I’ve always pitched my service as being scalable, so when a hedge fund client reports a $350,000 win and makes a comment like he did below, I’m inclined to share it. For obvious reasons I’m not going to disclose his fund but one thing is for certain, it’s proof this system works and how we worked this trade is what’s most impressive.

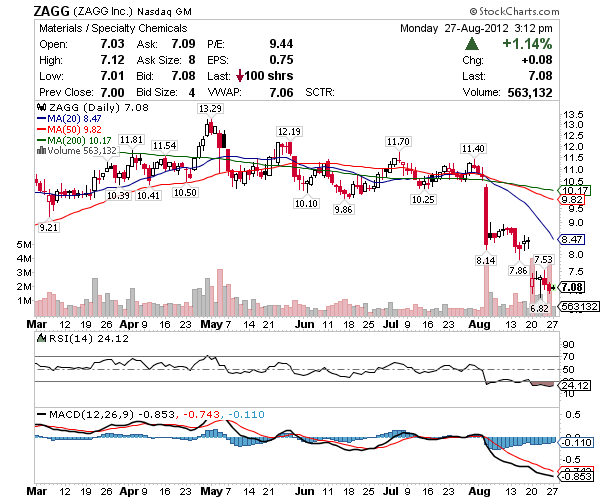

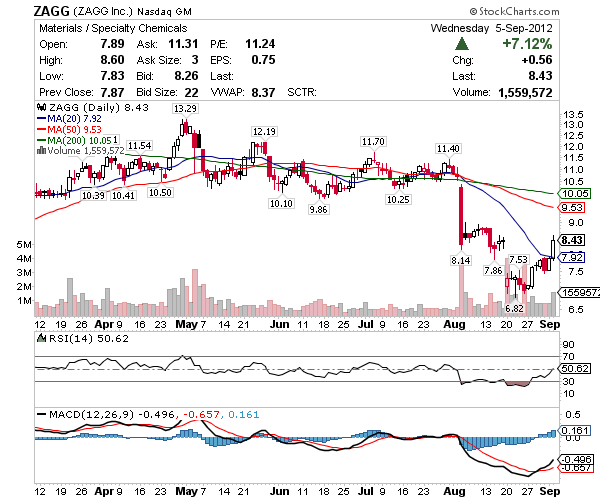

History… on Monday August 27, 2012 at 3:09 p.m. EST I issued the report seen below to my premium clients. My position at the time was 5,000 shares at $8.30 and 100 Sep 22 ’12 $7 Calls at $.50. The chart from that day is also seen below. Shortly after I bought another 2,500 shares of ZAGG stock. Today I cashed in my trade for almost $10,000 profit. What I’m most proud of here is not selling my family out that Friday evening when I had the chance. Instead I stood my ground and it paid off big for me and bigger for this client who I’m proud to be associated with.

I admire your patience on ZAGG – most traders would have bailed. Hopefully your steady influence kept many in the game as well. We rode it out for over a $350,000 profit. Good advice on your part. ~ Jim S. (Hedge Fund)

Best day I have had with you JB +1,400 in ZAGG, thank you very much! ~ Wendell J.

Lock up ZAGG for $4,700 total. ~ Chris L.

I took profits on my 75 ZAGG contracts yesterday for $2,860. Thanks Jason. ~ Jeff F.

JB thanks for ZAGG, out +$5,100 ~ Ryan S.

On Monday August 27, 2012 at 3:09 p.m. EST I issued the report to premium clients…

“Friday August 17 I was sucker punched holding 5,000 shares of ZAGG at $8.30 when the company announced the CEO was stepping down after hours around 4:30 p.m. EST and didn’t give a reason. I was at my computer when this went down that evening and while there was a bid for me to exit at $8.20 with a small loss, it meant clients would be buried Monday. Bailing on clients after hours on news like this to save myself is not my style, to me that’s like the captain who jumped off the cruise boat before he got his passengers off. I immediately decided to fight this one out across the coming weeks, even if it meant taking a loss. Several days later the company indicated the CEO stepped down because he was hit with a fairly large margin call and was forced to unload over 500,000 shares around $8 the week before… which brings us to today.

In the past I’ve had success swing trading ZAGG. Prior to this crap they pulled I happened to like the company, now I am on the fence. Up $.20 per share into Friday’s close on the 17th, Monday’s open put me down about $1.20 per share, with no option to stop out that morning due to the gap, I’ve been grinding it out since. So here’s why I’m sticking with ZAGG into Tuesday’s conference call and swing long into the fall. I do believe I can turn a profit on this dog, despite being buried right now.

First of all, the original reason for entering ZAGG was video lesson #1 and my history of winning on this trade out of oversold back on 12/29/11, the previous winning swing. We’d been testing the oversold waters on ZAGG a few times prior to Friday’s close and had locked a small win from the August 7 – 14 or $550 profit.

I like ZAGG because of its volatility with a Beta of 2.34 and a market cap of $215 million – it can produce big swings in either direction based on those numbers. When the company announced the CEO was stepping down they also confirmed guidance. To me this suggests there isn’t any fraud or that would have been the time to announce it. Basically the company had the opportunity to issue lower guidance when the CEO left… and they didn’t, so either we’re going to see them all get put in jail for fraud, or the company has some value. When you look at the forward P/E right now ZAGG is trading very cheap at just 8x the next 12 months earnings.

The upcoming catalyst for iPhone products and distribution channels are good. And while not too significant, Joel Greenblatt’s Gotham Capital has a small chunk of their portfolio or $1 million in stock, so while I would not make too much of it, it’s good to see they added a new position. Technically we’re buried in oversold status right now with the momentum starting to get under the trade. If things go well at the conference call I’d fully expect to see some bids and ZAGG trading in the $9’s into the fall. Those are my reasons for sticking with ZAGG. I have 5,000 shares at $8.30 and 100 Sep 22 ’12 $7 Calls at $.50. Over 30% of the float is short here and we’re already oversold, so if I’m right it should squeeze nicely.”

TODAY’S CHART!

I want to thank Jim, Wendell, Chris, Jeff, Ryan and everyone else who stuck it out with me and locked up some serious CHEDDAR on this trade! Hate to say it but it’s so true, when the market tosses you a lemon, squeeze shorts and make lemonade!

0 Comments