With the silver price refusing to be denied the top-end of the 200-day moving average, the long-awaited rally is still intact. Though traders haven’t seen the explosion in prices witnessed during 2010 and the following dramatic spike of the first quarter of 2011, silver aficionados know quite well that major rallies can be sparked at any moment.

And after an equally-long bear market to the aforementioned bull market, 2014 could be the year that everyone will be referencing as the beginning of the next super-bull move in the silver price.

“2014 will be the year of the upside explosion in gold and silver,” 60-year market veteran Ron Rosen told King World News (KWN).

If we can break $22 silver, we will then be breaking out higher, “approaching $50 and maybe even exceeding $50 in the not too distant future,” stated bullion dealer, James Turk.

And, referring to Chinese demand for silver to fulfill Beijing’s long-term plans to accelerate the People’s Republic of China’s alternative energy infrastructure, best-selling author Stephen Leeb said, “ . . . the move in silver will shock people in the West because they won’t understand why silver is moving so fast and so violently to the upside — Chinese demand. He added, “This is what is going to turbocharge the move in silver and send that metal past the $100 level.”

Traders of precious metals (PMs) have experienced “the most oversold position in the history of the silver market,” exclaimed anonymous technical analyst for King World News, David P.

Source: Stockcharts.com

HL Vs. MUX, a Critical Comparison

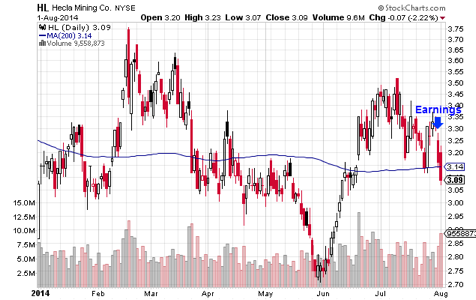

After falling 26 cents – leading up to a lackluster earnings report released Thursday and the follow-through trading on Friday – North America’s oldest mining company, Hecla Mining (HL), threatens to begin another trading range below its 200-day moving average – for the second time this year.

On Friday, HL closed at $3.09, or a price of 6 cents below its 200-day moving average. Volume reached 9.53 million shares, nearly twice the 3-month average for the stock.

Source: Stockcharts.com

So far this year, HL has performed poorly against the backdrop of 10.4% higher silver price. Since the close of $3.08 of Dec. 31, HL has managed to gain merely a penny.

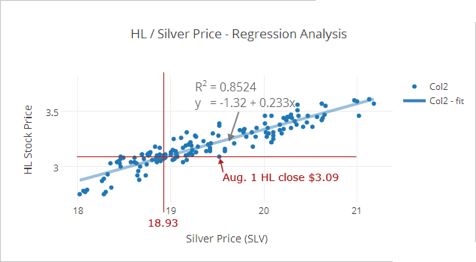

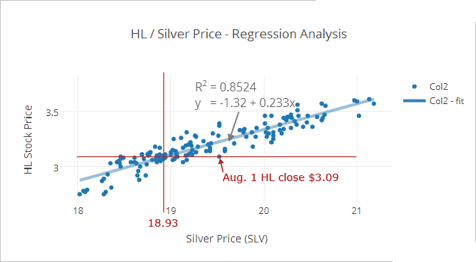

Moreover, below, the analysis of regression between the silver price and the share price of HL during 2014 demonstrates relative poor performance during a rally in the stock.

Source: Jason Bond Picks – JasonBondPicks.com

Inputting the silver price into the regression line equation, the result shows that when the silver price moves up $1, HL moves up $1.46.

Essentially, a 1.46-times leverage is not exactly the return traders of PMs stocks expect in return for the added risk.

From the graph, we can see that HL’s $3.09 handle implies that traders have discounted the stock equivalent to an underlying SLV share price of $18.93, or a discount of 3% to SLV’s closing price on Friday of $19.51.

We highlight HL due to its popularity among traders of U.S.-based mining shares, but there are other mining companies with just as favorable jurisdiction profiles and just as (or more) competent management.

Among the list of PMs shares we follow closely, McEwen Mining (MUX) stands out as, not only a high-profile stock among traders, but as a company that is well-managed, debt free and operates within jurisdiction-friendly countries.

So looking at McEwen Mining (MUX), we find a stock that trades well-above its 200-day moving average, and is up 46.9% for the year.

With earnings scheduled for Aug. 8, will MUX suffer a similar sell-off to HL? Maybe. But our analysis focuses upon the price action we expect for the remainder of the year – if our analysts at KWN finally got it right with their predictions of much higher silver prices this year.

Source: Stockcharts.com

Now look at MUX’s price action profile so far this year. The analysis of regression between the silver price (SLV) and MUX demonstrates that MUX soars during rallies and drops relatively modestly on pullbacks in the silver price. That fact is not a mystery to traders of MUX, but the implied return from owning a share of MUX when compared with the return on the silver price is the point of our analysis (see Conclusion).

Source: Jason Bond Picks – JasonBondPicks.com

From the chart, we see MUX’s price action at a more than 50% steeper slope (0.365) than HL’s slope (0.233). And Friday’s close of $2.88 implies traders are paying a 3.2% premium (SLV=20.14) to SLV’s closing price of $19.51 on Friday.

Conclusion: So What Does This Analysis Mean?

Based on 2014 data, our analysis suggests: Investors of HL can reasonably expect a return of $1.46 per a $1 rise in the price of silver – under the best of conditions. On the other hand, investors of MUX can expect a much higher return of $3.12 per a $1 rise in the price of silver. Why would traders not prefer MUX over HL?

Looking for another big stock idea like MUX?

To get a heads-up on other stocks we feel may better your rate of profit, start by joining our mailing list (top of the page). Or, take the next bold step now by joining Jason’s community of dynamic and active traders with your subscription to Jason Bond Picks.

Click here for 2013 Performance Record +77%

0 Comments