Made about $3,000 Thursday. Up over $10,000 in May and $105,000 in 2013. It was an awesome day for teaching, the video lesson is coming. After sitting on my hands Monday through Wednesday I got tempted to go after a few breakouts, when the market was breaking out. This would have been fine but a rumor hit QE3 was ending and the market rolled over, creating a strong headwind for my moves. Right before the close the rumor was dismissed by CNBC and the market snapped back but by then it was too late, most stocks with momentum lost it.

I recorded a video lesson last night about it because it’s not often I play video lesson 3 (breakouts), let alone 3 in a day. Actually did a lesson Thursday night which is good but after a good nights sleep the lesson deserves more attention, so I’ll record a new one today during the session and send it to you – there is a lot to learn from what happened to me Thursday.

Fed Chairman Ben Bernanke will take the mic in Chicago at 9:30 a.m. Eastern and investors will be tuning in for any clues about where we’re headed with the $85-billion-per-month asset-purchase program. If he hints at a halt or even cutting back, look out below. But that’s not going to happen with inflation running below the bank’s mandate and unemployment still up at 7.5%.

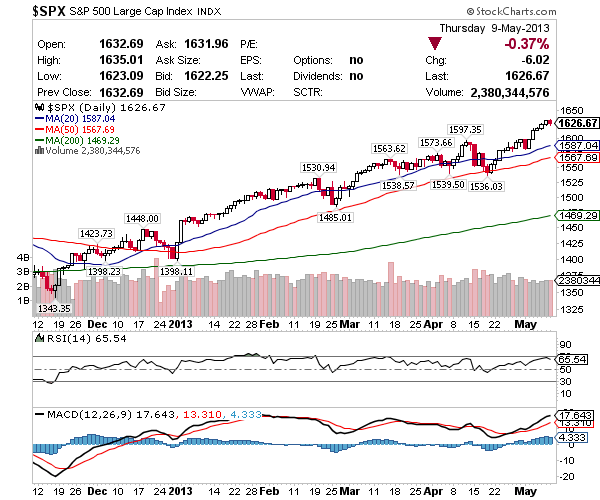

I think the market will rally today and close at an all time high. It continues to be difficult to keep a large portfolio of stocks overnight because the S&P 500 is overbought and a natural pullback to the 20 Moving Average could be right around the corner. Bull markets are fun to trade but once they get overbought it’s wise not to get caught in the pullback, not as a swing trader anyway.

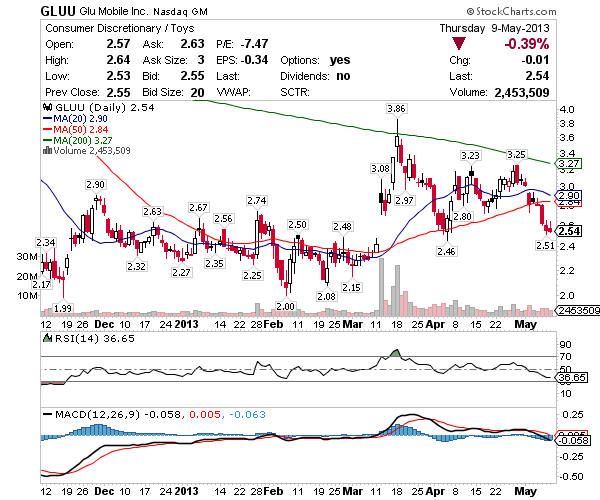

GLUU – Want to average in above $2.40 for the next swing up. This is a trade like MM was in that it’s starting to base and I like it between $2.40 – $2.60 swing back into the $3’s the next time it gets hot. Plenty of catalysts out there so it’s an accumulation game right now. I’d like to have 30,000 shares as close to $2.40 as possible and then hold onto it like I did MM, so starts as a swing with the intent to go long if it trades as expected.

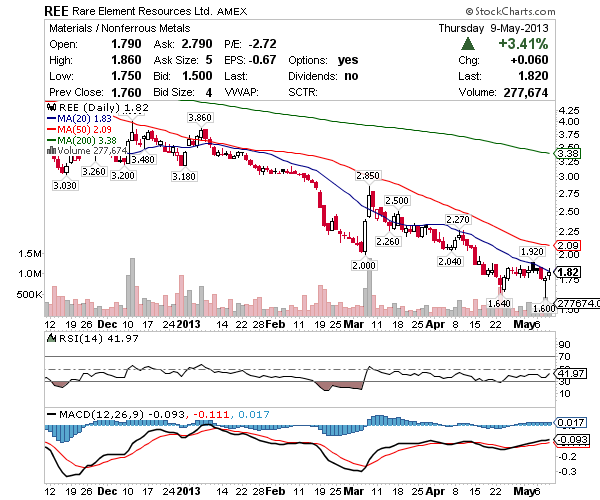

REE – MCP rocked earnings and is above $6 in the premarket. I’ve been trading and following MCP close daily so I’m confident this sector winner will lift the tide of other rare earth plays. Technically speaking a break of $1.90 and this could get above and work the 50 Moving Average as support. Thinking profit before $2.30 price action resistance.

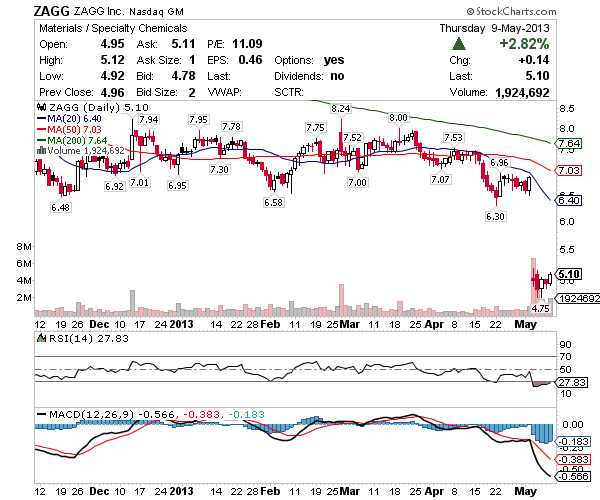

ZAGG – Considering this trade today working straight out of video lesson 1 (oversold). The MACD is close to setting up and my only reservation is the market has been strong, so if the market turns this pattern could attract another round of sellers sensing blood in the water. It’s heavily shorted and above $5.10 it could push hard into the gap. Candle over candle at $4.75 I’ll either play for the quick push into the gap or accumulate above $4.75. Sometimes these squeeze quick but then fade so I’m not looking to go long here, though it’s probably a decent long entry if $4.75 holds. Historically ZAGG doesn’t stay oversold for long if you check the charts.

i’m hanging long with gale. had a nice trade with gtat. would love to get in on gluu. looks ripe.