We’re about to enter the fourth quarter of 2019…

… and maybe you don’t remember, 2018s Q4 was wicked — a wild roller coaster ride that left traders dazed… confused… and shaken up.

Heck, I even got trapped in that whole volatility mess…

There’s no need to sugarcoat it… I took a beating.

I got torn to shreds… so much so… that I had to do a complete overhaul on my trading.

And it started with getting my head straight.

Frustration, discouragement, and anger are all emotions that race around our mind— although short-lived — we must not let us beat ourselves.

We must learn to take a loss, learn from it, and then move on to the next trade.

How do you begin the process?

The first step is to admit defeat and eat the loss.

The next step is to center yourself, and remember you are playing the numbers game… if you have a strategy that works overtime… you run with it… and the results will eventually tilt in your favor.

Despite trading for eight years, I only have two go-to strategies that I fall back on. Now, you might think that’s not impressive, but those two strategies have netted me over $500K in trading profits this year.

In any event, I’m not bulletproof. And I expect to take some licks along the way. And as consistent and profitable as I am, negative emotions still creep through my head when I experience a drawdown.

However, the dry spells are temporary.

In fact, it’s my ability to accept losing that stops me from taking further action that could put significant damage to my trading account—and the reason why I’m enjoying my most profitable year as a trader.

Want to learn how to block out the negative emotions that cripple a traders progress?

Embrace the Emotions, Trust the Process

During the last quarter of 2018… trading unraveled for me.

I don’t know if you remember, but I was also trading options then… buying every option in sight, throwing up “hail mary” trades to make some quick cash…

… but I was actually losing money buying options… and those losses were starting to eat at all the profits I made in momentum stocks.

I had no choice but to accept defeat, take a step back, examine everything, and deal with the emotions.

I took a few deep breaths… looked through my trades, and came back to the core strategy that was working for me… and immediately cut the one that was costing me money.

So of course, I stuck with my fish hooks and rockets with small-cap and momentum stocks… because those were my money makers.

Just looking for simple patterns like this…

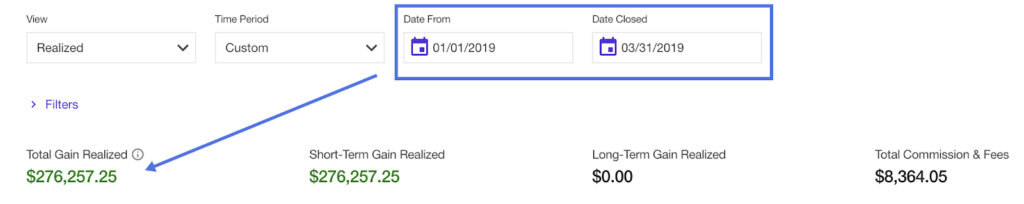

I quickly bounced back from the emotional roller coaster back in 2018… and started 2019 on the right foot.

I cut all those options trades I was doing… and just focused on my bread-and-butter setups…

… and I was up $276K during the first quarter of this year.

But the thing is… along the way, I actually took a big loss…

Outlier Losses Happen

I actually took a $23K loss on the rocket BPTH because I did not perfectly time my entry using the Fibonacci retracement pattern.

Rather than being stubborn with the trade and holding onto it… I cut it because the pattern was broken.

Of course, I felt horrible and had knots in my stomach… thinking I could’ve done better…

… but then I remembered that this is trading and my loss in BPTH was just an outlier.

Week after week, I was making money using my simple patterns and it was quite clear the trend was positive.

I embraced those emotions and reminded myself that my strategy has proven to work… and these losses don’t happen often.

The feelings are short-lived and at some point, you will be able to move on right away and get right back to business.

Bulletproof Your Mind — Turn Your Weaknesses into Strengths

There’s was still one thing eating at me though…

… my options trading.

I knew I was a good stock trader… and I knew I was losing money from buying options…

… any trader would have to think someone is making money on the other side.

So I decided to go out and learn more about selling options premium… because I wanted to bounce back from the losses I had from buying options, and turn my weakness into my strength.

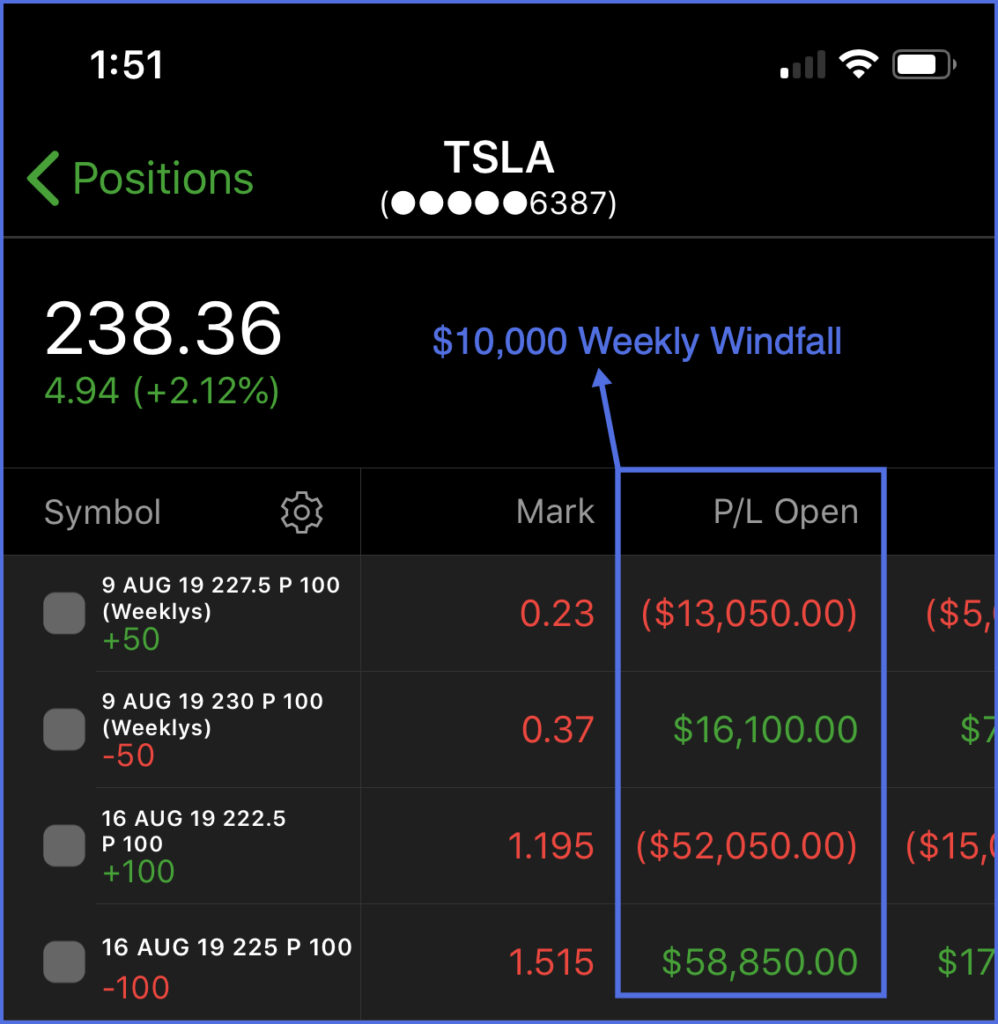

After a few months, I developed and launched Weekly Windfalls — shaping up to be one of my most profitable strategies ever.

I went from losing money buying options to making money selling options premium with my simple options trading strategy.

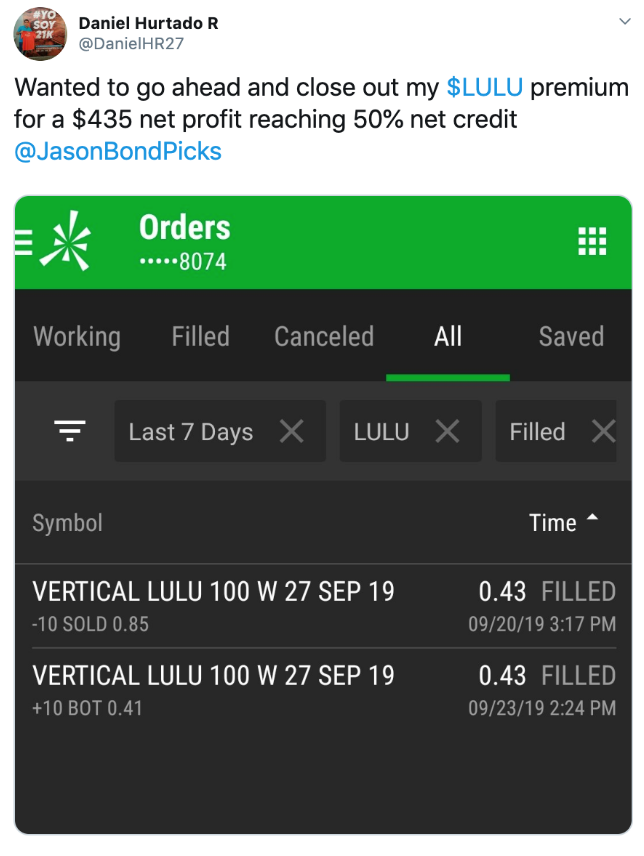

My clients have also been benefitting…

“Closed 4 ww for 3K. Thanks Jason!!!” ~ L.C.

“Hey JB thanks for the spreads I held all of them for around 60%+ each” ~ S.B.

By turning my weakness into my strength… I actually improved my performance tremendously. You see, I have two strategies to use now… if I go through a loss, I know that I’m in a position to still generate profits using the other.

Without a doubt, I’ll still stick with my Weekly Windfalls and Jason Bond Picks strategy heading into the fourth quarter because I know I could make money with both of them… regardless of the environment.

Join my community:

0 Comments