Up over 30% in 2013 despite the volatile market of late I know where to shop for trades.

Here’s a handful under $10 that came up on my nano – micro cap scans Wednesday night.

Join us in chat for more action.

All swing trade alerts by email, text and chat in real time.

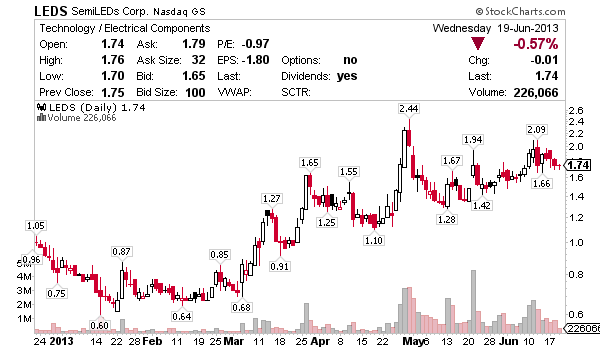

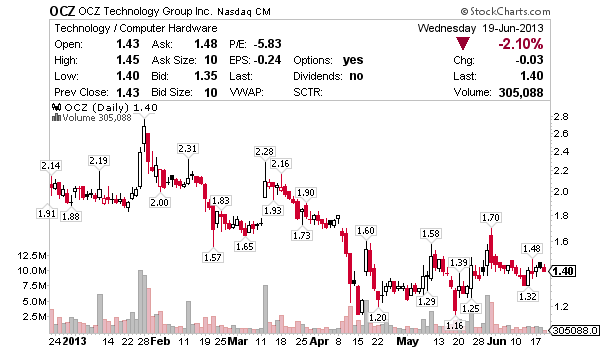

Favorites are OCZ and LEDS, but be sure to take into account U.S. stock futures are crashing premarket so no early moves for me.

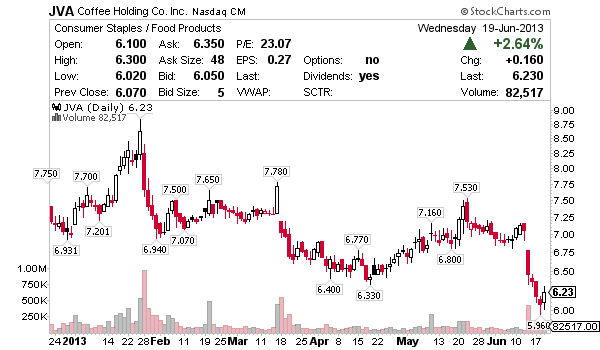

JVA – Candle over candle with range to $7. Entry is above $6.20, stop is below… chop at $6.40 profit around $6.80. Light volume trade, size accordingly.

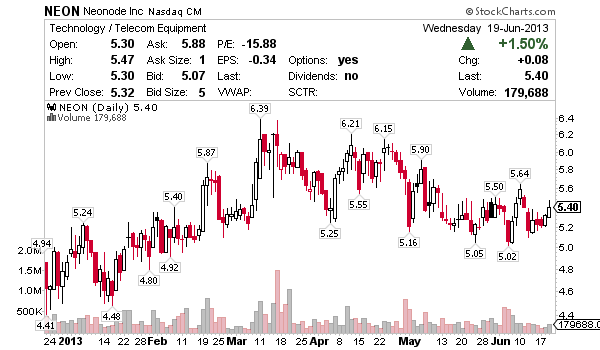

NEON – Up on a down day with good news. Entry is above $5.25, stop is below… if this breaks $5.46 it should test $5.70, chop and push $6.

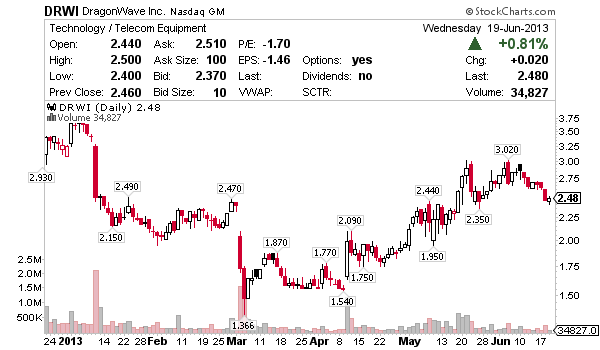

DRWI – Just above 50 and 200 Moving Average support entry above $2.44, stop is below… swing for a break of the 20 Moving Average.

LEDS – Like the higher lows here in the overall trend. Entry above the 20 Moving Average $1.68, stop is below… swing to $2.10, chop and I think a breakout is coming. Take at least half at resistance.

OCZ – Looking for entry around $1.40, stop is $1.35… swing this long for the filing news, though not for the faint of heart, should be volatile.

@ Jason- Are you strictly trading penny or under 2 dollar stocks? If so, and I want to join your group learn your trading system and follow your trades, should I sell off my current my holdings which is down today but up over all. I would be selling off minimally 200k? I have been adding stop losses all morning.only a few have kicked in. How much would you think I should start with? I am not a day trader and started with $600 and added a 40K IRA which I have turned into almost 500K minus the 15% we have lost in this most resent down turn. Some of this is held within an IRA’s so I am tying to monitor 4 accts. in all and find it overwhelming.My MSFT stop loss just kicked in and sold off everything but fractional shares. Who do you recommend we trade with?

Dave

Hi Dave, no we’re mostly small – mid cap stocks with the occasional nano – micro cap trades. We focus on liquid meaning $1,000,000 or more volume on the day NASDAQ, NYSE and AMEX between $1 and $10. Stocks like ACI, ZNGA, GRPN, MM, MCP etc… best to use TOS paperMoney $100k account while learning my system and then you can apply your real money trades once you see how I operate, based on the size portfolio you have I think you’ll like JBP.