Apparently I’ve been overly focused on bullish sentiment and need to get back to a neutral state where I see the market more clearly. I’m missing short after short trying to swing everything long but truly thought we were setting up to breakout Tuesday. More on that below, here is a look at what’s on tap for today.

U.S. stock futures edged higher on Wednesday after Wall Street’s lower finish in the previous session, as investors digested the results of Italian and German debt auctions.

The U.S. economic calendar is fairly thin on Wednesday, with data on November import prices due at 8:30 a.m. Eastern time.

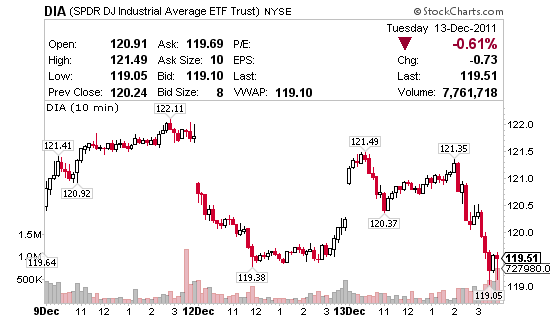

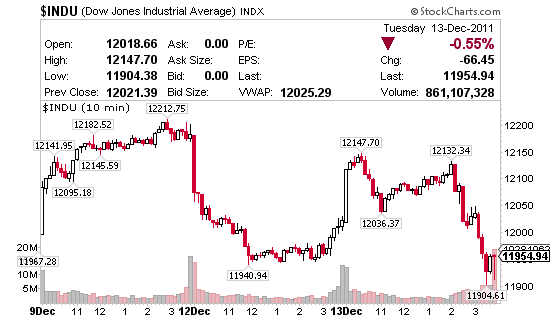

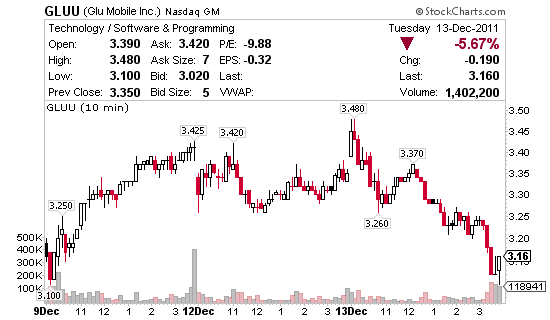

Yesterday’s price action seen here in a 3-day 10-minute chart reflects why the swing trades I bought Monday fell apart. After a big gap up for the Dow the market took a skid on news out of Germany followed by the FOMC meeting. I bet bull on Monday on HOV and GLUU as well as a few scalp trades in chat – all of which pulled back with the market.

Regarding Tuesday’s price action… let’s examine the Dow Jones Industrial Average as it pertained to GLUU…

Here is the 3-day 5-minute DIA ETF and below that is the 3-day 5-minute INDU chart – not an easy market to swing. Below that is the same time frame on GLUU. See how the market has a direct impact on swing trades like GLUU?

3-day 5-minute DIA (ETF representing the Dow Jones Industrial Average)

3-day 5-minute INDU – (Dow Jones Industrial Average)

3-day 5-minute GLUU – (Monday’s swing into Tuesday for Zynga runup)

Here is a look at the daily Dow Jones Industrial Average chart. I bring this up because yesterday I thought we were poised to breakout which is why I loaded the boat with 2 swings Monday and 3 scalps on my own. Clearly the market was looking for a reason to sell and after the FOMC meeting at 2:15 we did just that. From here I’ll need to evaluate all over – apparently I’ve been too bullish lately. If the market goes into a skid be prepared for short alerts.

Having said all that, I’m still in GLUU but will need the market to run to win on this trade. Further, the timing might be messed up now and that run might not happen before the Zynga IPO, even if the market does turn up.

LOCM – Like it above $2, goal $2.70 or higher.

GLUU – Still like it there but broke my stop – if market doesn’t head higher today I’ll consider selling.

USAT – Solid outlook guiding on Q2 Tuesday gives me hope that $1 will hold and $1.60 – $2 is possible.

HKN – Stop broke so I’m looking to exit – just no liquidity right now.

0 Comments