Cash is king on Wall Street and these companies below have a lot of it with very little to no debt. The China small cap space has been battered recently but mark my words, it will have another big rally and I’ll be ready to make big profits when it does. Simply follow stocks like Sina.com (NASDAQ:SINA), Baidu (NASDAQ:BIDU) and Youku.com (NYSE:YOKU) to spot a turn. When the move does happen I’ll pile into less popular plays like DANG, CNTF, RENN and YONG which excellent upside potential.

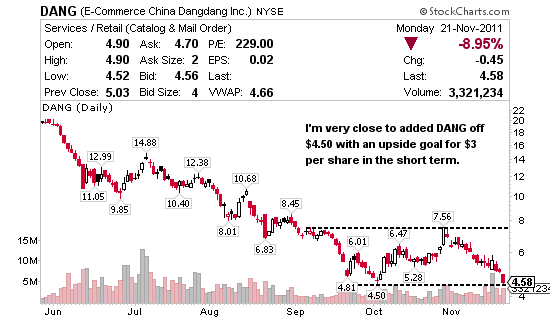

E-Commerce China Dangdang (NYSE:DANG) operates as a business-to-consumer e-commerce company in the People’s Republic of China. In their recent Q3 earnings call DANG reported net revenue increased 50% y/y to $142.5 million. The company has over $244 million in cash and 0 debt. This puts their total cash per share alone at $3.08 based on just over 79 million shares outstanding.

China TechFaith Wireless Communication Technology (NASDAQ:CNTF) operates as an original developed products provider that is focused on the original design and sale of mobile phones in the People’s Republic of China and internationally. Monday (Nov. 21) their Q3 earnings call beat Wall Street’s expectations on the high end of prior guidance. The company has over $220 million in cash and only $290 thousand in debt. With about 53 million shares outstanding their cash per share position is more than double the price of the stock at $4.17 per share. Call it a ‘value trap’ or anything you else you want but if and when CNTF gets traction it could easily double or triple from here on quarterly growth of 26% y/y.

Renren (NYSE:RENN) operates a social networking Internet platform in China similar to Facebook. While their recent Q3 earnings call didn’t impress Wall Street this company is sitting on a massive backstop of $1.2 billion in cash with 0 debt. With about 392 million outstanding the cash per share measure comes in at $3.05 meaning RENN is literally trading just above cash right now at $3.90 with quarterly revenue growth of 57% y/y.

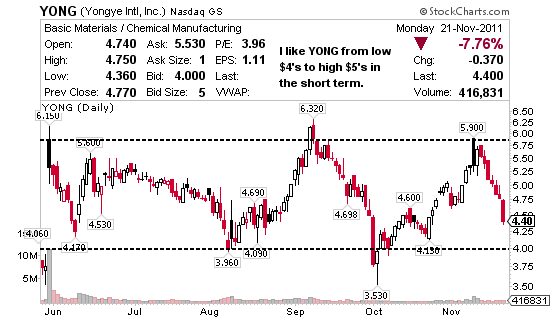

Yongye International (NASDAQ:YONG) engages in the research, development, manufacture, and sale of fulvic acid based liquid and powder nutrient compounds for plants and animals, which are used in the agriculture industry in the People’s Republic of China. Quarterly revenue growth for this company is a staggering 96% y/y. Their cash position is the weakest of the group at roughly $80 million with $21.5 million in total dept making their cash per share position $1.59 on about 50.5 million outstanding.

I am long RENN

Hi Jason,

I am concerned about the cost of getting in and out all of the time. Is there a particular broker you would use to cut these costs? Is there a way around these expenses or do you just jump in and pay the price. Just wondering about getting into this with a first quarter trial and see what is the outcome for myself. Ida

Hi Ida. Yes I use Etrade and the commissions there really can’t be beat considering the Etrade Pro platform they provide. You can’t avoid commissions, I think I pay about $8 per trade. It’s really not that much considering the goals of my service. If trades go well and I get 10% then $16 from the buy and sell really means very little compared to the profit. Commissions can eat up smaller accounts but smaller accounts have trading restrictions anyway so it balances out I think.