The S&P 500 finished Thursday in spectacular fashion, as it capped off its best week since 1974. Many traders are wondering whether the market continues the rebound, or if this is just a dead cat bounce…

To be honest with you, I’m wondering the same thing.

However, rather than focusing on what the market can do, I’ve adapted my trading and only get aggressive when the conditions are right for me. For the most part, I went into the 3-day weekend with mainly cash in Jason Bond Picks.

In this environment, I think it’s important to have a “master” watchlist — stocks that I’ll always keep my eye on.

Why?

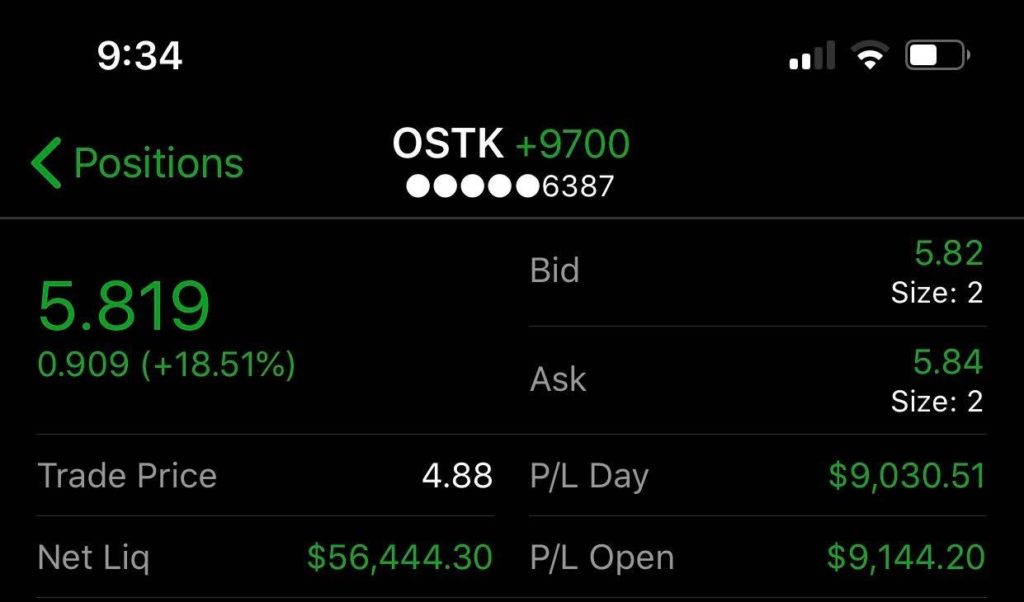

Well, without a master watchlist, I would’ve missed out on about a $9K winner in Overstock (OSTK).

How did I spot the trade in OSTK?

Why I Always Have A Master Watchlist

In this market environment, it can get difficult to find trading opportunities. For example, there are some days where there won’t be a lot of momentum stocks for me to hunt down.

There are days in the pre-market where I just don’t see anything too interesting in terms of momentum plays. However, that doesn’t mean I remain on the sidelines… I actively stalk stocks to see if my bread-and-butter setups come into play.

The thing is, I’m not going at this blind — I actually develop a master watchlist of stocks I really like. Overstock.com (OSTK) being one of those names.

So when I didn’t spot any momentum plays in the pre-market that morning, I remained patient because there were other stocks out there for me to trade. I know what you’re probably wondering, “Jason, how did OSTK actually come up on your radar?”

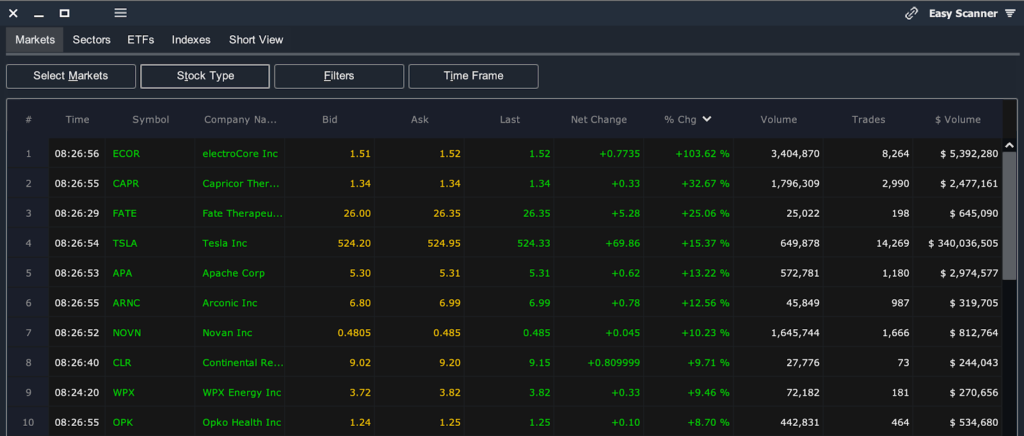

For me, it’s simple. I just pull up the Easy Scanner (the screenshot you see above) every trading day, and look for stocks that are moving with dollar-volume ($-volume) of at least $2M.

If you want to learn more about how I scan for momentum stocks to trade, I wrote a section about it in my new eBook, Momentum Hunter.

Moving along.

How I Uncovered The Momentum Opportunity in Overstock.com (OSTK)

Since I have a master watchlist, I can quickly pull up symbols I want to trade and analyze the chart setup. Well, the day I bought shares of OSTK, I noticed a continuation pattern pop up.

If you look at the chart below (spoiler alert), OSTK formed a bull flag/pennant pattern… and had a massive gap up!

Now, before this double-digit percentage move in OSTK, I actually spotted the trade.

When I noticed the pattern, I sent this to Jason Bond Picks subscribers.

“OSTK is pressing $4.90 again, the area I’ve been watching all week. It’s been green all day and it’s been strong all week against market pullbacks. I’m going with a day trade / possible swing trade here into the close to see if I can catch a squeeze like the PENN movement that just triggered. Thinking 10k at $4.90 would be my target, goal squeeze into the $5’s today, maybe swing, I don’t know.”

You see, OSTK was trading right around $4.90 for a few trading sessions, and I figured this could be a potential breakout opportunity.

Why?

Well, from my experience, $5 tends to be a key psychological level, and I’ve noticed if a stock breaks above that level, it typically runs higher!

Not only that, I believed OSTK was in the “rest” phase after it made a massive move off March lows (at $2.53) all the way to the high $5-area… and I thought OSTK could “retest” its recent high.

I spotted my pattern and had a strong thesis, so I entered the trade AFTER I sent out my advanced notice alert.

“I bought 10k OSTK at $4.88, day trade, maybe swing, looking for a Friday squeeze. Range is to $6 but man, $5.50 and I’d be really happy.”

I bought shares on a Friday, but with these plays, I always know I may have to hold into the weekend… and I was comfortable holding OSTK.

Come, Monday morning, ahead of the bell, OSTK looked ready to break north of resistance at $4.90 for a gap up

When OSTK hit my target, I took my profits off the table.

Here’s what I sent out to subscribers this past Monday shortly after the opening bell…

TD is messy this morning, working super slow, but looks like I filled OSTK in the $5.70’s for about $9,000 in profit. Really nice swing here. Wish I’d taken 3 swings, would have been a $20,000 morning but I can’t complain with $8,000-$9,000 on OSTK, about 20%.

This was in the top 30 movers out of nearly 2,500 stocks right now with at least $2,000,000 in liquidity.

That’s why I always have a master watchlist because you never know when a momentum stock could make another move.

I know this market environment can be tough, so I wanted to provide you with my brand new eBook: Momentum Hunter… in it, I reveal the techniques I use to find stocks poised to experience massive moves.

Thank You!