprise to my readers. I wonder how many readers catch what I mean. Let me explain.

Two events this week typified everything I’ve been communicating since the beginning of these reports about the Fed’s ultimate intentions regarding monetary policy. The first event took place on Thursday at a banking conference in Kansas City, where Fed Chair Janet Yellen presided as the featured speaker. The second event was France’s cooperation with Germany in a masterful effort, executed the following day, to save the banking system from another liquidity-induced collapse.

I’ve warned of Deutsche Bank’s (DB) threat to the banking system and by extension stocks, especially in last week’s LT Report. The divergence to the overall market in the direction and magnitude of that direction at a near-record-low share price of DB at the close of trading on September 23 glared at me. Last weekend, I knew something was up. Following last week’s action in DB, my 50/50 chance of truth to the rumor I heard from my reliable source about Deutsche Bank’s quiet default just jumped to 80/20 in favor of truth.

As DB decisively broke through support at $12.50 this week, the stock began the initial stages of what appeared to be a coming free-fall. Reports of 10 major hedge funds removing their accounts from Deutsche Bank indicated to me the start of a bank run. And with popcorn in hand, I waited in anticipation of what the central banks would do, say, lie and/or steal to save the system for another day.

And there, it happened. In her speech on Thursday, knowing DB had just closed again at a new record-low of $11.48 on massive volume of 60 million shares and the rapid-fire news surrounding the bank’s woes coming out more quickly, Yellen had to say something to do her part to calm markets.

Reuters reported at 5:06 p.m. (EST), 66 minutes after the closing bell on Thursday, Fed Chair Janet Yellen had said, that in the event of crisis, the U.S. central bank may not be able to adequately respond, as the Fed’s present policy initiatives have “reach[ed] the limits in terms of purchasing safe assets like longer-term government bonds.”

“It [buying corporate stock and debt] could be useful to be able to intervene directly in assets where the prices have a more direct link to spending decisions,” Yellen said, echoing solutions already in full deployment by the Bank of Japan (BOJ) and Swiss National Bank (SNB).

Yellen wants (or is ‘jawboning’ again) to buy stock and corporate bonds as the next step in the Fed’s monetization of debt and equity.

Didn’t the Fed’s policy statement following the FOMC meeting of September 20, 21 include language indicating an all-systems-go for another rate hike in the coming months? Now the Fed wants to follow the BOJ into the abyss of becoming the U.S.’s largest holder of private equity and debt?

Folks, that’s the farce. And not one mainstream financial news outlet featured the story as a top headline. But everyone’s buddy at CNBC, Rick Santelli, got the big story of the week—as he always does. When Santelli rants, you know it’s important. So, watch the video of his rant about Yellen’s latest remarks in Kansas City, here.

And of course, to put added teeth in Yellen’s statement to make her appear as the one able to wag the market as a matter of divine providence, Agence France Press reported early Friday that the Deutsche Bank and U.S. Justice Department were finalizing a $5.4 billion settlement, stemming from a civil case brought against Deutsche Bank that alleges the bank defrauded investors through the bank’s sale of mortgage-backed securities to U.S. investors.

If you remember, the initial settlement offer by the U.S. Justice Department was $14 billion, which Deutsche Bank immediately rejected. The case appeared headed for court.

And as we know, on Friday, DB soared $1.61, or 14.02%, following the news as reported by Agence France Press, which then triggered shorts to cover and help close the stock at $13.09, and back above $12.50.

The fire was snuffed out.

The five-minute interval chart of DB, below, is courtesy of zerohedge.com. Read the accompanying article by zerohedge, here.

Source: zerohedge.com

Instead of a crushing Friday trade, stocks ended up as the relative winners again this week. At the close of Friday’s trading, the DJIA, S&P500 and NASDAQ rose 0.26%, 0.17% and 0.12%, respectively, with the NASDAQ closing at another record weekly high. Amazing.

And of course, portfolio insurance traders liked what they saw in the central bankers’ response to the DB affair, taking the VIX back to a more-bullish bias of 13.29 from Thursday’s spike of as high as 15.69.

Overshadowed by the Deutsche Bank crisis, West Texas Intermediate Crude (WTIC) was the big winner this week. Saudi Arabia and Iran came to a tentative agreement in Algeria on Tuesday regarding output limits between the two rival nations. News of the agreement soared WTIC by 8.45% for the week to close a barrel of crude at $48.24.

Watch your oil trades if/when we approach $50. I suspect the oil price to be somewhat ‘monkey hammered’ at $50. Until we see U.S. dollar weakness or a Fed event, oil is going nowhere outside the $40 and $50 trading band.

In the precious metals market, gold and silver prices fell 1.83% and 3.01%, respectively, for the week, as traders who sought a safe haven from the Deutsche Bank scare unwound positions.

Traders of U.S. debt were in the mood to buy again this week. The U.S. 10-year Treasury extended its rally another week to close at 1.60%. The yield curve continued to flatten, closing at 83 basis points, down a sharp 13 basis points within two weeks from the 96-basis-point high reached prior to the FOMC meeting of September 20, 21.

By now, you should be able to anticipate what I think about this week’s market action. That’s right; the Fed won’t stop elevating stocks until it is stopped by the American people or forced to stop because of a ‘black swan’ event.

When will the money printing stop? If I knew, you would soon see me accepting my Nobel Prize in Stockholm, Sweden.

But an article I found at Epic Times, covering an interview on September 13 with internationally-famed money manager, Marc Faber, may help my readers understand my bullish longer-term outlook for stocks. In short, Faber said the DJIA could theoretically reach 100,000 if the Fed continues to print enough cash to support this level.

Okay, let’s talk stocks. As I alerted on Wednesday, September 28, I bought LIVE, so I’ll be talking about that stock in addition to updates on LQMT and a stock on my Watch List: FEYE.

This Week’s JBP Stock Ideas

LIQUIDMETALS (LQMT)

There was very little activity in LQMT this week. Although down $0.01, the stock still trades comfortably above its 200-week moving average. There’s nothing really to see here, as it appears the stock is still backing and filling from the 35.9% move higher in August. And from the December low of $0.06, the chart shows a nice bullish trend, with the 52-week moving average trending up nicely, as well.

I still own 100,000 of LQMT at a price of $0.137 per share (up 9.5%), with a profit of $2,300 in five weeks.

ABOUT LIQUIDMETAL (LQMT)

Liquidmetal® Technologies researches, developments and commercializes amorphous metals. The company’s revolutionary class of patented alloys and processes form the basis of high performance materials in a broad range of medical, military, consumer, industrial, and sporting goods products. Discovered by researchers at the California Institute of Technology, Liquidmetal alloys’ unique atomic structure enables applications to achieve performance and accuracy levels that have not been possible before. As the company controls the intellectual property rights with more than 70 U.S. patents, these high performance materials are dramatically changing the way companies develop new products.

Source: Liquidmetals Technologies

FIREEYE (FEYE)

Traders of FEYE followed through with another $0.36 move to the upside in the stock price this week to add to the previous week’s $0.35 move higher following revelations of a massive security breach at Yahoo. The breach was quite extensive, too, affecting approximately 500 million users!

Anytime a cybersecurity breach becomes well-publicized, traders begin to buy shares in the industry, almost across the board.

I added FEYE to my Watch List more than two weeks ago because of I like what I see in the company’s restructuring and turnaround plan. As long-term subscribers know, I like turnaround companies for their explosive stock performances once traders figure out a stock they’ve left for dead is still alive and has since been performing better than the company’s peers.

Last quarter’s 19% y-o-y rise in revenue was a good performance for FireEye, but where the focus of traders should be is in the growth of the company’s services and subscriptions revenue, which soared 37%, y-o-y. As I see it, that’s where rising EBITDA will come from. The cost of making a subscription and service revenue dollar is relatively small when compared with the cost associated with FireEye’s product revenue dollar.

Management’s tactic of placing more emphasis on subscription renewal rates, which now stands at approximately 90%, is precisely what the P/L doctor had ordered. The revenue from this stream is steady, high margin and growing as a percentage of the FireEye’s aggregate revenue, the latest of which is now 20% of total revenue, up 10% from last year. For this primary reason, I believe traders will be surprised at FireEye’s EBITDA for Q3.

Having stated all of this, I still don’t want to pay more than $13 per share for the stock because I’m looking for $17 as an exit price, which calculates to a 30% profit. At $13, I like the risk/reward of the stock much more than today’s risk/reward at $14.73.

I’ll alert subscribers if/when I pick up some shares of FEYE.

ABOUT FIREEYE (FEYE)

FireEye, Inc. provides cybersecurity solutions for detecting, preventing, analyzing, and resolving cyber-attacks. The company offers vector-specific appliance solutions that provide threat protection from network to endpoint for inbound and outbound network traffic that may contain sensitive information.

LIVE VENTURES (LIVE)

As I alerted on Tuesday, September 28, I bought 10,000 of LIVE at $1.76. My exit price target is $2.20, a 25% move higher from my purchase price. And with the stock trading at $1.91 at the close of business Friday, I’m already that much closer to closing out the trade for a 25% profit.

So, let’s get into why I like LIVE at this time.

First and foremost, the stock’s valuation is grossly discounted. How many stocks can you find with growth rates in revenue and earnings per share that reach well into triple-digits, yet sell at a Price-to-Sales of 40.9 cents? The NASDAQ sells at $3.23! And the NASDAQ, so far, shows a contraction in real earnings. Using this metric, LIVE is discounted 87.4% against the NASDAQ. Good grief.

Another metric that demonstrates the grossly discounted valuation of LIVE can be gleaned by the company’s Book Value, which calculates to $1.52 per share. Folks, today’s profitable companies don’t trade at pennies above Book Value unless the company appears to be a few quarters away from bankruptcy. And not only is LIVE nowhere near bankruptcy, insiders are buying stock at rates I haven’t seen in awhile.

At 50.1% of LIVE’s outstanding shares owned by insiders, it stands to reason, that if those most familiar with LIVE’s prospects have sought to own half the company equity then I want to own some shares for myself, too.

LIVE CEO, Jon Isaac, bought stock in April at $1.58 per share in the open market, the first purchase in two years. And get this: how many companies NOT trading as a pink sheet or OTCBB pay a director in stock instead of cash each month? Richard Butler, a director of LIVE, has just this arrangement with the company.

And it gets better. Not only is management buying shares, the company is buying shares, too, authorized in a stock buyback program. In April, LIVE announced it bought 53k shares under the program at an average price of $1.50 per share. On August 15, stock purchased totaled 180k shares. With another $7.5 million in the share buyback program remaining, and at today’s $1.91 share price, the remaining $7.5 million of the original $10 million represents approximately 25% of the company’s market capitalization!

As I write this report on LIVE, I noticed 5.56% of the company’s stock is presently sold short. The percentage is low, but I find it comical. Why? Earnings are expected to be released in mid-November. So far this year, each earning call jolted LIVE in price by at least 50% leading up to and into the last three earnings calls (chart, below). I’d really like to find these short sellers and nominate each of them for this years Darwin Award.

And to make the report on LIVE more complete, I should also mention the company’s plan to pay down debt, not that it is necessary, in my opinion. On June 21st, the company initiated a sale-and-leaseback “construction” with its subsidiary, Marquis Industries. The construction includes a $10 million cash transfer to Marquis in return for a lease, payable each year in the amount of $960k per year for the next 15 years. The interest rate calculates at CAR of 2.25%.

“Approximately 70 percent of the proceeds [$10.08 million] of the transaction will be used by the Company to pay down debt,” LIVE CEO, Jon Isaac, stated. “The transaction will also enable Live Ventures, the parent company, to freely utilize cash flows generated from Marquis, including to pay dividends to Live Ventures”

THE PLAY:

As we move into November, I anticipate another rally akin to the rallies leading up to three previous earning calls of this year. To be conservative with this play, I’m looking for a 25% rally to close out my position. If my instincts are working at full capacity, support for the stock should come within a price range of $1.50 and $1.70, a level at which the stock may never trade into mid-November.

I may accumulate more shares of LIVE. I’ll let you know.

ABOUT LIVE VENTURES (LIVE)

Live Ventures Incorporated is a diversified holding company with several wholly-owned subsidiaries and provides, among other businesses, marketing solutions that boost customer awareness and merchant visibility on the Internet. They operate a deal engine LiveDeal.com, which is a service that connects merchants and consumers via an innovative platform that uses geo-location, enabling businesses to communicate real-time and instant offers to nearby consumers. In addition, they maintain, through their subsidiary, ModernEveryday, an online consumer products retailer and, through their subsidiary, Marquis Industries, a specialty, high-performance yarns manufacturer, hard-surfaces re-seller, which is a top-10 high-end residential carpet manufacturer in the United States.

Trade Green!

Jason Bond

0 Comments