Political tensions rose over the weekend, as Iran admitted it lied and “mistakenly” shot down a Ukrainian passenger jet… yet, futures were trading higher early this morning. Talk about a wacky market.

Since when did political tensions not matter, especially when we’re looking at a potential war. Not only that, but it seems as if traders have been too complacent… and that’s when things could take a turn for the worse.

This week, we’ve got a slew of catalysts:

- The ongoing Middle East conflicts.

- The U.S. and China trade deadline.

- Earnings season kicks off with the big banks.

In this market environment, I don’t think it makes sense to go out on a limb — whether you’re bullish or bearish. Instead, I think it’s a good idea to remain patient and look for signals that tell us where the market could be headed.

I don’t know about you… but I don’t want to be long any stocks related to the overall market because I don’t want to wake up with knots in my stomach and staring at a gap down. Instead, I’m going to stick with what’s working for me — small-cap momentum stocks.

For the most part, we’re seeing proof that small-cap momentum patterns are working…

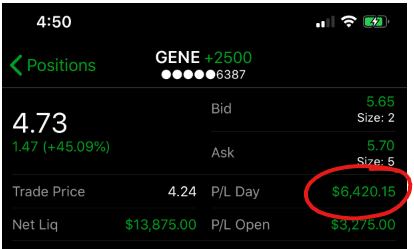

RagingBull Elite clients are privy to real-time trade alerts like this one. If you’re not a subscriber — call (833) 498-5427

Missed out on this monster win? Find out how RagingBull Elite can help you achieve your trading goals and call (833) 498-5427

So why does trading small-cap stocks work so darn well in this environment, and any market environment for that matter?

Small-Cap Momentum Strategy Is Pummeling The Markets

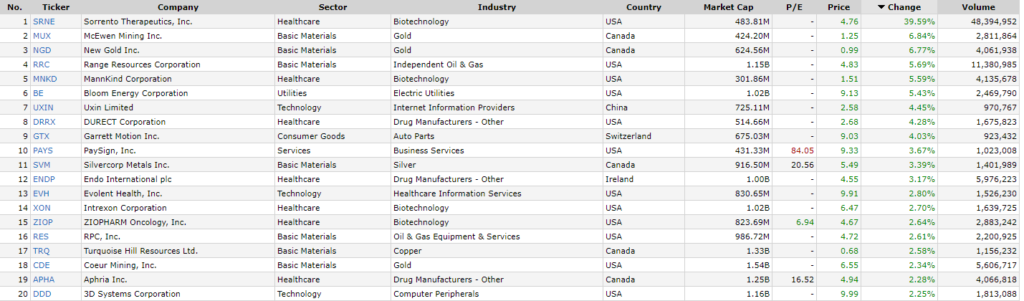

On any given day, small-cap momentum stocks dominate the leader board. Just take a look at Friday’s action for some small caps…

The reason I love to trade these stocks is that they move… and if you have the right patterns, you can spot some massive winners. Not only that, but these stocks don’t care what the overall market does.

Why?

Think about it like this… small-cap stocks have market capitalizations between $300M and $2B. It’s very unlikely a market headline will affect them. Quite simply, they move to the beat of their own drum.

So when the direction of the overall market isn’t clear, I love to pounce on these momentum stocks. You see, over the years, I’ve figured out that my patterns work extremely well.

I think the best way for you to understand how to trade in a foggy market is to go over a real-money case study… and I’ll show you one of my favorite setups — the fish hook pattern.

Fish Hook Pattern Reels in $12K Winner

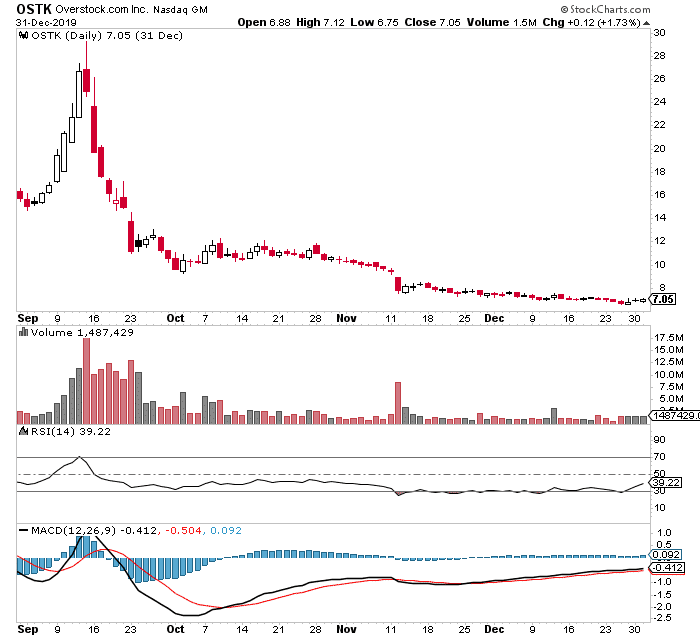

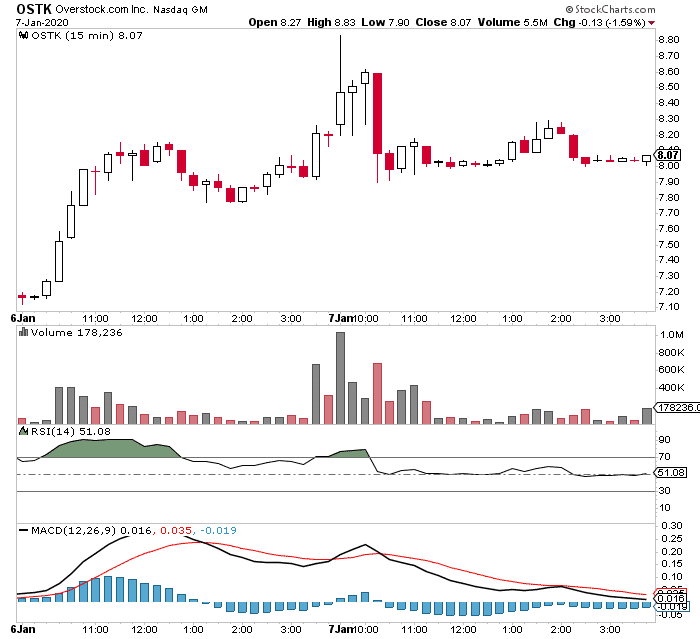

I alerted my clients about a potential January effect play in Overstock.com Inc (OSTK).

Of course, I let my Jason Bond Picks clients know I was keeping an eye on this stock. It was one of my favorite stocks, and it played into the January effect thesis.

Stocks I’m looking to buy soon for January effect are OSTK and I, hopefully in the middle $6’s on both. No rush for new positions since the market is likely to see some selling early this week. Swing trades with hold times ranging from a few days to a few weeks is what you should expect here.

If you look at the daily chart in OSTK… the stock got smoked from September all the way until late December. When a small-cap stock gets destroyed like that… it’s when I love to look for my fish hook pattern.

So we had a few things going for the stock… the January effect thesis… and it found some support and started to catch a bounce.

Here’s what I look for with my fish hook pattern.

The stock experiences a massive drop

The stock finds support and holds, it’s what I call an area of value.

The stock to catch a small bounce.

Take a look at the chart in OSTK above and be mindful of the fish hook pattern conditions. That looks like a textbook setup to me.

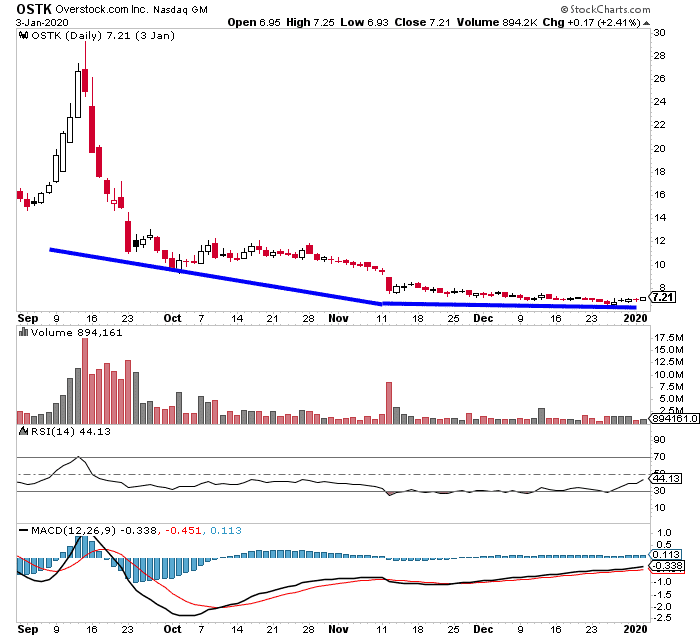

However, I was a little late to the party… I got in OSTK after it caught a massive bounce last week.

Of course, I was chasing a little because I was stubborn the other day… but I’m not mad about it. In fact, the move higher was actually confirmation OSTK could run higher.

Sure, I didn’t get the price I wanted… but I didn’t miss out on the trade. Since I did chase, I wasn’t looking for a massive winner, just 5-10%. However, at the time, I figured OSTK had massive upside potential, and it could’ve been good for a 20%+ winner.

Here’s a look at what happened with OSTK.

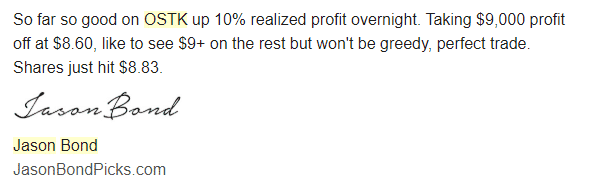

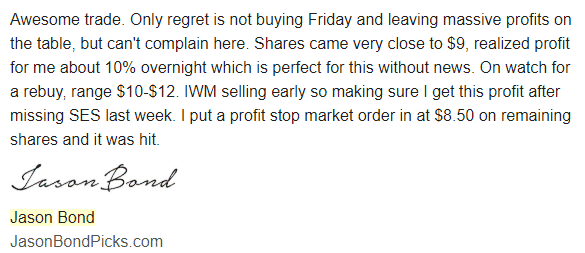

Not too long after, OSTK started to ramp higher… and one day, it hit a high of $8.83… and I sold into the momentum.

Just by focusing on small-cap stocks, I locked in about 10% overnight, a $9,000 profit overnight!

Of course, I took some profits off the table and tried to juice a little more out of the trade. But I wasn’t going to just leave it on without protecting my profits.

So for the rest of my position, I actually put a stop-market order.

Well, my order got hit at $8.50 on the remaining shares, so I still came out on top with about a 10% winner overall.

That was good for approximately $12,000 overnight!

Right now, I don’t think it’s a great time to be solely focused on the overall market… especially when small-cap stocks are rocking.

If you want some clarity, then check out how I’m able to use simple patterns to uncover massive winners in the small-cap market.

0 Comments