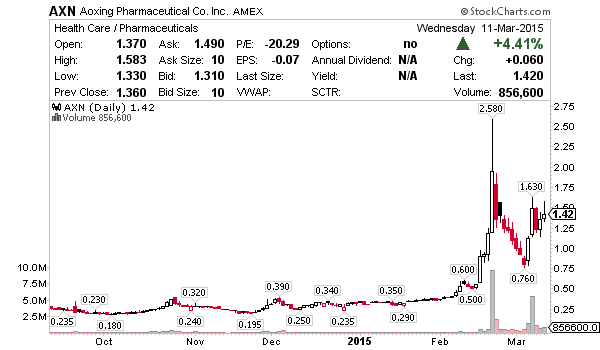

Last Thursday’s watch list had AXN on it for the first time.

Using the lessons on Jason Bond Picks and a RINSE & REPEAT strategy I found success once again.

In the past week I made +$7,640 profit on AXN going 3 for 3 +12% +$3,600, +7% +$1,740 and +13% +$2,300.

Here’s how I did it and how you can look for other similar trades.

Last Thursday’s watch list said,

“AXN – Continuation pattern, look for entry above $1.30, thinking swing to $1.60′s resistance, take half off and let the rest ride for $2.”

BEFORE

I bought 20,000 shares that same day at $1.54, sold it at $1.72 +12% +$3,600. Remember, anytime you get +10% inside a day, turn the swing into a day trade to protect the gain and look to rebuy on a technical dip.

And rebuy on a dip I did.

Jumped back in at the close, +7% higher than my initial $1.54 purchase earlier that day. This time I bought 15,000 shares at $1.64, sold them the following morning at $1.76 +7% +$1,740.

And finally, Monday I bought AXN once again at $1.77, 15% higher than initial $1.54 purchase and +8% higher than my $1.64 rebuy. This time I bought 10,000 shares at $1.77 and sold them the following day at $2.00 +13% +$2,300, the stock closed Tuesday at $2.09 after hitting a high of $2.17.

Top to bottom that’s +41% from the first $1.54 buy. My RINSE & REPEAT strategy protects gains once they reach 5 – 20% along the way, because sooner or later patterns reverse, nothing worse then turning a green trade red, right?

AFTER

Now let’s break this trade down.

Here are those purchases in real time with a 5 minute 5 day chart from E*TRADE Pro.

- 20k @ $1.54 in, 20k @ $1.72 out +12% +$3,600

- 15k @ $1.64 in, 15k at $1.76 out +7% +$1,740

- 10k @ $1.77 in, 10k at $2 out +13% +$2,300

Simple technical analysis combined with an overcrowded short bidding up higher lows made the risk reward excellent here.

Notice as I chased the higher lows higher, I reduced size to protect previous gains so 20k at $1.54, then 15k at $1.64, then 10k @ $1.77 = good risk management. Yes I got out too early in many instances but you never know where the top is, so have a goal and stick to it. For me it’s 5 – 20% profit and I’m locking it up.

To find more small caps in an uptrend simply apply video lessons 2 – 4. Understanding short interest is quite simple, if there are no shares to borrow at most brokers, it’s overcrowded. Also watch video lesson 10 which details why shorts move into stocks and where they’re likely to bid it up.

Jason- After the first profit of $3600, if the prices had gone down, rather than UP, would you have SHORTed a TRADE, to profit from the DOWN SIDE?

WENDELL COOK wcook101@cox.net

Yes, nothing wrong with playing both sides, I have lessons on the site about short selling and I’m a big fan of it myself. These stocks should be viewed as money making vehicles, nothing more. Buy them or short them, who cares, just make money.