Good morning!

No matter what economic data prints, stocks continue to rise. Unexpected weakness in U.S. retail sales and disappointing consumer confidence along with another drop in U.S. productivity and further signs of a slowing economy in China were ignored by traders of stocks this week. For the week, the DJIA closed at 18,576.47 (+0.18%), S&P 500 at 2,184.05 (+0.05%) and NASDAQ at 5,232.90 (+0.23%), all record highs, reached simultaneously for the first time since Dec. 31, 1999, led by the NASDAQ’s seventh-straight weekly gain.

No doubt, oil’s biggest move since the week of April 22 helped bid stocks. After reaching as high as a $44.78 per barrel, West Texas Intermediate Crude (WTIC) stood for delivery on Friday at $44.49, up $2.69, a 6.44% move. The catalyst for the rise in WTIC came by way of Saudi Arabia, who, after insisting the Kingdom wouldn’t responding to lower global crude demand with production cuts, is now undergoing a change of heart. Following the news of Riyadh’s overtures, oil and stocks immediately attracted more bids than offers.

The VIX responded in kind as well, with the index of perceived risk of owning stocks barely budging from its remarkably-low reading of sub-12 points (11.55) for the third straight week. We have to go back to late June of 2014 before we find another consecutive three-week sub-12 reading of the VIX.

Back then, it took 15 weeks before stocks corrected 10%, in October, following the June period of complacency. Before reaching October’s 10% drop in the S&P 500, stocks rose an additional 1.3% before correcting and resuming the bull rally (see chart, below).

Chart notations:

1) S&P 500 reaches 1,985.44 in late June 2014 concurrently with the third straight VIX reading of below 12.

2) S&P 500 reaches 2,010.40 by mid-September 2014, a 1.3% move higher.

3) S&P 500 corrects 10% to as low as 1,820.66 in mid-October 2014

Two years later, the same set-up appears. Do we repeat?

Among my subscribers are index traders, many of you, who need to ask a simple question. Is a long position at this stage offer good odds?

Of course, we’re in an election year and a highly cooperative Fed, but preventing a correction may be a lot easier for the Fed than raising stock valuations further into an already overstretched market. And this doesn’t include the unseen “black swans” flying around. My gut doesn’t like the feeling of record highs and a three-week VIX below 12.

Or, are we to assume the White House has instructed the Fed to goose stocks much higher in the months leading up to the November election, causing the Republican presidential candidate Donald Trump to look foolish in late October after his negative comments about stock valuations in July?

Vision of a moving steamroller while investors snatch pennies from the approaching roller comes to mind. Maybe it’s time to stick with my picks and leave the index portfolio idle for a while. In fact, an addition to the billionaire’s row of market players, David Tepper, has joined Peter Druckenmiller, Jeff Grundlich, Bill Gross, Carl Icahn and George Soros this week as the latest “nervous Nellie” of investor capital. Source: David Tepper Catches Bearish Billionaire Bug: Cuts Long Exposure By A Third; Liquidates All SPY, QQQ Calls

I, too, am a bit nervous about the valuations of the major indexes and remarkable complacency among market participants, and am staying with my researched of exceptions to index trading until, either we see a break in the market to the downside or get an announcement from the Fed of another signal of easing soon. But so far, the Fed is playing a game of “good cop, bad cop” with its communiques.

Other action in markets this week included a smash in the gold price on Friday by the Bank of International Settlements (BIS), whose $5 billion market sell order during the European aftermarket tamed another rally back to a nearly-unchanged week.

Rumors circulating this week of an International Monetary Fund announcement scheduled for Sept. 30., the subject of which pertains to details of the Chinese yuan inclusion to the Special Drawing Rights (SDR), may have added to the fuel of a gold rally. After tracing the source of this latest chatter back to financial author Jim Rickards and one of his promotional emails, I wondered to myself why Rickards would risk his well-earned credibility in this way. If he’s wrong, I suspect he won’t be selling too many books in the future.

Okay, back to the market wrap up.

A curious dichotomy this week can be seen in the big move higher in the oil price and Deutsche Bank (DB), while the U.S. Treasury market rallied along with a strong appetite for 30-year Treasury bonds by central banks. The WTIC price spiked the most in four months; DB spiked as well, by $1.10 (+8.37%), but the yield of 10-year U.S. Treasury note drops eight basis points along with the steepness of the yield curve (10-year note rate minus two-year bill rate), as the latest flattened by the same amount, eight basis points, this week.

Are the Saudis cooperating with the U.S. to relieve pressure on the banking system by raising oil prices? The biggest threat to the banking system is the Ponzi-like scheme is the oil market; so everyone says. And I cannot counter that argument, especially when all it took to crash global stocks was a hiccup at a much, much small financial institution, Lehman Brothers, in 2009. And we do know Deutsche Bank’s $60 trillion of derivative bets include bets on oil industry paper.

Or is a deal coming from the White House?

Or is Saudi’s new regime playing tough through media to show the financial stress of a weakening balance sheet at the Kingdom doesn’t hurt?

In any event, the timing of this “rethink” by the Saudis comes at a fortuitous time for the White House and Fed.

Now, for a the mailbag. “Stan the Man” from Liverpool, U.K. writes:

Q: Do you think the Fed will eventually catch up with Japan’s negative interest rate policy?

A: Good question, Stan; it’s the $64,000 question. Isn’t it? My short answer is: yes.

If the U.S. bond market allows a Japan-like monetary policy, then the Fed has room. But we have to remember that 61% of global forex reserves are held in U.S. dollars. The Japanese yen represents only 6% of central bank reserves. The question is: will global markets tolerate paying the U.S. Treasury for the privilege of holding U.S. dollar-denominated securities. I doubt it.

So, as long as the 10-year bond rate doesn’t skyrocket due to a proverbial dollar strike, stocks are supported by the yield advantage of higher-yielding blue-chip stocks over U.S. sovereign debt yields.

Billion of dollars of pension funds must go somewhere, Stan, and blue-chip stocks have the advantage of yield and direct support from several central banks. For now, I’m just waiting for a better entry point before my index trading account becomes active again.

Okay, let’s move on to an update to my trading activity this week.

This Week’s JBP Stock Ideas

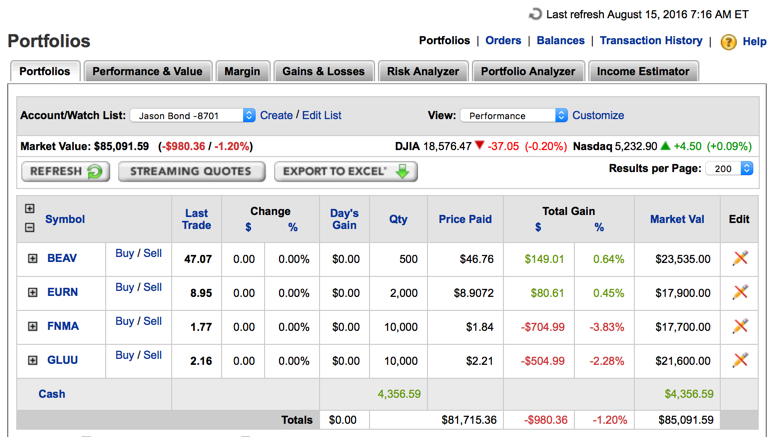

As I noted in an Alert on Tuesday, in order to move my account to a new E*TRADE, I closed my positions in EURN, GLUU and FNMA. I initiated long positions in those stocks at prices of $8.91 (2,000 shares), $2.21 (10,000 shares) and $1.84 (10,000 shares), respectively, in the new E*TRADE account, totaling $86,000, including purchases of the three stock positions.

The additional account for my long-term trades followed research of various platforms and services offered by the several big names in the business, and I chose the provider who offered the best of those features most valuable to me: E*TRADE.

So, now I have two E*TRADE accounts: one for swing trades, the original account, and a new E*TRADE account for my long-term trades. I had to take into consideration commissions and, at my tax bracket, tax obligations. These two accounts simplify my life in addition to the ease of tracking my long-term portfolio. And who couldn’t use that?

And as I also noted, I intend to carry no more than five open positions, with an expectation of holding no more than three long-term trades and two swing trades at any time. I also expect to step up the number of trades in my swing account, so let’s look forward to that bit of good news for subscribers.

And believe me, I’m as anxious as you are to get into fifth gear on my swing trades. I know some hardcore “traders” who are presently going through withdrawal symptoms from limiting their exposure to this discombobulated market. This is temporary; I assure you! Fortunately I’m not wired for this particular hazard. I’m no gambler; I’m a professional trader.

B/E Aerospace (BEAV)

In my Friday Alert, I notified subscribers of my purchase of 500 shares of BEAV at $46.75. This is a new stock idea for subscribers, so let’s get into the details of this trade.

ABOUT

B/E Aerospace is the world’s leading manufacturer of aircraft cabin interior products. B/E Aerospace designs, develops and manufactures a broad range of products for both commercial aircraft and business jets.

OVERVIEW OF HOW CALL OPTIONS WORK AS A PROFIT STRATEGY

Stocks have characteristics, like people have. In the case of BEAV, the stock has a “trending” characteristic to the stock’s moves, has low relative volatility within the trend, and pays a dividend. The stock is more of a “steady Freddie,” with a less highly speculative nature among most shareholders. The characteristics of BEAV are suitable to execute an options strategy of selling a call option against the stock.

Selling a call option works bests with a solid growth company, a positive trend combined with the potential to grow steadily further, but is not likely to jump up and down during a short term horizon (volatility). These companies attract long-term investors, especially when a dividend is paid by the company. B/E Aerospace is such a company.

Contrast those characteristics of B/E Aerospace with a typical small cap biopharmaceutical. Small cap biopharmaceutical stocks typically don’t trend well, are very volatile, and pay no dividend. If an option was available to play a small cap biopharmaceutical, I assure you the call premium would be exorbitantly high due to the underlying volatility of the stock, a presumably small float, and the highly speculative nature of the traders involved in the stock, especially when the stock also has a high short ratio to the float, suggesting the possibility of a violent short squeeze.

HOW CALL OPTION WORK

Traders who buy a call option are placing bets the stock will rise; but, instead of taking an outright position in the stock, such as buying 1,000 shares, a “premium” of x-amount of dollars per 100 shares is paid to the seller of the option. The seller of the call believes the stock price won’t rise in an amount beyond the premium paid by the buyer for the option AND the stock price won’t rise enough points beyond the strike price within the expiration date of the option. So, the buyer of the call option must be correct on direction AND time to profit, otherwise he loses his premium as his total loss—and no more.

The seller of the call receives the premium and adds that amount to the total return on his shares, assuming the call expires worthless.

In the case of my long position in BEAV, I’m taking the other side of the buyer of the call option by receiving his premium. I’m the seller of the option. The seller of a call option, who also owns the underlying shares, is executing a “covered call,” which I intend to execute.

If the underlying stock trades at a market price above the strike price, the option is referred to as an “in-the-money” call. At that point, the buyer of the call has the option of collecting the proceeds from a higher premium price for the call, just like he would a stock, or he may receive (call in) 100 shares for each option he purchased.

In my case, to avoid giving up the shares at expiration if the trade goes against me, I would unwind both my share and option positions. That is: I would sell my shares and buyback my option. If the option becomes in-the-money, I would make money on my long position in the shares and lose on my options position, the net result of which usually nets to zero, excluding commissions. But I retain the premium, nonetheless.

In the above example, my risk is very low and limited, but my return is also capped at a low profit as well. In contrast, the buyer of the call takes almost all of the risk, but if he’s correct with direction and time period, he scores large because of the leverage involved in the trade.

If you’re interested in getting involved with covered calls, a more detailed explanation can be found in an Investopedia video here.

BRIEF BACKGROUND OF B/E AEROSPACE

In the recent second-quarter earnings call at the end of July, B/E Aerospace reported an increase of 7.0% to revenue for the second quarter, an increase to operating earnings of 7.9% and an increase to EPS of 12%. Guidance is very favorable.

In addition, the company has instituted a share buyback program, and pays an annual dividend of 1.74%. The stock’s P/E ratio is only 16.23, which is low compared with some of its competitors, e.g., United Technologies (UTX) of 24.56.

See earning slideshow here.

The business fundamentals look good and, as I stated, guidance is also good. The company’s total backlog of orders (slide 2) is currently $8.9 billion. This is a huge amount, considering Q2 revenue was $755M. This backlog is worth nearly three years of revenue, less cancellations, of course.

TRADING STRATEGY

The company’s ex-dividend date is August 11 (just past), when I expect a sell-off due to willing sellers waiting until the ex-dividend date to receive a dividend before selling. And as planned, the sell-off on Aug. 11 was enough for me get in at a much better price, $46.75. I’m already up 32 cents on the trade.

At the moment, October calls sell for 90 cents per 100 shares at a strike price of $50 per share. Roughly calculated, the option presently returns approximately 7.2% per annum.

And lastly, I expect a run-up in the stock price leading into Q3 earnings, which is scheduled just after the expiration of the October call.

Trade Green!

Jason Bond

0 Comments