LeapFrog Enterprises Inc. (LF), a developer of education entertainment for children with a portfolio consisting of multimedia learning platforms and related content and learning toys, recently reported strong third-quarter financial results.

However, shares of the Emeryville, California-based toy maker fell nearly 15% in the next two trading sessions.

Given LF’s strong results and the fact that the company raised its full-year forecast, the sharp drop in LF shares is not justified. However, the sell-off has provided investors with an excellent entry point.

Strong Q3 Results

On November 5, LeapFrog Enterprises reported a profit of $41.7 million, or $0.60 per share for the quarter ended September 30, 2012, compared to $23 million, or $0.35 per share reported for the same period in the previous year. Excluding one-time items, LF’s earning for the quarter were $0.51 per share, beating the consensus forecast of $0.42 per share.

Net sales for the third quarter jumped 28% to $193.1 million, beating consensus forecast of $174.2 million. The increase was driven by sales of LF’s new products and strong demand for LeapPad line.

CEO John Barbour last week said, “This summer, we introduced LeapPad2, the next generation of the #1 kids’ learning tablet. In a very competitive tablet market, LeapPad2 has already won many accolades, been featured on every major top holiday toy list and is a top-selling product in key retail layaway programs.”

Full-Year Outlook Raised

Following the strong quarterly results, LF also raised its forecasts for the full-year. The company now expects net sales for the full-year to be between $535 million and $550 million, which represents an increase of 18% to 21% from the previous year. LF had previously forecasted an increase of 13% to 15% in full-year net sales. Earnings for the full-year are expected to be between $0.75 per share and $0.81 per share.

According to CFO Ray Arthur, the company has good momentum heading into the holidays. Arthur cited strength of LF’s third-quarter results, retail point-of-sale trends and inventory position as the reason for raising full-year forecasts.

Preparing for the Holiday Season

LF is well prepared for the upcoming Holiday Season. Arthur noted during the company’s conference call last week that the company’s inventory balance at the end of the third quarter was up 64% compared to last year. This will help the company immensely as it heads into the all-important Holiday Season. The company also expects its advertising expenditure to rise 20% to 25% in the fourth quarter.

LF is certainly doing all it can to boost its Holiday Season sales. The company is increasing its advertising expenditure in the fourth quarter. However, I don’t expect the increased expenditure to have an impact on LF’s bottom-line. LF, I believe, has been conservative with its sales guidance for the full year and I expect the company to easily surpass it, considering that the company is well-positioned ahead of the crucial Holiday Season.

The only worry is that the uncertainty due to the looming fiscal cliff may have a negative impact on the Holiday Shopping Season. Having said that consumer confidence has been rising and there has been an improvement in the labor and housing markets. Therefore, we may still end up with a robust Holiday Season despite the looming fiscal cliff.

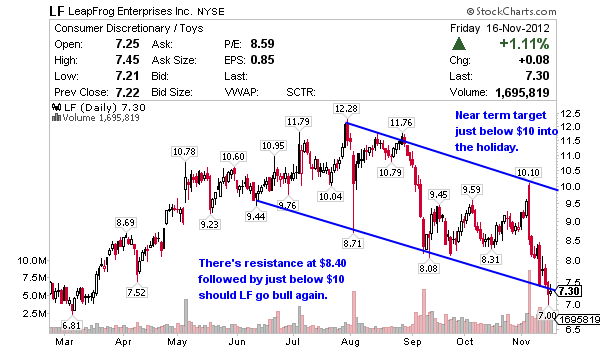

Sell-Off Offers an Excellent Entry Point

Given all the positive factors, the sell-off in LF shares following the release of third-quarter results is not justified. Part of the sell-off may have been due to the fact that investors were disappointed with LF’s guidance last week.

LF’s consolidated net sales for the first nine months of 2012 were $336.6 million. This means that even at the high end of company’s latest revenue guidance for the full year, net sales for the fourth quarter would be $213.4 million, which is nearly flat compared to the fourth quarter of 2011 when the company reported net sales of $210.21 million. Also, earnings for the fourth quarter at the high end of company’s guidance would be $0.46 per share, compared to $0.49 per share reported for the same period in the previous year.

However, as I noted before, LF has been cautious with its guidance. Given the popularity of the LeapPad 2 and the fact that the company has built higher retail inventory of LeapPads before the Holiday Season, sales could easily surpass expectations.

The sell-off in LF shares was exacerbated by the sharp decline in the broad market due to concerns over the looming fiscal cliff.

However, the sharp drop has made LF shares attractive. LF is trading on a P/E ratio of 9.42, compared to Hasbro Inc.’s (HAS) 14.14, and Mattel Inc.’s (MAT) 14.72.

LF is an attractive proposition at current level, given the company’s potential, and the recent sell-off has provided an excellent entry point.

Disclaimer: I am long LF

Fast forward 12 hours and LF is up 8.22%! Great find, JB!

Thanks PI. Bull markets make all the difference.