As the financial media steers the retail investor to focus on the major averages, an undertow of smart money positions for the next major move in the all-but-forgotten precious metals (PM) mining sector. And when the next bull leg in PM mining reaches the radar of CNBC and Bloomberg, the lion’s share of the move will have already taken place.

We believe this JBP Special Alert will become the next hard example of the additional value a subscription to Jason Bond Picks brings to the marketplace.

Rationale to this Special Alert

Today, the dynamics which drive the PM mining shares are now all in place for the long-awaited next leg in the bull market of PM shares. Premature calls for a market bottom in the PM miners have been devastating to those investors who heeded the call, and chased every weak hand from the sector thereafter as the presumed low got even lower.

As a result, sentiment, as well, has been so low for so long since the 2011 ‘crash’ that many latecomers to the gold market during the summer of 2011 won’t be back again (if ever) until the excitement starts anew.

We believe the bottom in the PM shares is in, and McEwen Mining (MUX) will be the odds-on favorite to outperform the S&P by a country mile in the coming months, and even blow away the performance of even the most explosive of all ETFs, the Market Vectors Junior Gold Miners (GDXJ).

The underlying fundamentals of the gold market have been discussed to the point of nausea. Money printing, a fragile global banking system, and the ruinous fiscal policies of the United States and Europe have conspired to provide a compelling reason for investors to ‘hang in there’ for the longer-term.

But for more then two years now, the $64,000 question has repeatedly been: When will the fundamentals of the PM mining shares finally translate to higher stock prices?

We make a strong case that the answer is: NOW. Sentiment could change rapidly, and for a much longer period of time than most now think.

Here’s Why

Firstly, the turn of events in Iraq (and the implications thereof) may not be fully appreciated by casual observers of the geopolitics of the Middle East. In recent days, the Islamic State in Iraq and Syria (ISIS) militants have embarked on what appears to be a 21st century version of a Blitzkrieg, shocking policymakers in Washington, Brussels and others of the western alliance as to the sudden threat to world oil supplies. Within mere days, ISIS forces have taken over two of the nine oil refineries in Iraq. What was touted by the United States as a functioning Iraq appears soon to be a country which is anything but functioning. Listen to the analysis of a disturbing potential for rapidly rising oil prices (at TruNews Radio).

On Jun. 13, the price of West Texas Intermediate Crude (WTIC) has now reached the threshold of another breakout, and at precisely the most inopportune time. Recent signs of a global slowdown in economic activity in the United States, Europe, China and SE Asia cannot withstand a bout of higher energy prices at this time. We believe that the Iraq situation will be in the future looked upon as the catalyst for the resumption of the PM sector.

Below, find a chart of gold price as a ratio of the (WTIC) price. The chart suggests that the gold price may substantially outperform the oil price during the next bull run in both ‘commodities’. At the extreme of the intermediate bull move we forecast, gold could reach as high as $3,000, and $150 for a barrel of WTIC. In other words, a 50% move higher in the price of oil (implied weak Petrodollar) could soar the gold price (anti-dollar) by more than 100% (20:1) in the coming months.

Dan Dicker, author of Oil’s Endless Bid, told Yahoo that Iraq’s oil production is in imminent danger, and that production shortfalls from the war-torn nation could result in a slashing of already-tight global supplies.

“We’ve waited quite a long time for Iraq to get to this production level,” said Dicker. “The demand profile continues to increase and there’s no question that prices will rise in the long term.”

Dicker expects the oil price to reach at least $130 per barrel by 2015.

Until then, we believe that traders will take WTIC prices up further to test the high of $147.27 set on Jul. 11, 2008.

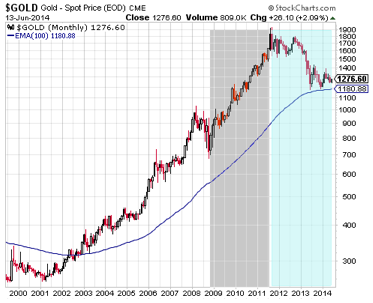

Gold Market Cycle Reaches Nadir of the Cycle

Secondly, cycles analysts have recently alerted us to the fast-approaching cycle low of the gold market. They say that the duration of the correction will approximate the 33.5-month run-up in gold prices during the November 2008 – Aug. 2011 rally. If we add 33.5 months to the beginning of the correction in August 2011, the expected bottom will be during the month of June 2014, or as late as early July, depending upon the precise definition of when the previous cycle began and ended.

The chart, above, shows the shaded area (gray) of the last major bull run in the gold price. The shaded area (light-blue) highlights the predicted 33.5-month cycle period in which the bear market in the gold price will end.

If We Are Correct in Our Forecast, Why Choose MUX?

In our SeekingAlpha article of Apr. 16, McEwen Mining: Best Performing Stock Of Any Junior Producer, we demonstrated MUX’s superior share-price performance against other junior mining stocks, both during bill markets and bear markets. At this time, we see no material reason to change our pick for the best performer within the junior mining sector.

McEwen Mining management, headed by former-CEO of Goldcorp and McEwen chairman, Rob McEwen, ranks among the best of the sector. McEwen’s tenure and performance at Goldcorp (GG) are legendary. After taking the once-tiny Goldcorp from a collection of junior mining companies ($50MM market cap) to a major producer ($20B market cap), McEwen is often cited as one of the very best in the business. Under McEwen, Goldcorp had achieved a compound annual growth rate in the share price of 31%.

McEwen reports no debt on its balance sheet, and has grown production and reserves each year since the collapse of Lehman Brother of 2008.

The additional critical information not contained in our article of Apr. 16 include McEwen’s penchant for preparing for rapidly increasing production during bull-market runs. At Goldcorp, McEwen seemed to have a knack for timing peek production and sales during bull rallies, and conserving reserves during pullback periods.

With no debt to service, McEwen has allowed himself flexibility to leverage the company’s balance sheet at almost any time.

Another option that McEwen has is acquisitions. If we are correct in our forecast of $2,000+ gold by 2015, McEwen will be in a position to acquire other junior mining companies whose balance sheets are far less healthy. And after nearly three years of declining PM prices, many junior mining companies have sunk to near-bankruptcy. McEwen Mining could easily initiate a debt offering to acquire other juniors.

In all, we suggest that McEwen Mining deserves your attention.

0 Comments