With the holiday season coming I’m looking for winning small cap swing trades priced $1 – $10 with market caps between $50 million and $2 billion. Provided they hold the support levels mentioned into the tax selling season, the following 3 small caps are poised to bounce 30% or more for investors willing to hold longer than the normal swing time frame. I don’t just write about these ideas, I put real money on them. DMD, LF and ZAGG stock are all earnings winners with reasons to head significantly higher into the holidays.

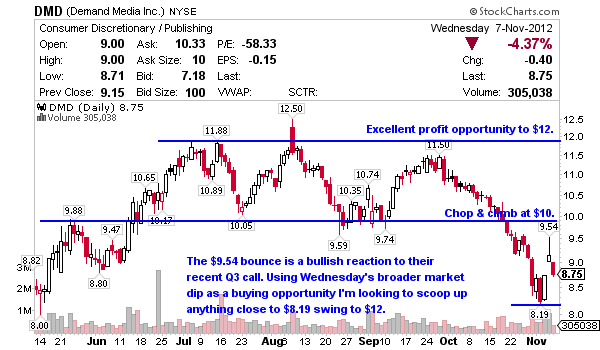

Demand Media (NYSE:DMD) identifies, creates, distributes, and monetizes in-demand and long-lived content formats. DMD’s stock market cap is $745 million, they have $112 million in cash and $0 debt. Key assets include eHow.com and Livestrong.com both of which have seen increases in traffic helping DMD to beat Wall Street’s expectations recently. About 15% of the float is betting against the company with short interest of 17 days to cover. Technically I like this one on a reversal above $8 swing to $12.

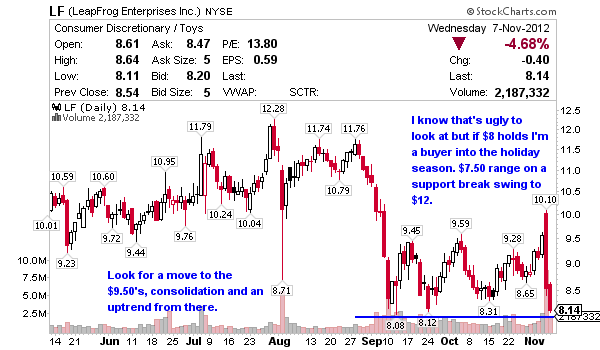

Leapfrog Enterprises (NYSE:LF) designs, develops, and markets technology-based learning products and related proprietary content for children worldwide. LF’s stock market cap is $541 million, they have about $50 million in cash and $0 debt. Into the holiday season I really like this trade, especially since they just beat Wall Street’s Q3 expectations and guided full-year sales 20% higher. About 18% of the float is betting against the company with short interest of 8 days to cover. Technically I’m looking for an entry just above $8, otherwise I’m a buyer around $7.50 support swing to $10.

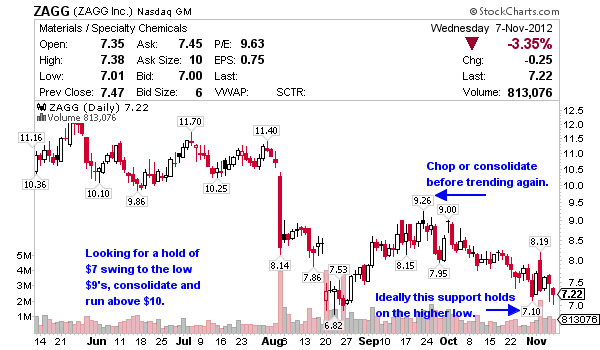

Zagg (NASDAQ:ZAGG) designs, manufactures, and distributes protective coverings, audio accessories, and power solutions for consumer electronics and hand-held devices primarily in the United States and Europe. ZAGG’s stock market cap is $220 million, they have $16 million in cash and $45 million in debt. Recently JPMorgain started the accessory king of the mobile era at overweight with a price target of $13.50 or 87% from today’s price. About 33% of the float is betting against the company with short interest of 10 days to cover. Technically I like it above $6.80 swing to $9.

0 Comments