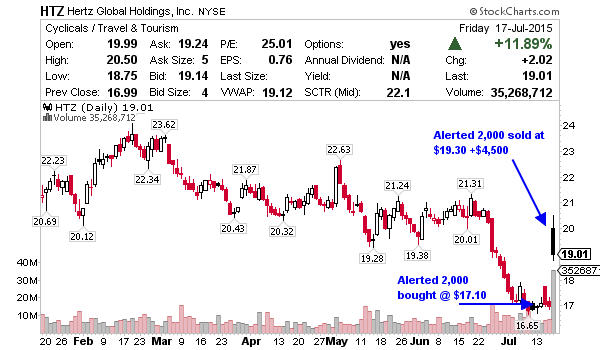

Good morning. Huge score on HTZ last week buying at $17.10 on Tuesday and selling at $19.30 on Thursday for nearly +15% +$4,500 profit. The portfolio is now green since inception up about +$1,000.

Welcome to all the new clients, let me reiterate, the main focus of this passive swing and long term trading newsletter is FLEXIBLE entries and exits. I’ll be targeting trade ideas in which you A) have plenty of notice and B) don’t need to be chained to your computer to follow.

I target small caps, mid caps and large caps so disregard price in this newsletter, just know the goal is still 5 – 20% for passive swings, more for story stocks and true long term plays. I like about $30,000 in a passive swing, less if it’s a story stock or true long term idea.

Most of the time we’ll be passively swing trading. This means we’re looking for those 5 – 20% profits on trades, like HTZ above, but don’t care if it’s in 1 – 4 days. Again, the main focus is FLEXIBLE entries and exits. If it takes 10 days for a stock to give us 10%, we’ll sit and wait that long. That’s the key difference between this service and my active day and swing trading service, in which I’m looking to score in 1 – 4 days which means more volatility.

From time to time we’ll stumble upon an amazing story stock or excellent long term hold, as you’ve watched in the video lessons. Those will be identified as such during the alert, so you know how they differ from the normal passive swings.

I do 1 watch list a week either on Sunday or Monday morning. Then as the week goes on I let you know what I’m about to buy and where. Then when I buy, I alert it in real time by email and text.

That’s all for now. Let’s keep piling up the wins.

JNUG – Gold is down big again Monday morning on news Chinese reserves aren’t as big as Wall Street expected. This will make 5 days in a row and a buying opportunity at some point this week. Currently -12% in the premarket I’m watching for initial entry after it stabilizes on an intraday chart meaning a base.

ERX – We nailed the bounce on energy last week and I do believe it’s time to start scaling in again around $44. I’ll look to start in with about 500 shares again and built to 1,000 looking for profit around $48 – $51.

HTZ – The long term outlook of this company has changed based on the recent news. I scored nicely last week and would like to get back in around $18 if it comes in a little. I’m fine chasing it up too and then scaling in lower. If I go with the latter plan, I’ll start in with 1,000 shares.

This is actually a question regarding the July 27 watch list, which isn’t posted here yet.

When you say entry and stop loss is “at the pivot “, do you mean the stop loss is 2.15 or 2.70 (pivots on the chart) or a trend line from 2.70 and the following low? Exit is 3.50?

Thanks.

Great question. Stop loss at a pivot is based on the video lessons oversold, continuation and breakout. The pivot is the candle or base I’m buying just above, which affords me an identifiable stop loss area, tight to my entry, which keeps stop losses small.