I’m not sure if you’d call it lying… or simply no disclosing the full truth.

See, I’m not the Wall Street fat cat I portray daily to my 71,891 Facebook friends.

I’m not rich and I’m certainly not the best trader on Wall Street.

Truth is, a few years ago I was really struggling to get by, embarrassingly something I wrote about here & here.

Weighed down by a mortgage, student loans, car loans, personal loans, a home equity loan and more, I was honestly living paycheck to paycheck.

Before I left public schools in 2011 I remember teaching all day, coaching varsity boys and girls cross country, supervising the districts high school football game and as embarrassing as it is to share, when everyone left including the other supervisors, (my colleagues) I’d pick soda cans out of the garbage cans and return them to Wegmans to put gas in my car.

Here I am with a Masters in Education, working 3 jobs and picking cans. I’ll be honest, it wasn’t what I had in mind, but it was my reality.

I hit a low when I called my wife one Friday night after supervising a high school football to come help me collect the cans, she was stung by a bee.

I remember her saying, “Jay, what the &^%$ are we doing!” I knew that that meant, every husband knows what that means. I love my wife, I was letting her down.

So I started serving tables at Empire Brewery whenever I could in addition to teaching, coaching and supervising events. They were training me to be a bartender until one day I showed up to work and the doors were chained, closed up and hit hard apparently by Eastman Kodak’s failing business.

I had about half a dozen businesses fail and fell sucker to a few pyramid scams including Amway’s Quixtar.

I remember returning a used Brita water filter and VCR to the store to make the mortgage, I lied about not using them, I am sorry for lying about that.

During that time I taught myself how to trade penny stocks. This was actually one of my better ideas when you consider 10% on a $5,000 account is $500. Maybe you’re not aware but teachers in NYS make about $150 / day after taxes. Think of how many cans you’d have to dig out of bee invested garbage cans to make $500.

Don’t ask me where I got the $5,000. It’s horrible. I took a personal loan from the credit union. That story deserves a full blog so I’m not going to start in. All I will say is DO NOT DO THAT! Trust me. If your going to trade, do it with money you’ve made in your profession, I was gambling but didn’t know better at the time. Okay I’m lying, again, I did know better but I made a mistake.

I bought this bed set for my wife with the profit from my first winning trade. Prior to that we were using a blanket from the lost and found we acquired in college. I can’t explain to you how proud I was.

So there you have it. I’m not the Wall Street fat cat I make myself out to look like. I’m a regular guy who was recently broke. I failed at a number of businesses and picked cans out of garbage cans to fill my gas tank.

But through all that I never gave up. I taught myself to trade and make money with money. Trust me, if you ever ran a roofing business in the summer like I did, you’ll fully appreciate that statement.

I paid off all my debt following Dave Ramsey’s plan.

Shortly after that I woke up one morning and told my wife I’d like to take a break from teaching in public schools and teach on Wall Street instead. She put her faith in me which brings me to today, about 2-years later.

Being an entrepreneur is stressful, I eat what I kill. The first year after I left safe and secure teaching in public schools I had regular panic attacks in the middle of the night where I’d wake up, grab my wife’s arm and tell here I was dying of a heart attack. Being in business for yourself isn’t as easy as you’d think. My favorite blogger, James Altucher explains this better… it’s a good read.

No I’m not on ‘Wall Street’ per say, I teach from home using a state of the art web conferencing software which includes voice, screen share, PowerPoint etc… I also use email, text and my blog.

I’m doing the same thing as I did when I was teaching in public schools, the only difference is my audience is no longer children, it’s adults with much deeper pockets who are willing to pay for a strategy that works and helps them. Until you’ve ever run a service, it’s hard to understand how good it feels to earn a strangers trust, respect and teach them how to make money using your strategy.

Take for example this guy, this guy deserves a steak and a beer when I meet him.

I now have clients in more countries than I can name. My classroom has gone from 50 children to thousands of adults. With success has come criticism. People call me a fraud, a fake and a scam. A lot of people who don’t know me write nasty things about me on the Internet. I’d be lying, again, if I said it didn’t hurt my feelings.

Why did this work and my roofing business fail? Because I combined my love for teaching in public schools with a stock trading strategy that works. Add in some hard work and a MUCH bigger audience and there’s a recipe for success. That’s it! I’m the same guy who picked cans out of a garbage can just a few short years ago and not the Wall Street fat cat I’ve been pretending to be.

Yesterday I made $1,404 swing trading part time. Today I made $2,124 doing the same thing or as I like to call it, rinse and repeat. Yes, my strategy is that good… that I’m not lying about. Am I getting rich, no. Will you get rich trading, no. It’s not about getting rich to me and I don’t think it is for my clients either. It’s about the FREEDOM it affords you. Do I have losses, oh my goodness yes. But does a baseball batter swing and miss? A good hitter in the MLB gets a hit 3 out of every 10 at bats.

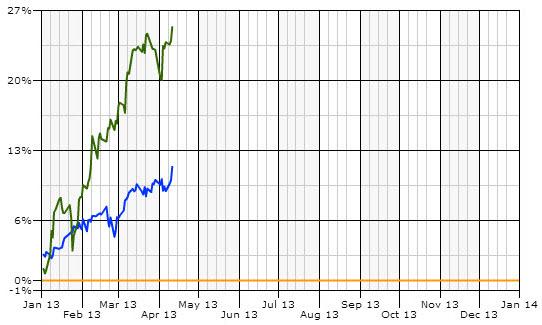

As mentioned above, I teach trading. In 2013 I’m hitting 7.4 out of every 10 trades or to be exact, 55 wins and 19 losses or 74.32%. The portfolio is up 26% in just over 3-months or $84,104 swing trading part time.

The reason I’ve found success is because I’m committed to teaching how I make money with money. In an industry riddled with frauds and expensive strategies, my simple approach to beating Wall Street has attracted thousands. So was I lying, or just playing the part? At the end of the day it’s your call, but what you just read is the truth and I plan to just build on that from here.

If you’re reading this, I feel blessed to have your time. Existing client or soon to be client… Namaste.

Jason, how much investment is required. Since u buu 2000 or 3000 shares for that we need 40 or 50 k. I have only 8k in my ttading acct. Can i learn from u.

Hi Jeff, sure you can learn from me. You don’t need a portfolio to start anyway. Check out what this client did. http://www.jasonbondpicks.com/blog-posts/this-clients-deserves-a-huge-congratulations

If bullshit were electricity you would be a powerhouse

I’m sorry you see it that way.

Hey jackass, show some respect and common courtesy. Typical cowardice response under an anonymous guise. Get a life!!

Jason, I wonder how easy is to follow luke on the day trades. In practice I have seen other chat rooms where day trading is difficult to follow, because when the “teacher” announce the trade, he is already in, and you end up chasing, doing market orders, and losing money. I wonder how can I prevent that?

Mirroring day traders is never a good idea. Instead learn how to spot momentum and capitalize on it, that’s what we teach.

I signed up for your service 2 weeks ago I thought I would give it a try and I for one can say I know you are making money because of your alerts I have made money off of the same trades. Not only that but I have learned a lot from the videos so to anyone who thinks you are full of it I say don’t knock it until you try it because it works.

ok Jason …i ve been recieving your literature for quite some time and i have to ask

you something…..if you are successful, why do you need others ?

I ask this because i do exactly what you do and i make a fair bit of money doing that ..

but i yearn for the day when i can make zillions with my own money and tell the world to..

hhhh hh…!

i am not naive , because i have been managing money since last 25 yrs quite successfully…

none the less….i feel the pinnacle in this business for me is when i dont need others ….

what say you ?

I thought I made it clear that I ‘teach’ trading, did you miss that part?

After a month or so with Jason Bond Picks, it is clear to me that Jason has a genuine passion for teaching others to be successful. John, perhaps when you make zillions with your own money, your feelings toward others will change to a desire to help and give.

Jason,

I’m checking your services out. I do believe that they can be good, even if you would stand to make more money than your followers, by entering the trade sooner than they do. I see nothing wrong with that. It would be really stupid if you waited for your your announcement to enter the trade–no one would profit with that. Also, your followers are adults (at least that is what you would your audience to be) and ignorance (of any of the followers) is no excuse for their failure or success.

BUT, I believe that you would sound really honest if your answer included the amount of money you get from your subscriptions. If each subscriber paid you $100 /month, 1,000 subscribers would equal $100,000 /month. So how many subscribers did you say you have?… 3,000, 5,000, 10,000? Again, I see nothing wrong with that! I congratulate you for making all that money and more, as long as your service is valuable to your subscribers and you’re not deceiving anyone. So, my point is you would sound a lot more honest if you disclosed the whole truth about WHY you “teach.” Respectfully,

I don’t think anyone is confused about how much money I make teaching trading but if you’ll sleep better at night I’ve built this company to a valuation of roughly $100m in 7-years. Now shall we proceed with trading or would you like to know how much money my sports camps made over the summer when I was a school teacher / coach too? Just busting your balls, but seriously, I charge a fee to teach, it’s pretty straightforward stuff here Sal.

WOW! That’s wonderful, Jason! I like your answer. Good deal!

I like “now shall we proceed with trading…” and “straightforward stuff.”

Thank you!

Jason, I couldn’t agree more with your reply. It sounds like it went completely over this guys head.

this is a true testimont on jason bond picks. i too was skeptical. started out at a very small account of 2500 dollars. have been with jason bond picks for 3 months. looked at all the vidoes and learned as much as i could. after 3 months with his stradegies im happy to say i have more than double my account. im happy to pay the fee for his ideas and this web site. he does all the research, which has to be mind boggling, he gives us the stocks to watch and even though not all of them are winners, mine that i have chose of his list are over 65% profitable. 5-10% is the way to go thanks you jason bond!!!

Congrats Jason, your money worries are behind you. To achieve $84,000 or 26%, your account has to be very large.

Rich to me is over a 100k a year….I believe one can get rich from swing trading. Either way if one can keep compounding their money with trades and cutting loses quick and living within their means you can be rich in my eyes even into the millions in the long run. Little by little is what it takes. Jason has been very quick to respond to my email questions and I am not even signed up yet. (Which I will be soon)

Losers always have to cut down others, winners move forward.

Folks… how much money could you make if you could get in on a trade before others found out about it. Well, that’s what’s happening here. Nothing wrong with it, nothing illegal with it, and if I could do it I would. My respect goes to Jason and his crew for building the business they have built. Its one thing to talk about it, but another to actually do it. But folks, before investing you should keep in mind that the profits Jason and Luke make are not typical. They have a built-in mechanism for knowing when others will enter the trade, and when they will likely exit the trade. They know that by simply announcing the trade to their followers, many will likely buy in (after all, that’s what the followers are paying for). That creates buyers. What moves share price upward… buyers. So, they have a known market in order to forecast increases in the share price. They know that when they announce, there is a good chance (greater chance than without followers) that others will follow their lead and also buy shares, taking the price along with it. Again, not illegal, and nothing wrong with it… but would YOUR profits be higher if you knew when possibly hundreds of investors were going to buy into a stock, and you bought before them??? Stock service owners know they can buy into a stock, announce it, and they know many more investors, that are paying to follow their picks, will buy also. Does this work every time… of course not. Does it work more times than if you were to buy into a stock with NO followers… yet bet it does. Just be careful folks… like they say in the car commercials… YOUR mileage per gallon may differ, and so is the same for a stock service providers claim of profits. Those stated profits (and win ratios) are due in some degree (I think a large degree) to YOU… the followers.

Larry do think I attained a lot of clients in a little over 2-years because they enjoy watching me make money? Or do you think there’s more to my service? I’m pretty sure Roger isn’t getting my returns but do you think he’s ‘unhappy’ about that http://bit.ly/17vo9Ck ???

Or how about this grandmother, Deb’s made it clear what her goals are, I’m curious what your thoughts are here http://bit.ly/Zet5b9 ???

I’d like your comment on Asim’s review as well http://bit.ly/16S78kz ???

I could run this business and never make another trade and still be just as successful. See it’s not about what I make, my strategy works and clients who take the time to learn what I’m teaching stand to benefit. That, in my opinion is why I’ve attained thousands of clients in a little over 2-years.

Stop by the chat, you’ll find Michael in there daily and he makes much more than I do trading. How does that factor into your opinion http://bit.ly/170d1u2 ???

There’s 450 clients in my chat right now. Ask yourself why that number is up from 1 to 450 in 2-years. If I’m only making money because of my big following, how then did I get the big following because the chat room started with Cristian, Matt and I when I launched it. There were 3 guys in that room 2-years ago.

Finally, share with me what you think about Jody’s testimonial here please http://bit.ly/XHuJUm ???

I appreciate you sharing your thoughts with my future clients Larry, but I honestly think your missing the whole point of my blog. This isn’t about me, it’s about teaching a strategy that works to others through doing. In each of the links I’ve provided you I’m trying to illustrate this point. I hope you take the time to look at them, read them and then follow up to this response you’ve left.

Bottom line, the reason a lot of people my trade alerts voluntarily is because I’ve earned the respect and trust of my clients and anyone who has been on Wall Street for even the shortest period of time knows that type of trust is extremely difficult to achieve.

How do you explain how I made 35% on one trade using the *lessons* that Jason Bond teaches? He didn’t alert the stock. It wasn’t even on his watch list. There were no built in buyers to drive the price up. Just me doing good research and chart reading, coming up with a plan, and then making the trade. I learned how to do all of that from Jason Bond. So why did I choose Jason? Because he’s a great TEACHER. He’s easy to understand, enthusiastic, and engaging. Stock trading can be a very dry subject but Jason makes me want to learn more and the results prove that his system works.

I wrote a long reply… but it would be wasted on you…

In my 4 months here… I have never seen Jay take profit on the back of his clients. As unbelievable as it sounds… there IS integrity in this place. No matter what any current member says to you… you will not believe it. All I can say is .. your loss. Those who come here, learn the skills and arent greedy.. will almost always be loyal members. I mean for what I get for $100/mo here.. the cost is a joke. (don’t get any funny ideas JB)..

…never in my life I have wanted to pay a bill so badly as my first renewal to JBP.

Disclaimer: I’ve been a member of JBP since early-2012. This insinuates that my opinion may be bias. But regardless of whatever bias may exist, I’m a very honest person at heart.

Let me say that I know exactly what the main point of your post is and the message you’re trying to get across. With that being said, let me throw in a couple of counter-scenarios and counter-points.

#1. If you believe JB front-loads (you never said that, but I’m saying it to illustrate a point) then why not do it to him? If he alerts at X, you get in at X+.01, then you sell at X+.02.

#2. If JB were to alert a stock, have the chat drive up the price, then the stock tanks -.15 below the entry, your point would be made. However, JB’s alerts do not do that for a majority of times.

#3. There are alerts/picks that even a chat room cannot move. For example, ZNGA will go nowhere. (Ok, MAYBE +.02.) NUGT may have a slight move.

#4. When it comes to the thinly traded alerts (e.g. MEET, ZAGG), I can see where your point would be made. These thin stocks aren’t a big favorite of mine and there may be people who market order and have a big amount of leakage.

At the end of the day, if every/majority of the alerts were rocketships, then a complete failboat, I’d agree with you all the way. But that isn’t the case.

I’m not interested in getting into a confrontational dialog with you. I stand by my statements. Let the readers decide if my statements have any merit. I’m sure there will be supporters of yours who can attest to the profits they have made, however its unlikely the responses will be a fair and balanced representation of ALL your clients, because those that had little or no success using your service will likely not be reading your blog and therefore not respond with their experiences. Again… you have my respect for creating and maintaining your following. Many have tried, and many have failed, and you have succeeded. I wish everyone all the best !

Best of luck to you Larry.

been taken before by trade rooms/programs.

Why not offer a 30 day free trial to prove your programs to new members ?

Lots of scams on Wall Street Pete but I’m a firm believer in no free trials and no discounts, ever. If my service is good, word of mouth will spread and it will grow on its own. If it’s not good then how does a free trial help me anyway? I believe I’m fairly priced. A discount is a kick in the shin to existing clients who paid more. A free trial distracts me from existing clients who are already paying. I started with no clients and now have thousands… so I think my business decision here was and is a wise one.

Larry, sometimes there is a little spike in price after JB gets in, and others follow, but often there is a retrace back to where he got in within 5 minutes. The little bump in volume that the board creates on many of these stocks is like a flea on an elephant. On occasion, I have got into a trade under JB’s price, and keep in mind, he has them on a watch list out to us the night before, so, if or when I get in is my own business. In fact, there is a master watch list that I have made money from trading completely independently from JB’s picks.

Anyway, count me a happy client. His system works, but I the real value here that doesn’t seem to get talked about is the education. JB is a teacher at heart (that can’t be emphasized enough), and so if you want to skip years of learning, and compact it down into months, this is the place to be. At least that’s mu opinion.

That is the primary reason I’m here. I know the things he does works, and the day trading that goes on in chat works for the people who do it. My goal is to learn, because knowledge is the key, and JB is truly an open book of a man. Trading by yourself is miserable and boring. Trading in the great community of JB picks, is fun, and exciting, but most importantly it’s a support system of education and a community of help and encouragement. I can say this after only having been a member a month and a half. I’m so glad I found this place!

Also Larry,

I can tell you that as a member Jason Bond is actually pretty easy to beat as for as the percent of gain on his swing trade picks. At least for those of us who are members.

He plays his trades pretty conservatively, and if a swing trade goes up sharply on some news or something, if he is long on the swing, he many times just stays in it. (I guess so as not to confuse people following him, I dunno) But I have played the Fibonacci Retrace (you do know what a Fibonacci retrace is right? I didn’t 2 months ago) , taken profits and scaled back into the stock when it goes down 50% from it’s high. That little bit of knowledge keeps making me money again and again. That why I say I believe the knowledge gained is the most valuable aspect, because it’s like the: “give a man a fish, feed him for a day, teach him how to fish, feed him for a lifetime.”

JB is a teacher at heart, and like I said the education there is the most underrated aspects. To me, that was the original selling point, and it still is, Although the financial gains are nice too.

Jason,

Thank you for your candor. It sure is refreshing after the fraudsters baloney out there.

Not sure if I made it clear that I learned the Fibonacci Retrace from Jason Bond’s teaching. I’m there to learn, but I’d be stupid not to follow JB into picks. Swing Trading is his expertise , and he spends hours of his time researching before he picks a stock for a swing trade. I don’t have that kind of time or expert knowledge, and so in some ways that’s what I pay JB for.

Jason, you have taught me so much and changed my life completely! I don’t know you, but I will forever be grateful to you for your dedication and ability to teach. You truly care about your clients, and I can tell. Do not listen to the negative people trying to talk bad about you. It goes back to one of my favorite quotes “If there isn’t anyone out there hating on you, then you aren’t doing anything right.” lol… Congrats on your success, and thank you for teaching me how to beat the street.

Jason, I have been looking at your emails. Let me be upfront with you. I have been trading with binary options, and not doing well. From what I understand there is definitely a lot more to this. I don’t know much, but I love trading, and want to be successful. Will I learn How to buy and sell, as well entry and enter, and stop loss. Also, how do you do your training? I will waiting your response, and very soon to join.

Hi John, yes the whole website is about improving as a trader and therefore education based.

Do you do one on one teaching I tried the computer based courses before with other people and it did not work for me at all lost my ass off lost every penny and when I needed the advise they were not there to really assist me in the effort .I had to give up and loose all my money and more.

I do a lot of mentoring in the Millionaire Roadmap, I find clients get out of it what they put in.

I signed up for Jason’s service. I have done detailed analysis of his trades over a period. His winning % and $ lost on the portfolio is more than 75%. But his portfolio won’t show the same in the account. His contact center people. will never give a straight answer. Repeated request to talk to Jason never materialized. Use this service at your own peril.

What’s up Sam! What questions do you need answered? Jason

Hello Jason! I have my regular 8 hrs. day job. I’m not able to check my phone at all times to make trades. How will your program help me make daily trades? Also, I’m new to trading and Robinhood is what I use. Just invested $5,000, but having hard time choosing good stocks. What trading platform do you recommend for someone like me? Thank you in advance!

I like E*TRAE a lot, I’d recommend them or TD. Yes, you can learn to swing trade effectively with a busy schedule.

Hello Jason Bond,

I watch your video today 10/17/2018 i like what i see, however i dont have the founds to pay the low price offered in the video. And i work 57 hours + a week to afford my rent and pay my bills each month. If you could email me if there any option(s) on how to work my self out of this issue it be great. I also wanted to know if i could start with just $20 in trading to try and make that in to real money?

Chris Krec

I’m sure that, someone like Jason who has a $100M business, who he built in just 7 years “teaching” (much less risky than actually trading), would be able to spare some change to help you out of your dilemma. What do you think? Who knows, you’ll get a $20K trading prize for participating in the forum? 🙂 By the way, what is he doing staring at a computer screen the whole day, putting up with people like us, while he owns $100M? There is so much fun to be had and so much to see, and so little time… Well, I guess everyone has a different concept of “fun…”

I saw that you prefer Etrade or TD For day trading, but you need 25K+ in your account right?

Also I have a full time job and I have not traded actively but I have had good trades although few.

Do u guide in the 399/q program?